13213 Village 13 Unit 13 Camarillo, CA 93012

Estimated Value: $664,000 - $781,000

2

Beds

2

Baths

1,498

Sq Ft

$480/Sq Ft

Est. Value

About This Home

This home is located at 13213 Village 13 Unit 13, Camarillo, CA 93012 and is currently estimated at $719,413, approximately $480 per square foot. 13213 Village 13 Unit 13 is a home located in Ventura County with nearby schools including Tierra Linda Elementary School, Las Colinas Middle School, and Adolfo Camarillo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 18, 2025

Sold by

Park Ellen Kum

Bought by

Ellen Kum Park 2025 Revocable Trust and Park

Current Estimated Value

Purchase Details

Closed on

Aug 25, 2005

Sold by

Gonzales Vivian

Bought by

Park Ellen Kum

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$350,000

Interest Rate

5.87%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 13, 2005

Sold by

Gonzales Vivian and Blumer Living Trust

Bought by

Gonzales Vivian

Purchase Details

Closed on

Jul 13, 2001

Sold by

Dennis Donald and Dennis Family Trust

Bought by

Blumer Eva L and The Blumer Living Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ellen Kum Park 2025 Revocable Trust | -- | None Listed On Document | |

| Park Ellen Kum | $500,000 | Ticor Title Company 71 | |

| Gonzales Vivian | -- | -- | |

| Blumer Eva L | $237,000 | Fidelity National Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Park Ellen Kum | $350,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,633 | $245,051 | $27,680 | $217,371 |

| 2024 | $2,633 | $240,247 | $27,138 | $213,109 |

| 2023 | $2,538 | $235,537 | $26,606 | $208,931 |

| 2022 | $2,529 | $230,919 | $26,084 | $204,835 |

| 2021 | $2,438 | $226,392 | $25,573 | $200,819 |

| 2020 | $2,428 | $224,073 | $25,312 | $198,761 |

| 2019 | $2,416 | $219,680 | $24,816 | $194,864 |

| 2018 | $2,371 | $215,374 | $24,330 | $191,044 |

| 2017 | $2,231 | $211,152 | $23,853 | $187,299 |

| 2016 | $2,176 | $207,013 | $23,386 | $183,627 |

| 2015 | $2,153 | $203,906 | $23,036 | $180,870 |

| 2014 | $2,102 | $199,914 | $22,586 | $177,328 |

Source: Public Records

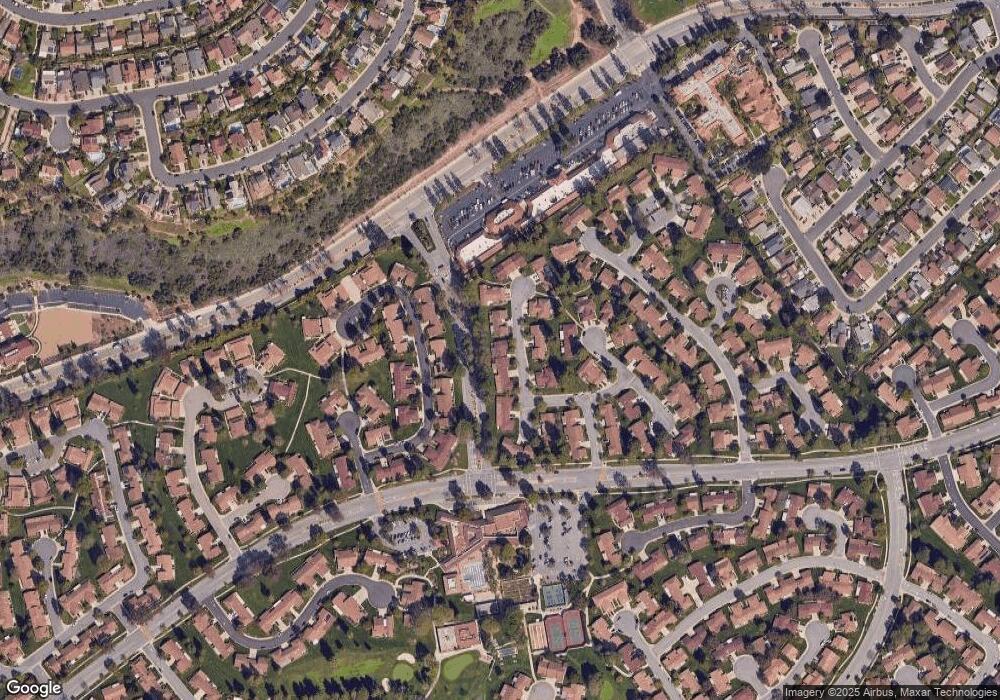

Map

Nearby Homes

- 11225 Village 11

- 15122 Village 15 Unit 15

- 15413 Village 15

- 25126 Village 25

- 23132 Village 23

- 5662 Willow View Dr

- 6118 Village 6

- 29221 Village 29

- 7202 Village 7 Unit 7

- 17306 Village 17 Unit 17

- 26121 Village 26

- 5118 Village 5

- 17223 Village 17

- 31328 Village 31

- 31310 Village 31 Unit 31

- 33229 Village 33

- 5696 Recodo Way

- 6169 Arabian Place

- 4112 Village 4

- 17101 Village 17

- 13211 Village 13 Unit 13

- 13211 Village 13

- 13215 Village 13

- 13209 Village 13 Unit 13

- 13217 Village 13 Unit 13

- 13214 Village 13

- 13216 Village 13

- 13219 Village 13 Unit 13

- 13210 Village 13 Unit 13

- 13218 Village 13 Unit 13

- 13221 Village 13

- 13220 Village 13

- 11228 Village 11

- 11230 Village 11 Unit 11

- 11232 Village 11

- 13325 Village 13

- 13327 Village 13

- 13205 Village 13

- 11222 Village 11