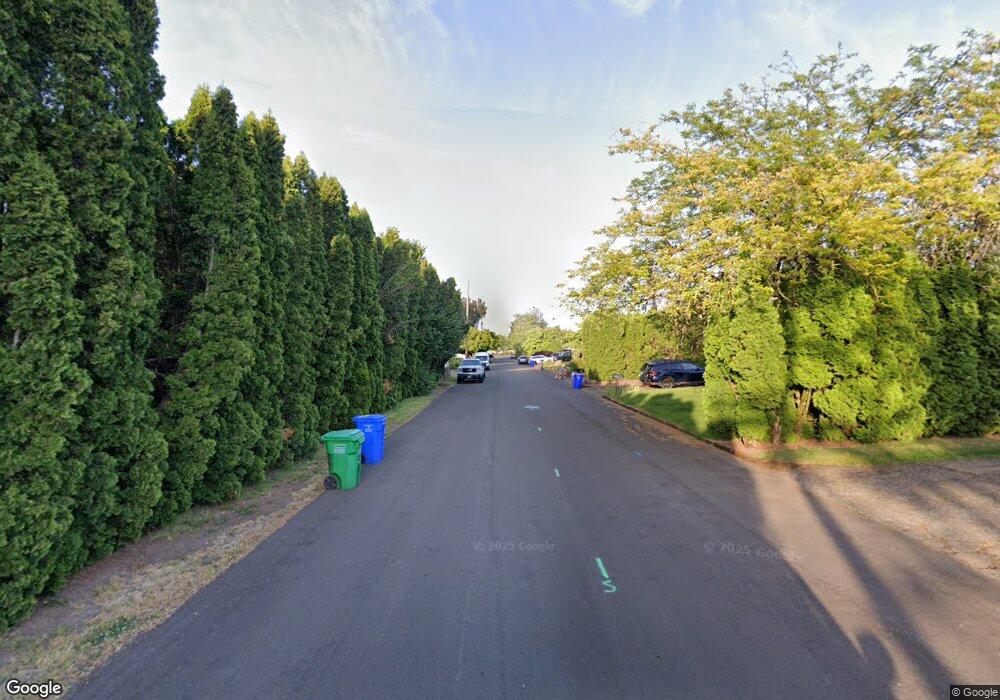

1306 SE 282ndreduced$10 000 Gresham, OR 97030

Powell Valley NeighborhoodEstimated Value: $486,000 - $547,000

3

Beds

2

Baths

1,736

Sq Ft

$302/Sq Ft

Est. Value

About This Home

This home is located at 1306 SE 282ndreduced$10 000, Gresham, OR 97030 and is currently estimated at $525,060, approximately $302 per square foot. 1306 SE 282ndreduced$10 000 is a home located in Multnomah County with nearby schools including Powell Valley Elementary School, Gordon Russell Middle School, and Sam Barlow High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2020

Sold by

Castro Leon Enrique and Castro Leon Kathryne

Bought by

Trickel Jason and Trickel Brenda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$375,250

Outstanding Balance

$331,895

Interest Rate

3.2%

Mortgage Type

New Conventional

Estimated Equity

$193,165

Purchase Details

Closed on

Mar 11, 2005

Sold by

Ransier Amanda M

Bought by

Castro Leon Enrique and Castro Leon Kathryne L

Purchase Details

Closed on

Aug 15, 2001

Sold by

Nordlund Ronald Melvin

Bought by

Ransier Amanda M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,721

Interest Rate

7.19%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Trickel Jason | $395,000 | First American | |

| Castro Leon Enrique | $214,900 | First American | |

| Ransier Amanda M | $159,950 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Trickel Jason | $375,250 | |

| Previous Owner | Ransier Amanda M | $157,721 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,348 | $311,950 | -- | -- |

| 2024 | $6,077 | $302,870 | -- | -- |

| 2023 | $5,536 | $294,050 | $0 | $0 |

| 2022 | $5,382 | $285,490 | $0 | $0 |

| 2021 | $5,246 | $277,180 | $0 | $0 |

| 2020 | $4,936 | $269,110 | $0 | $0 |

| 2019 | $4,807 | $261,280 | $0 | $0 |

| 2018 | $4,583 | $253,670 | $0 | $0 |

| 2017 | $4,397 | $246,290 | $0 | $0 |

| 2016 | $3,877 | $239,120 | $0 | $0 |

| 2015 | $3,793 | $232,160 | $0 | $0 |

| 2014 | $3,701 | $225,400 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1415 SE Pheasant Ave

- 1427 SE Pheasant Ave

- 1439 SE Pheasant Ave

- 5856 SE Woodland Dr

- 28421 SE Lusted Rd

- 1478 SE Pheasant Ave

- Pepperwood Plan at The Vineyards at Blue Pearl

- Glacier Plan at The Vineyards at Blue Pearl

- 5960 SE 15th Loop

- 1490 SE Pheasant Ave

- 1494 SE Pheasant Ave

- 6102 SE 15th St

- 6108 SE 15th St

- 6114 SE 15th St

- 4567 SE 282nd Ave

- 1221 SE Ironwood Ln

- 5392 SE 13th Ct

- 5709 SE 18th Ct

- 28467 SE Kw Anderson Rd

- 5295 SE Woodland Dr

- 1306 SE 282(troutdale Ave)

- 1306 SE 282 (Troutdale Ave)

- 1306 SE 282nd Ave

- 1306 SE 282(troutdale) Ave

- 1300 SE 282nd Ave

- 1220 SE 282nd Ave

- 1322 SE 282nd Ave

- 1311 SE 282nd Ave

- 1232 SE 282nd Ave

- 1225 SE 282nd Ave

- 1303 SE 282nd Ave

- 1200 SE 282nd Ave

- 6103 SE Lusted Rd

- 1206 SE 282nd Ave

- 6200 SE Lusted Rd

- 1140 SE 282nd Ave

- 6100 SE Lusted Rd

- 5996 SE Woodland Dr

- 1120 SE 282nd Ave

- 5992 SE Woodland Dr