1230 Walts Rd Georgetown, IN 47122

Estimated Value: $466,000 - $924,718

3

Beds

3

Baths

2,045

Sq Ft

$340/Sq Ft

Est. Value

About This Home

This home is located at 1230 Walts Rd, Georgetown, IN 47122 and is currently estimated at $695,359, approximately $340 per square foot. 1230 Walts Rd is a home located in Floyd County with nearby schools including Georgetown Elementary School, Highland Hills Middle School, and Floyd Central High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 27, 2019

Sold by

Kirchgessner Stephen J and Kirchgessner Ramona J

Bought by

Roach Kevin J and Roach Mandy L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$510,000

Outstanding Balance

$450,605

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$244,754

Purchase Details

Closed on

Aug 11, 2006

Sold by

Brewer Jason G and Brewer Casey M

Bought by

Kirchgessner Stephen J and Kirchgessner Ramona J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Roach Kevin J | -- | None Available | |

| Kirchgessner Stephen J | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Roach Kevin J | $510,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,892 | $720,700 | $111,800 | $608,900 |

| 2023 | $6,892 | $672,200 | $111,800 | $560,400 |

| 2022 | $6,484 | $605,700 | $111,800 | $493,900 |

| 2021 | $5,782 | $543,600 | $111,800 | $431,800 |

| 2020 | $4,869 | $482,300 | $111,800 | $370,500 |

| 2019 | $4,375 | $447,100 | $111,800 | $335,300 |

| 2018 | $3,847 | $392,200 | $108,700 | $283,500 |

| 2017 | $4,154 | $396,200 | $111,800 | $284,400 |

| 2016 | $3,830 | $395,800 | $111,800 | $284,000 |

| 2014 | $3,903 | $356,800 | $118,100 | $238,700 |

| 2013 | -- | $338,200 | $118,100 | $220,100 |

Source: Public Records

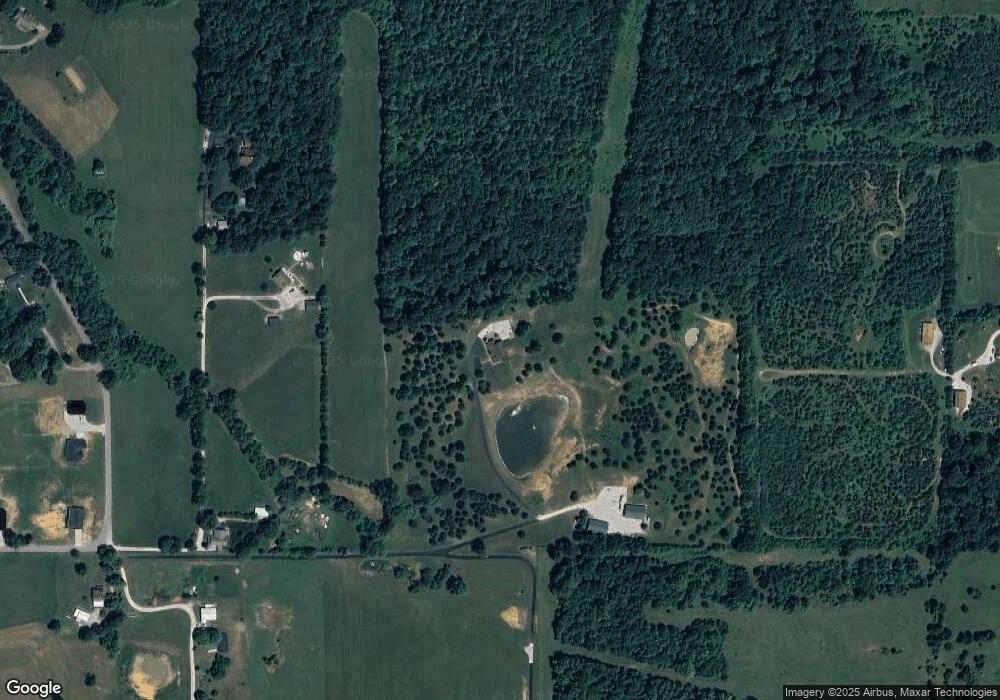

Map

Nearby Homes

- 2022 Brookstone Way

- 1034 Brookstone Ct

- 3006 Zachary Trail

- 7014 Dylan Cir Unit Lot 406

- 4046 Oakstone Dr

- 8031 Hudson Ln

- 8026 Hudson Ln

- 2004 Peach Tree Ln

- 8245 Corydon Ridge Rd

- 1004 Carter Dr

- 7001 - LOT 971 Mitsch Ln

- 6614 State Road 64 Vacant Land

- 7003- LOT 970 Mitsch Ln

- 7005- LOT 969 Mitsch Ln

- 1805 Marking Place

- 1807 Marking Place

- 7790 Corydon Ridge Rd NE

- 1209 Crones Hill Rd

- 1034 Oskin Dr Unit 204

- 1040 Oskin Dr Unit 201

- 1236 Walts Rd

- 1240 Walts Rd

- 1225 Baylor Wissman Rd

- 1355 Walts Rd

- 1201 Walts Rd

- 1200 Walts Rd

- 1143 Baylor Wissman Rd

- 1212 Walts Rd

- 8389 Indiana 64

- 1224 Walts Rd

- 1161 Baylor Wissman Rd

- 1210 Walts Rd

- 1480 Walts Rd

- 0 Southern Railway Unit 62

- 8410 Southern Railway Unit 64

- 8805 Southern Railway Unit 64

- 6862 Southern Railway Unit 64

- 9020 Southern Railway Unit 64

- 4819 Southern Railway Unit 62

- 6200 Southern Railway Unit 62

Your Personal Tour Guide

Ask me questions while you tour the home.