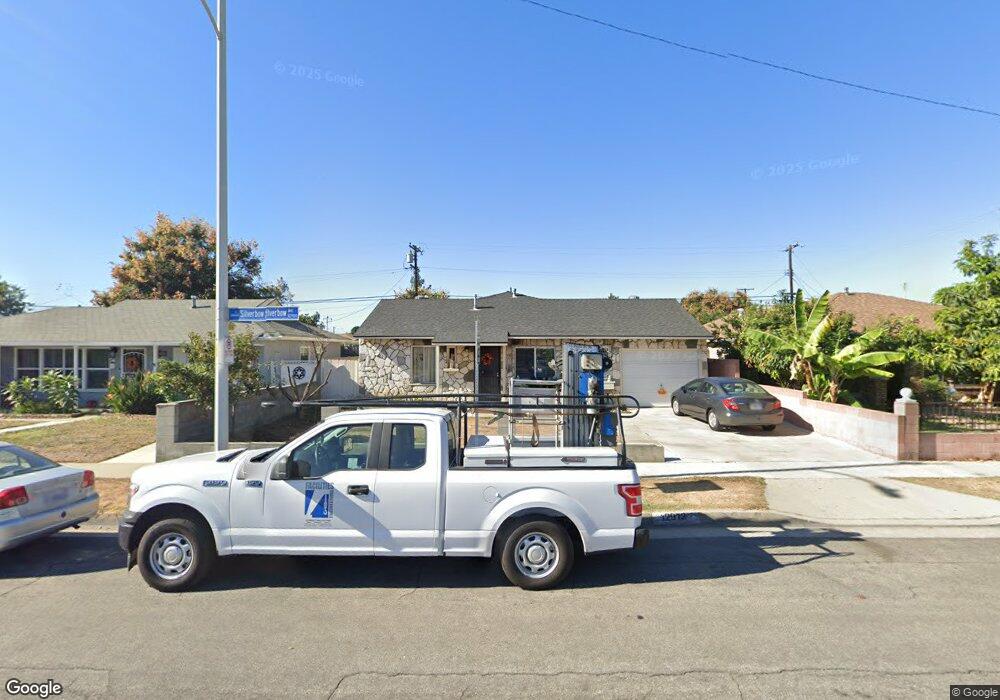

12913 Silverbow Ave Norwalk, CA 90650

Estimated Value: $702,739 - $825,000

3

Beds

2

Baths

1,471

Sq Ft

$526/Sq Ft

Est. Value

About This Home

This home is located at 12913 Silverbow Ave, Norwalk, CA 90650 and is currently estimated at $774,435, approximately $526 per square foot. 12913 Silverbow Ave is a home located in Los Angeles County with nearby schools including Thomas B. Moffitt Elementary School, Corvallis Middle School, and John H. Glenn High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 16, 2007

Sold by

Deavila Pedro

Bought by

Deavila Pedro and Deavila Gregoria

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$226,000

Outstanding Balance

$135,740

Interest Rate

6.21%

Mortgage Type

New Conventional

Estimated Equity

$638,695

Purchase Details

Closed on

May 27, 1998

Sold by

Gonzalez Gregoria

Bought by

Deavila Pedro

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,812

Interest Rate

7.13%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 22, 1998

Sold by

Lasalle National Bank

Bought by

Deavila Pedro

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,812

Interest Rate

7.13%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 10, 1997

Sold by

Burdelas Edward

Bought by

Lasalle National Bank and Nomura Asset Securities Corp Mtg Pass Th

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Deavila Pedro | -- | North American Title Co | |

| Deavila Pedro | -- | Orange Coast Title | |

| Deavila Pedro | $129,000 | Orange Coast Title | |

| Lasalle National Bank | $106,751 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Deavila Pedro | $226,000 | |

| Closed | Deavila Pedro | $127,812 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,830 | $273,997 | $133,630 | $140,367 |

| 2024 | $3,830 | $268,625 | $131,010 | $137,615 |

| 2023 | $3,707 | $263,359 | $128,442 | $134,917 |

| 2022 | $3,643 | $258,196 | $125,924 | $132,272 |

| 2021 | $3,588 | $253,134 | $123,455 | $129,679 |

| 2020 | $3,505 | $250,540 | $122,190 | $128,350 |

| 2019 | $3,489 | $245,629 | $119,795 | $125,834 |

| 2018 | $3,326 | $240,814 | $117,447 | $123,367 |

| 2016 | $3,180 | $231,466 | $112,888 | $118,578 |

| 2015 | $3,152 | $227,990 | $111,193 | $116,797 |

| 2014 | $2,944 | $223,525 | $109,015 | $114,510 |

Source: Public Records

Map

Nearby Homes

- 12802 Bloomfield Ave

- 12812 Arroyo Ln

- 12415 Imperial Hwy Unit 41

- 12930 Joshua Ln

- 12909 Lariat Ln

- 13406 Lancelot Ave

- 11979 Olive St

- 12012 1/2 Sproul St

- 13057 Miller Ave

- 12014 Hebe Ave

- 12224 Fidel Ave

- 12029 Tina St

- 11904 Painter Ave

- 12038 Orange St

- 11816 Arlee Ave

- 11808 Laurel Ave

- 11428 Painter Ave

- 11702 Brimley St

- 11518 Fidel Ave

- 14615 Horst Ave

- 12909 Silverbow Ave

- 12917 Silverbow Ave

- 12912 Avonlea Ave

- 12923 Silverbow Ave

- 12905 Silverbow Ave

- 12908 Avonlea Ave

- 12916 Avonlea Ave

- 12904 Avonlea Ave

- 12922 Avonlea Ave

- 12927 Silverbow Ave

- 12908 Silverbow Ave

- 12916 Silverbow Ave

- 12928 Avonlea Ave

- 12922 Silverbow Ave

- 12904 Silverbow Ave

- 12933 Silverbow Ave

- 12926 Silverbow Ave

- 12932 Avonlea Ave

- 12512 Anabella St

- 12513 Anabella St