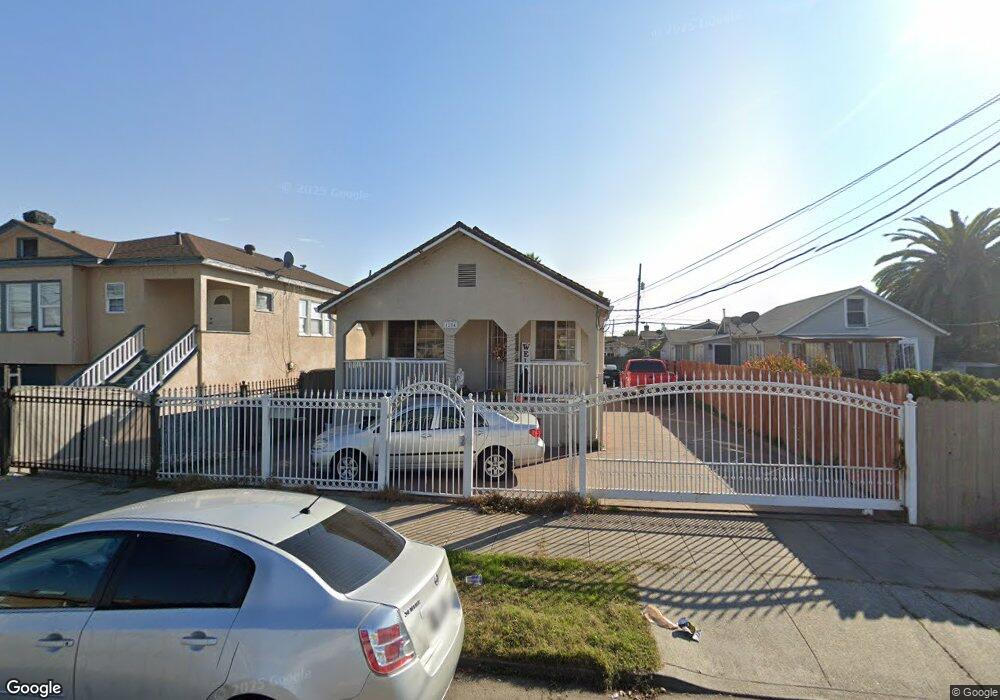

1254 75th Ave Oakland, CA 94621

Fitchburg NeighborhoodEstimated Value: $367,000 - $419,000

2

Beds

1

Bath

755

Sq Ft

$524/Sq Ft

Est. Value

About This Home

This home is located at 1254 75th Ave, Oakland, CA 94621 and is currently estimated at $395,474, approximately $523 per square foot. 1254 75th Ave is a home located in Alameda County with nearby schools including Futures & CUES at Lockwood, Greenleaf TK-8, and Coliseum College Prep Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 28, 2011

Sold by

Gallegos Florencio S

Bought by

Fregoso Saul R and Hernandez Irma

Current Estimated Value

Purchase Details

Closed on

Aug 12, 2003

Sold by

Ramirez Amaparo Marin

Bought by

Gallegos Florencio S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,400

Interest Rate

6.4%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 6, 2001

Sold by

Sue Carlton and Grace & Gloria Investments

Bought by

Gallegos Jesus

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,680

Interest Rate

7%

Purchase Details

Closed on

Sep 5, 2001

Sold by

Gallegos Martha L

Bought by

Gallegos Jesus

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,680

Interest Rate

7%

Purchase Details

Closed on

Jan 25, 2001

Sold by

Jackson Joe L and Jackson Joannah

Bought by

Sue Carlton and Grace & Gloria Investments Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,500

Interest Rate

7.41%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Fregoso Saul R | $74,250 | None Available | |

| Gallegos Florencio S | -- | Ticor Title Company Of Ca | |

| Gallegos Florencio S | $263,000 | Ticor Title Company Of Ca | |

| Gallegos Jesus | $144,000 | American Title Co | |

| Gallegos Jesus | -- | American Title Co | |

| Sue Carlton | $80,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gallegos Florencio S | $210,400 | |

| Previous Owner | Gallegos Jesus | $139,680 | |

| Previous Owner | Sue Carlton | $52,500 | |

| Closed | Gallegos Florencio S | $52,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,090 | $100,478 | $30,143 | $70,335 |

| 2024 | $3,090 | $98,508 | $29,552 | $68,956 |

| 2023 | $3,123 | $96,577 | $28,973 | $67,604 |

| 2022 | $2,971 | $94,684 | $28,405 | $66,279 |

| 2021 | $2,692 | $92,828 | $27,848 | $64,980 |

| 2020 | $2,660 | $91,877 | $27,563 | $64,314 |

| 2019 | $2,466 | $90,076 | $27,023 | $63,053 |

| 2018 | $2,419 | $88,310 | $26,493 | $61,817 |

| 2017 | $2,292 | $86,580 | $25,974 | $60,606 |

| 2016 | $2,127 | $84,881 | $25,464 | $59,417 |

| 2015 | $2,112 | $83,607 | $25,082 | $58,525 |

| 2014 | $2,024 | $81,970 | $24,591 | $57,379 |

Source: Public Records

Map

Nearby Homes