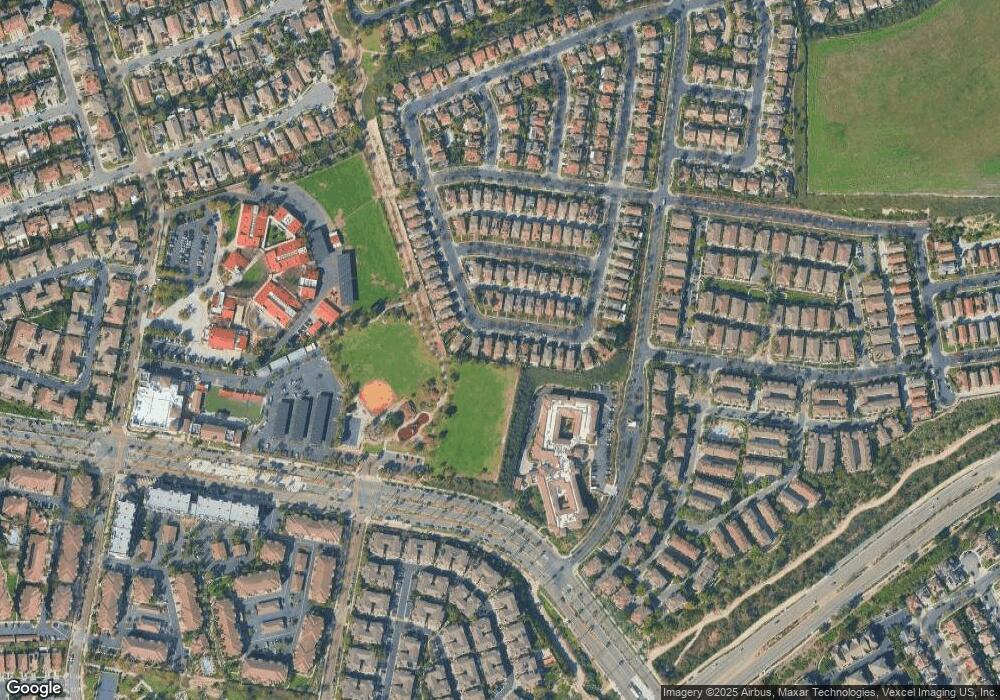

1331 Mill Valley Rd Chula Vista, CA 91913

Otay Ranch Village NeighborhoodEstimated Value: $806,000 - $861,000

3

Beds

3

Baths

1,613

Sq Ft

$518/Sq Ft

Est. Value

About This Home

This home is located at 1331 Mill Valley Rd, Chula Vista, CA 91913 and is currently estimated at $835,733, approximately $518 per square foot. 1331 Mill Valley Rd is a home located in San Diego County with nearby schools including Corky McMillin Elementary School, Rancho Del Rey Middle School, and Olympian High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 23, 2013

Sold by

Johnston Russell James and Maningas Mona Ria

Bought by

Johnston Russell James

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$328,000

Outstanding Balance

$243,336

Interest Rate

4.33%

Mortgage Type

New Conventional

Estimated Equity

$592,397

Purchase Details

Closed on

Mar 11, 2005

Sold by

Johnston Russell James and Johnston Mona Ria

Bought by

Johnston Russell James and Johnston Mona Ria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Interest Rate

5.53%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Purchase Details

Closed on

Jan 15, 2001

Sold by

Otay R-29 Llc

Bought by

Johnston Russell James and Johnston Mona Ria Maningas

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$268,346

Interest Rate

7.15%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Johnston Russell James | -- | Lawyers Title Sd | |

| Johnston Russell James | -- | North American Title Co | |

| Johnston Russell James | $271,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Johnston Russell James | $328,000 | |

| Closed | Johnston Russell James | $400,000 | |

| Previous Owner | Johnston Russell James | $268,346 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,998 | $399,882 | $162,491 | $237,391 |

| 2024 | $6,998 | $392,042 | $159,305 | $232,737 |

| 2023 | $6,882 | $384,356 | $156,182 | $228,174 |

| 2022 | $6,694 | $376,820 | $153,120 | $223,700 |

| 2021 | $6,570 | $369,432 | $150,118 | $219,314 |

| 2020 | $6,430 | $365,645 | $148,579 | $217,066 |

| 2019 | $6,281 | $358,476 | $145,666 | $212,810 |

| 2018 | $6,180 | $351,448 | $142,810 | $208,638 |

| 2017 | $13 | $344,558 | $140,010 | $204,548 |

| 2016 | $5,874 | $337,803 | $137,265 | $200,538 |

| 2015 | $5,743 | $332,730 | $135,204 | $197,526 |

| 2014 | $5,711 | $326,213 | $132,556 | $193,657 |

Source: Public Records

Map

Nearby Homes

- 1306 Mill Valley Rd

- 1279 Fools Gold Way Unit 2

- 1285 Fools Gold Way Unit 2

- 1280 Haglar Way Unit 2

- 1873 Fargo Ln Unit 4

- 779 Caminito Francisco Unit 1

- 1295 Haglar Way Unit 1

- 1401 Caminito Capistrano Unit 1

- 1760 E Palomar St Unit 111

- 1930 Parker Mountain Rd

- 1757 Via Capri

- 1875 Baudouin Place Unit 1731

- 1733 Mendota St

- 1655 Deer Peak Ct

- 1469 Normandy Dr Unit 58

- 1481 Normandy Dr

- 1433 Vallejo Mills St Unit 1

- 1633 Quailsprings Ct

- 1459 Sutter Buttes St

- 1444 Wooden Valley St

- 1335 Mill Valley Rd

- 1327 Mill Valley Rd

- 1323 Mill Valley Rd

- 1337 Mill Valley Rd

- 1319 Mill Valley Rd

- 1330 Mill Valley Rd

- 1340 Battle Creek Rd

- 1334 Mill Valley Rd

- 1326 Mill Valley Rd

- 1315 Mill Valley Rd

- 1322 Mill Valley Rd

- 1338 Mill Valley Rd

- 1318 Mill Valley Rd

- 1336 Battle Creek Rd

- 1311 Mill Valley Rd

- 1314 Mill Valley Rd

- 1332 Battle Creek Rd

- 1310 Mill Valley Rd

- 1328 Battle Creek Rd

- 1307 Mill Valley Rd