13305 Marystown Rd Shakopee, MN 55379

Estimated Value: $893,000 - $1,148,000

4

Beds

4

Baths

3,594

Sq Ft

$293/Sq Ft

Est. Value

About This Home

This home is located at 13305 Marystown Rd, Shakopee, MN 55379 and is currently estimated at $1,051,980, approximately $292 per square foot. 13305 Marystown Rd is a home located in Scott County with nearby schools including Sweeney Elementary School, East Middle School, and Shakopee Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 26, 2021

Sold by

Rudolph Jeffrey and Rudolph Mariah

Bought by

Ferraz Souza Katie Marie and Ferraz Souza Mateus

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$765,000

Outstanding Balance

$685,768

Interest Rate

2.7%

Mortgage Type

New Conventional

Estimated Equity

$366,212

Purchase Details

Closed on

Jan 9, 2008

Sold by

Crooks Jodie

Bought by

Rudolph Jeffrey and Rudolph Jaclyn

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ferraz Souza Katie Marie | $850,000 | Title Mark Llc | |

| Rudolph Jeffrey | $600,000 | -- | |

| Ferraz-Souza Katie Katie | $850,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ferraz Souza Katie Marie | $765,000 | |

| Closed | Ferraz-Souza Katie Katie | $765,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,534 | $940,300 | $482,300 | $458,000 |

| 2024 | $7,876 | $925,800 | $486,800 | $439,000 |

| 2023 | $7,942 | $851,700 | $448,300 | $403,400 |

| 2022 | $7,724 | $847,900 | $412,200 | $435,700 |

| 2021 | $6,870 | $709,800 | $323,700 | $386,100 |

| 2020 | $7,678 | $705,600 | $319,300 | $386,300 |

| 2019 | $7,348 | $672,600 | $336,000 | $336,600 |

| 2018 | $6,988 | $0 | $0 | $0 |

| 2016 | $6,504 | $0 | $0 | $0 |

Source: Public Records

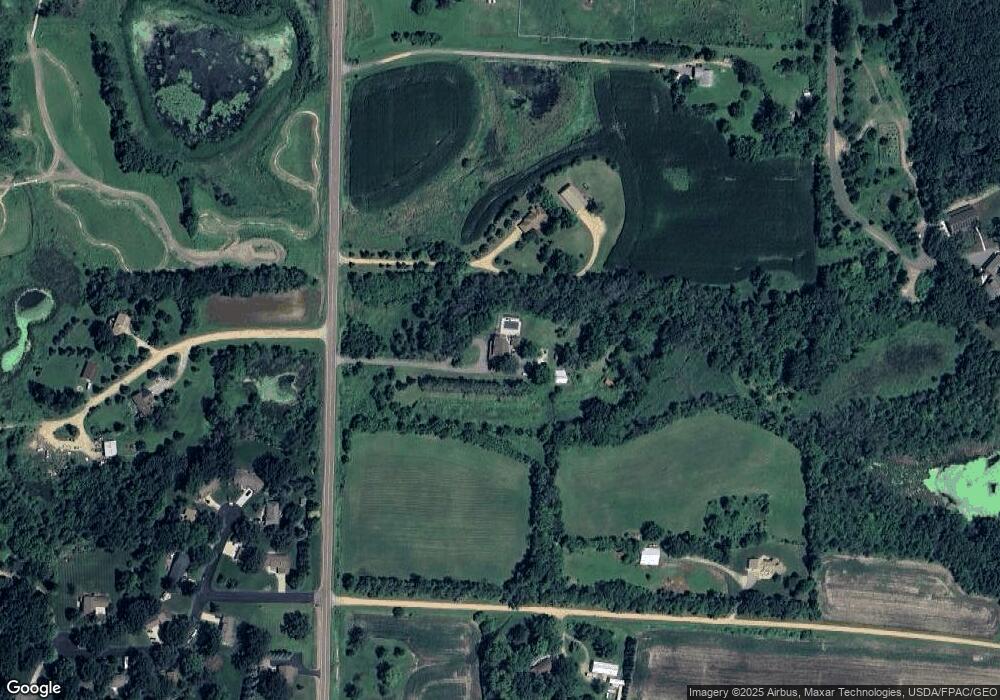

Map

Nearby Homes

- 13720 Marystown Rd

- 1719 Marsh View Terrace

- 1741 Marsh View Terrace

- 1824 Rainier Dr

- 1742 Marsh View Terrace

- 2483 Marsh View Ct

- 2495 Marsh View Ct

- 1764 Marsh View Terrace

- 1842 Rainier Dr

- 1860 Rainer Dr

- 2494 Marsh View Ct

- 1634 Denali Dr

- 1695 Denali Dr

- The Finnegan Plan at Highview Park - Express Premier

- The Cameron II Plan at Highview Park - Express Premier

- The Whitney Plan at Highview Park - Tradition

- The Henry Plan at Highview Park - Tradition

- The Elm Plan at Highview Park - Express Select

- The Hudson Plan at Highview Park - Express Select

- The Elder Plan at Highview Park - Express Select

- 13261 Marystown Rd

- 1032 Oak Cir

- 1038 Oak Cir

- 1026 Oak Rd

- 13421 Marystown Rd

- 1044 Oak Cir

- 13155 Marystown Rd

- 13401 Marystown Rd

- 13300 Marystown Rd

- 1050 Oak Cir

- 13296 Marystown Rd

- 13081 Marystown Rd

- 1041 Oak Rd

- 1056 1056 Oak-Circle-

- 13460 Marystown Rd

- 1056 Oak Cir

- 1051 Oak Rd

- 1060 Oak Rd

- 1061 Oak Rd

- 13501 Marystown Rd