12675 County Road J Wauseon, OH 43567

Estimated Value: $567,000

4

Beds

2

Baths

3,000

Sq Ft

$189/Sq Ft

Est. Value

About This Home

This home is located at 12675 County Road J, Wauseon, OH 43567 and is currently priced at $567,000, approximately $189 per square foot. 12675 County Road J is a home located in Fulton County with nearby schools including Delta Elementary School, Pike-Delta-York Middle School, and Pike-Delta-York High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 28, 2006

Sold by

Rupp John P and Snyder Michael A

Bought by

Leininger Trevor S and Leininger Jennifer L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$265,000

Outstanding Balance

$187,907

Interest Rate

9.5%

Mortgage Type

Construction

Purchase Details

Closed on

Apr 5, 2006

Sold by

Johnson Robert A and Johnson Michael C

Bought by

Snyder Michael A and Rupp John P

Purchase Details

Closed on

Oct 26, 2005

Sold by

Estate Of Timothy W Johnson

Bought by

Fisher Claudia J and Terrell Judith J

Purchase Details

Closed on

Apr 25, 2003

Sold by

Estate Of Ruby Winifred Guhl

Bought by

Johnson Timothy W

Purchase Details

Closed on

Jan 1, 1990

Bought by

Guhl Winifred

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Leininger Trevor S | $36,000 | None Available | |

| Snyder Michael A | $149,900 | None Available | |

| Fisher Claudia J | -- | -- | |

| Johnson Timothy W | -- | -- | |

| Guhl Winifred | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Leininger Trevor S | $265,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,228 | $190,050 | $72,240 | $117,810 |

| 2023 | $5,235 | $190,050 | $72,240 | $117,810 |

| 2022 | $5,978 | $167,300 | $60,200 | $107,100 |

| 2021 | $6,146 | $167,300 | $60,200 | $107,100 |

| 2020 | $6,166 | $167,300 | $60,200 | $107,100 |

| 2019 | $5,737 | $154,320 | $52,780 | $101,540 |

| 2018 | $2,971 | $154,320 | $52,780 | $101,540 |

| 2017 | $6,746 | $153,200 | $52,780 | $100,420 |

| 2016 | $6,340 | $130,070 | $44,560 | $85,510 |

| 2015 | $5,981 | $130,070 | $44,560 | $85,510 |

| 2014 | $6,067 | $130,070 | $44,560 | $85,510 |

| 2013 | $4,944 | $110,920 | $33,430 | $77,490 |

Source: Public Records

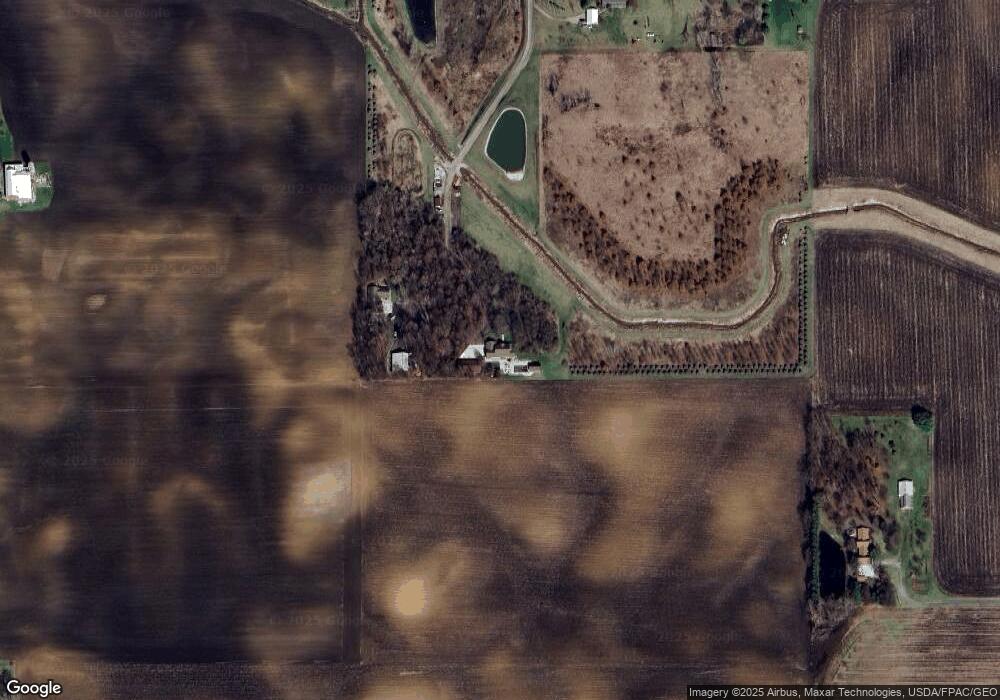

Map

Nearby Homes

- 8453 County Road 13

- 0 County Road H

- 7620 County Road 12

- 7373 County Road 12

- 13354 U S 20a

- 13242 Us Highway 20a

- 460 Airport Hwy

- 14900 W Co Rd H

- 14900 County Road H

- 11715 County Road L

- 1209 Apache Dr

- 14578 Us Highway 20a

- Integrity 1830 Plan at Arrowhead Trails

- integrity 2280 Plan at Arrowhead Trails

- Integrity 2080 Plan at Arrowhead Trails

- 1090 Seneca Dr

- 1062 Seneca Dr

- 1058 Seneca Dr

- 1066 Seneca Dr

- 1338 N Park Ln

- 12745 County Road J

- 12645 County Road J

- 8629 County Road 12 1

- 12785 County Road J

- 12541 County Road J

- 12642 County Road J

- 12463 County Road J

- 12495 County Road J

- 8566 County Road 13

- 8520 County Road 13

- 8711 County Road 12 1

- 8851 County Road 12

- 8851 County Road 12 1

- 8985 County Road 12 1

- 8529 County Road 12 1

- 8525 County Road 13

- 8545 County Road 13

- 9089 County Road 13

- 12180 County Road J

- 13190 County Road J