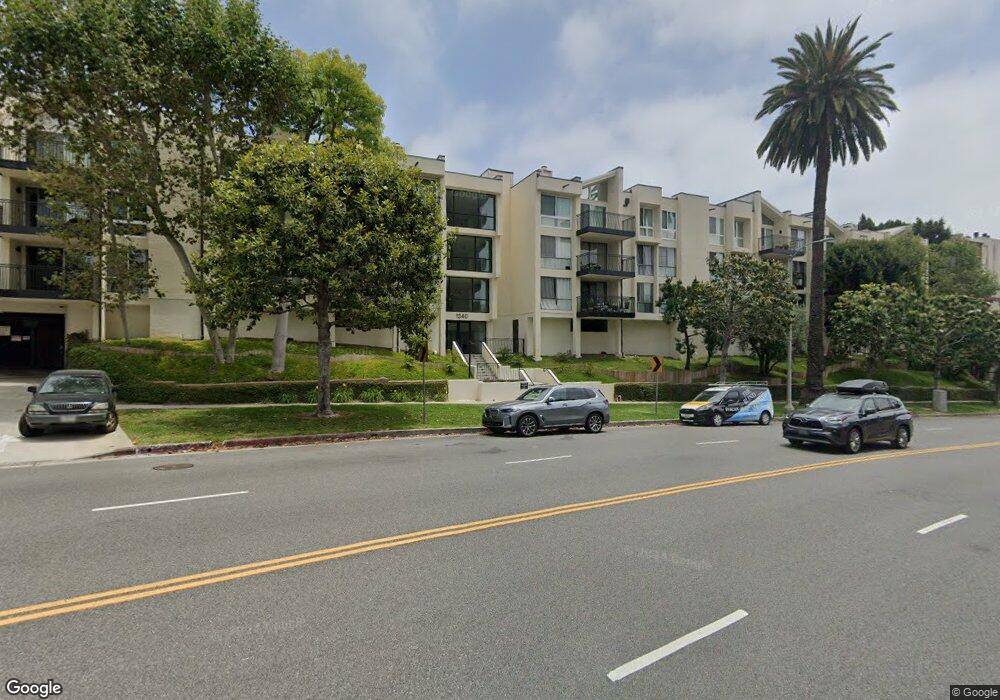

1340 S Bev Gln Blvd Unit 307 Los Angeles, CA 90024

Westwood NeighborhoodEstimated Value: $813,799 - $955,000

2

Beds

2

Baths

1,201

Sq Ft

$727/Sq Ft

Est. Value

About This Home

This home is located at 1340 S Bev Gln Blvd Unit 307, Los Angeles, CA 90024 and is currently estimated at $873,200, approximately $727 per square foot. 1340 S Bev Gln Blvd Unit 307 is a home located in Los Angeles County with nearby schools including Fairburn Avenue Elementary, Ralph Waldo Emerson Community Charter Middle School, and University High School Charter.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 28, 2012

Sold by

Samsky Lisa Robyn

Bought by

George Rhonda Lynn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$313,155

Interest Rate

3.74%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 19, 2009

Sold by

Samsky Lisa Robyn

Bought by

Samsky Lisa Robyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Interest Rate

4.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 11, 1999

Sold by

Flausta S A

Bought by

Samsky Lisa Robyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$156,000

Interest Rate

6.79%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| George Rhonda Lynn | $477,500 | Lawyers Title Company | |

| Samsky Lisa Robyn | -- | First American Title Co La | |

| Samsky Lisa Robyn | $195,000 | Equity Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | George Rhonda Lynn | $313,155 | |

| Previous Owner | Samsky Lisa Robyn | $260,000 | |

| Previous Owner | Samsky Lisa Robyn | $156,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,195 | $599,754 | $372,666 | $227,088 |

| 2024 | $7,195 | $587,995 | $365,359 | $222,636 |

| 2023 | $7,059 | $576,467 | $358,196 | $218,271 |

| 2022 | $6,731 | $565,165 | $351,173 | $213,992 |

| 2021 | $6,644 | $554,085 | $344,288 | $209,797 |

| 2019 | $6,444 | $537,652 | $334,077 | $203,575 |

| 2018 | $6,425 | $527,111 | $327,527 | $199,584 |

| 2016 | $6,141 | $506,644 | $314,809 | $191,835 |

| 2015 | $6,051 | $499,035 | $310,081 | $188,954 |

| 2014 | $6,076 | $489,260 | $304,007 | $185,253 |

Source: Public Records

Map

Nearby Homes

- 1360 S Beverly Glen Blvd

- 1340 S Beverly Glen Blvd Unit 113

- 1361 S Beverly Glen Blvd

- 1333 S Beverly Glen Blvd Unit 901

- 1333 S Beverly Glen Blvd Unit 904

- 1333 S Beverly Glen Blvd Unit 703

- 1333 S Beverly Glen Blvd Unit 1006

- 1333 S Beverly Glen Blvd Unit 402

- 10321 Rochester Ave

- 1519 Comstock Ave

- 1260 S Beverly Glen Blvd Unit 408

- 1520 Comstock Ave

- 1250 S Beverly Glen Blvd Unit 107

- 10370 Ashton Ave

- 1414 Club View Dr

- 1231 Devon Ave

- 1617 S Beverly Glen Blvd Unit 303

- 1325 Thayer Ave

- 10380 Wilshire Blvd Unit 1501

- 10430 Wilshire Blvd Unit 1005

- 1340 S Bev Gln Blvd Unit 103

- 1340 S Bev Gln Blvd Unit 308

- 1340 S Bev Gln Blvd Unit 306

- 1340 S Bev Gln Blvd Unit 305

- 1340 S Bev Gln Blvd Unit 304

- 1340 S Bev Gln Blvd Unit 303

- 1340 S Bev Gln Blvd Unit 302

- 1340 S Bev Gln Blvd Unit 301

- 1340 S Bev Gln Blvd Unit 218

- 1340 S Bev Gln Blvd Unit 217

- 1340 S Bev Gln Blvd Unit 216

- 1340 S Bev Gln Blvd Unit 215

- 1340 S Bev Gln Blvd Unit 214

- 1340 S Bev Gln Blvd Unit 213

- 1340 S Bev Gln Blvd Unit 212

- 1340 S Bev Gln Blvd Unit 211

- 1340 S Bev Gln Blvd Unit 210

- 1340 S Bev Gln Blvd Unit 209

- 1340 S Bev Gln Blvd Unit 208

- 1340 S Bev Gln Blvd Unit 207