13192 Gemstone Ct Saint Paul, MN 55124

Scott Highlands NeighborhoodEstimated Value: $306,000 - $340,000

3

Beds

3

Baths

1,642

Sq Ft

$194/Sq Ft

Est. Value

About This Home

This home is located at 13192 Gemstone Ct, Saint Paul, MN 55124 and is currently estimated at $318,955, approximately $194 per square foot. 13192 Gemstone Ct is a home located in Dakota County with nearby schools including Greenleaf Elementary School, Falcon Ridge Middle School, and Apple Valley Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 17, 2021

Sold by

Rose Brady Allan and Rose Natalie Elaine

Bought by

Morey Michael Richard

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Outstanding Balance

$272,978

Interest Rate

2.8%

Mortgage Type

VA

Estimated Equity

$45,977

Purchase Details

Closed on

May 10, 2019

Sold by

Eich Dayne and Eich Emily

Bought by

Rose Brady Allan and Gagner Natalie Elaine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$223,155

Interest Rate

4%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 21, 2017

Sold by

Ramstad Carol E

Bought by

Eich Dayne and Peetsch Emily

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$185,576

Interest Rate

4.4%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 26, 1997

Sold by

Peterson Randy J and Peterson Dori L

Bought by

Ramstad Donald J and Ramstad Carol E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morey Michael Richard | $300,000 | All American Title Company | |

| Rose Brady Allan | $234,900 | First American Title Ins Co | |

| Eich Dayne | $189,000 | First American Title | |

| Ramstad Donald J | $116,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Morey Michael Richard | $300,000 | |

| Previous Owner | Rose Brady Allan | $223,155 | |

| Previous Owner | Eich Dayne | $185,576 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,320 | $297,400 | $54,500 | $242,900 |

| 2023 | $3,320 | $300,000 | $53,400 | $246,600 |

| 2022 | $2,674 | $286,100 | $53,200 | $232,900 |

| 2021 | $2,520 | $240,900 | $46,300 | $194,600 |

| 2020 | $2,406 | $223,700 | $44,100 | $179,600 |

| 2019 | $2,065 | $208,900 | $42,000 | $166,900 |

| 2018 | $2,016 | $190,800 | $38,900 | $151,900 |

| 2017 | $1,986 | $179,800 | $36,000 | $143,800 |

| 2016 | $1,961 | $169,700 | $34,300 | $135,400 |

| 2015 | $1,814 | $144,027 | $29,100 | $114,927 |

| 2014 | -- | $133,890 | $26,437 | $107,453 |

| 2013 | -- | $121,682 | $23,285 | $98,397 |

Source: Public Records

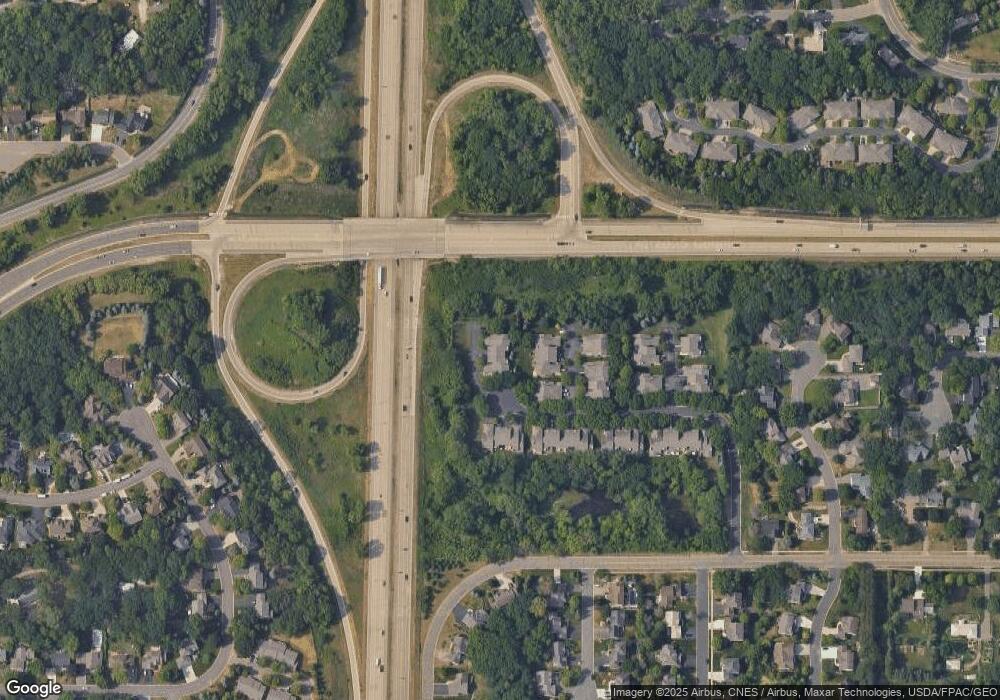

Map

Nearby Homes

- 13199 Gemstone Ct

- 12867 Pennock Ave

- 13135 Gamma Way

- 13420 Gull Ct

- 12710 Granger Ct Unit 323

- 13715 Grafton Ct

- 8000 132nd Ct

- 12596 Gavotte Ave Unit 98

- 12585 Gavotte Ave Unit 96

- 6790 132nd St W

- 13720 Georgia Dr

- 7577 138th St W

- 13868 Glendale Ct

- 12865 Foliage Ave

- 7508 Germane Trail

- 109 Cimarron Ct

- 13055 Florida Ct

- 12310 Geneva Way Unit 282

- 108 Hidden Meadow Rd

- 6567 133rd St W

- 13196 Gemstone Ct

- 13184 Gemstone Ct

- 13166 Gemstone Ct

- 13170 Gemstone Ct

- 13162 Gemstone Ct

- 13174 Gemstone Ct

- 13176 Gemstone Ct

- 13180 Gemstone Ct

- 13195 Gemstone Ct

- 13189 Gemstone Ct

- 13185 Gemstone Ct

- 13154 Gemstone Ct

- 13179 Gemstone Ct

- 13160 Gemstone Ct

- 13152 Gemstone Ct

- 13175 Gemstone Ct

- 13148 Gemstone Ct

- 13144 Gemstone Ct

- 13169 Gemstone Ct

- 13140 Gemstone Ct