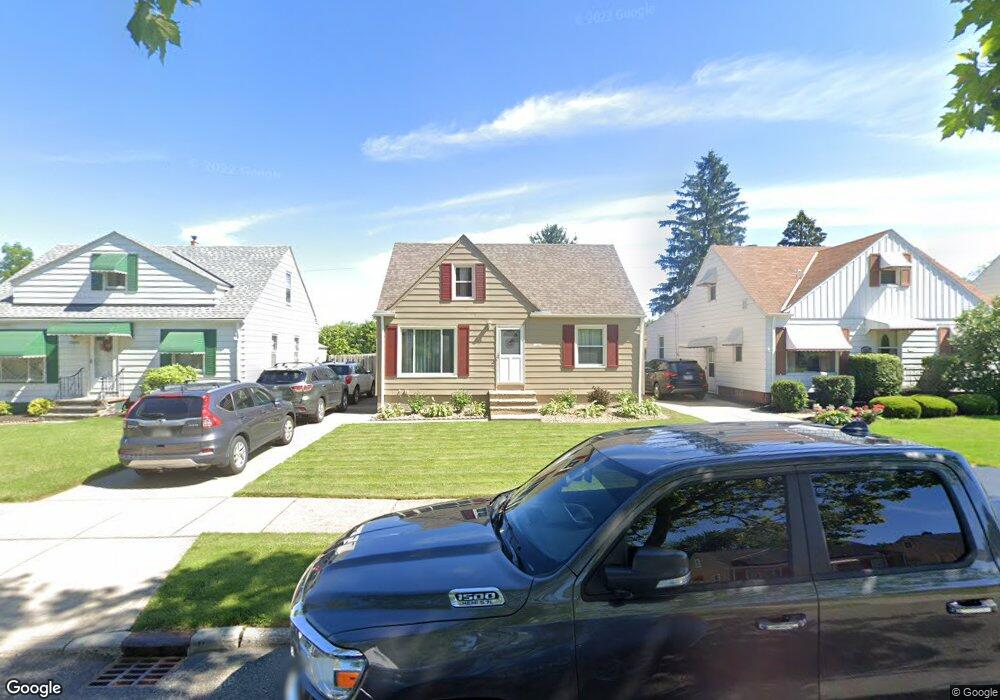

12613 York Blvd Cleveland, OH 44125

Estimated Value: $152,000 - $182,000

3

Beds

3

Baths

1,560

Sq Ft

$110/Sq Ft

Est. Value

About This Home

This home is located at 12613 York Blvd, Cleveland, OH 44125 and is currently estimated at $171,595, approximately $109 per square foot. 12613 York Blvd is a home located in Cuyahoga County with nearby schools including Garfield Heights High School, St Benedict Catholic School, and Trinity High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 8, 2024

Sold by

Glending Carly A and Glending Mark David

Bought by

Ogletree Natasha M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Outstanding Balance

$147,539

Interest Rate

7.29%

Mortgage Type

New Conventional

Estimated Equity

$24,056

Purchase Details

Closed on

Jun 23, 2011

Sold by

Steely Deborah A and Steely Gary L

Bought by

Glending Carly A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$59,815

Interest Rate

5.25%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 23, 1984

Sold by

Fox Frank H and Fox Ann M

Bought by

Fox Frank Henry and Fox Anna M

Purchase Details

Closed on

Jan 1, 1975

Bought by

Fox Frank H and Fox Ann M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ogletree Natasha M | $160,000 | Titleco Title | |

| Glending Carly A | $51,500 | Ohio Real Title | |

| Fox Frank Henry | -- | -- | |

| Fox Frank H | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ogletree Natasha M | $150,000 | |

| Previous Owner | Glending Carly A | $59,815 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,610 | $56,000 | $9,030 | $46,970 |

| 2023 | $3,267 | $29,410 | $6,480 | $22,930 |

| 2022 | $3,220 | $29,400 | $6,480 | $22,930 |

| 2021 | $3,402 | $29,400 | $6,480 | $22,930 |

| 2020 | $2,922 | $23,520 | $5,180 | $18,340 |

| 2019 | $2,896 | $67,200 | $14,800 | $52,400 |

| 2018 | $2,888 | $23,520 | $5,180 | $18,340 |

| 2017 | $2,902 | $22,090 | $4,340 | $17,750 |

| 2016 | $2,944 | $22,090 | $4,340 | $17,750 |

| 2015 | $2,828 | $22,090 | $4,340 | $17,750 |

| 2014 | $2,828 | $23,240 | $4,550 | $18,690 |

Source: Public Records

Map

Nearby Homes

- 12512 York Blvd

- 5781 Turney Rd

- 12912 Thraves Rd

- 5817 Turney Rd

- 13009 Orme Rd

- 12214 Woodward Blvd

- 12313 Eastwood Blvd

- 13405 York Blvd

- 13310 Thraves Ave

- 12804 Havana Rd

- 12930 Havana Rd

- 13304 Orme Rd

- 12324 Oak Park Blvd

- 13206 Shady Oak Blvd

- 13300 Shady Oak Blvd

- 13012 Oak Park Blvd

- 13101 Littleton Rd

- 11808 Fordham Rd

- 13009 Oak Park Blvd

- 12120 Orme Rd

- 12617 York Blvd

- 12609 York Blvd

- 12701 York Blvd

- 12605 York Blvd

- 12612 Maple Leaf Dr

- 12705 York Blvd

- 12601 York Blvd

- 12616 Maple Leaf Dr

- 12608 Maple Leaf Dr

- 12700 Maple Leaf Dr

- 12604 Maple Leaf Dr

- 12709 York Blvd

- 12517 York Blvd

- 12612 York Blvd

- 12704 Maple Leaf Dr

- 12608 York Blvd

- 12600 Maple Leaf Dr

- 12616 York Blvd

- 12604 York Blvd

- 12700 York Blvd