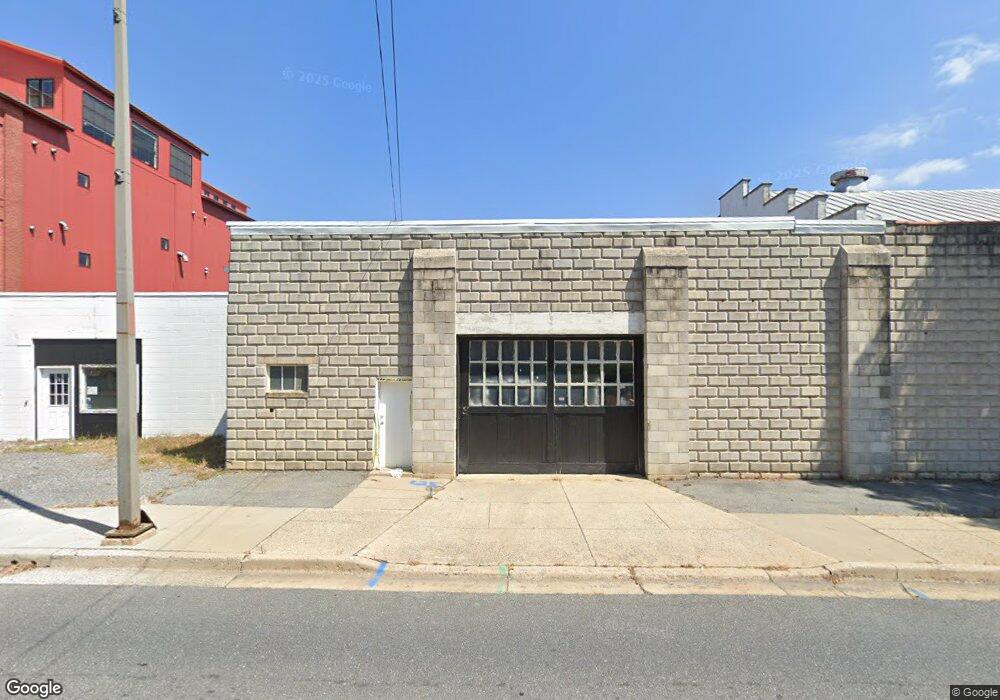

127 S Carroll St Frederick, MD 21701

Downtown Frederick NeighborhoodEstimated Value: $1,210,484

Studio

--

Bath

7,909

Sq Ft

$153/Sq Ft

Est. Value

About This Home

This home is located at 127 S Carroll St, Frederick, MD 21701 and is currently priced at $1,210,484, approximately $153 per square foot. 127 S Carroll St is a home located in Frederick County with nearby schools including Spring Ridge Elementary School, Gov. Thomas Johnson Middle School, and Gov. Thomas Johnson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 26, 2021

Sold by

Butler Joseph E

Bought by

South Carroll Opportunity Fund Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,650,000

Outstanding Balance

$1,487,346

Interest Rate

2.9%

Mortgage Type

Commercial

Purchase Details

Closed on

Nov 22, 2005

Sold by

Corner Top General Partnership

Bought by

Butler Joseph E

Purchase Details

Closed on

Aug 1, 1988

Sold by

Bussard Clarence

Bought by

Corner Top General Partnership

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Interest Rate

10.49%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| South Carroll Opportunity Fund Llc | $950,000 | Excalibur T&E Llc | |

| Butler Joseph E | $750,000 | -- | |

| Corner Top General Partnership | $285,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | South Carroll Opportunity Fund Llc | $1,650,000 | |

| Previous Owner | Corner Top General Partnership | $210,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $19,577 | $1,221,600 | $350,700 | $870,900 |

| 2024 | $19,577 | $1,040,867 | $0 | $0 |

| 2023 | $11,246 | $603,400 | $0 | $0 |

| 2022 | $8,330 | $441,300 | $250,700 | $190,600 |

| 2021 | $7,851 | $436,067 | $0 | $0 |

| 2020 | $7,861 | $430,833 | $0 | $0 |

| 2019 | $8,025 | $425,600 | $250,700 | $174,900 |

| 2018 | $7,592 | $425,600 | $250,700 | $174,900 |

| 2017 | $8,144 | $425,600 | $0 | $0 |

| 2016 | $8,273 | $433,500 | $0 | $0 |

| 2015 | $8,273 | $432,233 | $0 | $0 |

| 2014 | $8,273 | $430,967 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 35 E All Saints St Unit 306

- 230 S Market St

- 208 Broadway St

- 427 S Market St

- 210 E 2nd St Unit 402

- 210 E 2nd St Unit 401

- 208 E 2nd St

- 110 N Court St

- 13 E 2nd St

- 203 E 3rd St

- 17 W 3rd St

- 104 Evergreen Ct

- 103 Pennsylvania Ave

- 426 Chapel Aly

- 15 E 4th St

- 418 N Maxwell Ave

- 23 W 4th St

- 20 Maxwell Square

- 209 Dill Ave

- 229 E 5th St

- 47 E South St Unit 301

- 47 E South St Unit 302

- 47 E South St Unit PENTHOUSE

- 47 E South St Unit 1

- 47 E South St

- 47 E South St Unit 201

- 47 E South St Unit 101

- 47 E South St Unit 203

- 47 E South St Unit 202

- 47 E South St Unit 102

- 47 E South St Unit 103

- 75 E South St

- 84 E South St

- 121 S Carroll St

- 76 E South St

- 86 E South St

- 78 E South St

- 74 E South St

- 88 E South St

- 88 E South St Unit B