12880 Magnolia Ave Unit 15 Riverside, CA 92503

Estimated Value: $610,747 - $625,000

4

Beds

4

Baths

1,916

Sq Ft

$323/Sq Ft

Est. Value

About This Home

This home is located at 12880 Magnolia Ave Unit 15, Riverside, CA 92503 and is currently estimated at $618,187, approximately $322 per square foot. 12880 Magnolia Ave Unit 15 is a home located in Riverside County with nearby schools including Lake Hills Elementary School, Ysmael Villegas Middle School, and Hillcrest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 23, 2011

Sold by

Sarabia Alejandro C

Bought by

Rodriguez Antonio F

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$201,495

Interest Rate

3.3%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 29, 2004

Sold by

Dunzo Kalamo

Bought by

Sarabia Alejandro C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,875

Interest Rate

5.61%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

May 29, 2001

Sold by

Jms Savannah Llc

Bought by

Dunzo Kalamo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$173,000

Interest Rate

7.15%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rodriguez Antonio F | $210,000 | Lawyers Title Riverside | |

| Sarabia Alejandro C | $342,500 | Lawyers Title Company | |

| Dunzo Kalamo | $223,000 | Orange Coast Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rodriguez Antonio F | $201,495 | |

| Previous Owner | Sarabia Alejandro C | $256,875 | |

| Previous Owner | Dunzo Kalamo | $173,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,180 | $263,756 | $75,356 | $188,400 |

| 2023 | $3,180 | $253,516 | $72,431 | $181,085 |

| 2022 | $2,931 | $248,546 | $71,011 | $177,535 |

| 2021 | $2,871 | $243,673 | $69,619 | $174,054 |

| 2020 | $2,824 | $241,176 | $68,906 | $172,270 |

| 2019 | $2,787 | $236,448 | $67,555 | $168,893 |

| 2018 | $2,746 | $231,813 | $66,231 | $165,582 |

| 2017 | $2,694 | $227,269 | $64,933 | $162,336 |

| 2016 | $2,649 | $222,813 | $63,660 | $159,153 |

| 2015 | $2,612 | $219,467 | $62,704 | $156,763 |

| 2014 | $2,603 | $215,171 | $61,477 | $153,694 |

Source: Public Records

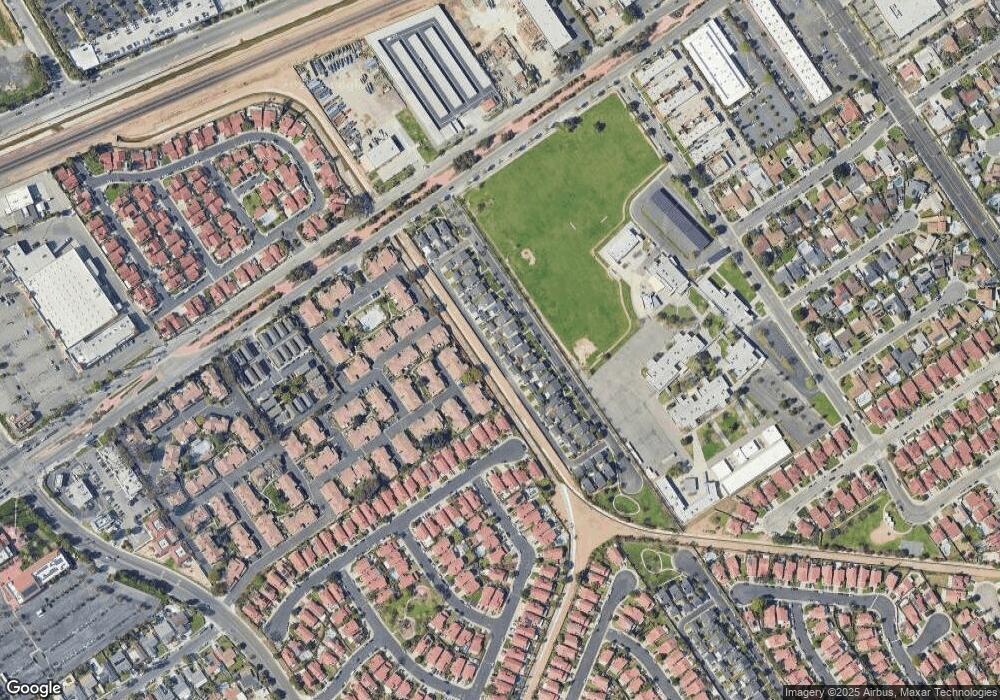

Map

Nearby Homes

- 12911 Via Napoi

- 3771 Harvill Ln

- 13136 Harlow Ave

- 13163 Harlow Ave

- 12660 Fieldstone Cir

- 3638 Candlewood St

- 3555 Dixie Ln

- 3577 Briarvale St

- 13006 August Cir

- 3496 Briarvale St

- 3370 Hollowood Ct

- 3700 Buchanan St Unit 180

- 3700 Buchanan St Unit 98

- 3700 Buchanan St Unit 189

- 3700 Buchanan St Unit 25

- 3700 Buchanan St Unit 28

- 3700 Buchanan St Unit 132

- 3700 Buchanan St Unit 105

- 3700 Buchanan St Unit 164

- 3700 Buchanan St Unit 108

- 12880 Magnolia Ave Unit 11

- 12880 Magnolia Ave

- 12880 Magnolia Ave Unit 25

- 12880 Magnolia Ave Unit 24

- 12880 Magnolia Ave Unit 23

- 12880 Magnolia Ave Unit 22

- 12880 Magnolia Ave Unit 21

- 12880 Magnolia Ave Unit 20

- 12880 Magnolia Ave Unit 19

- 12880 Magnolia Ave Unit 18

- 12880 Magnolia Ave Unit 17

- 12880 Magnolia Ave Unit 16

- 12880 Magnolia Ave Unit 14

- 12880 Magnolia Ave Unit 12

- 12880 Magnolia Ave

- 12880 Magnolia Ave Unit 10

- 12880 Magnolia Ave Unit 9

- 12880 Magnolia Ave Unit 8

- 12880 Magnolia Ave Unit 7

- 12880 Magnolia Ave Unit 6

Your Personal Tour Guide

Ask me questions while you tour the home.