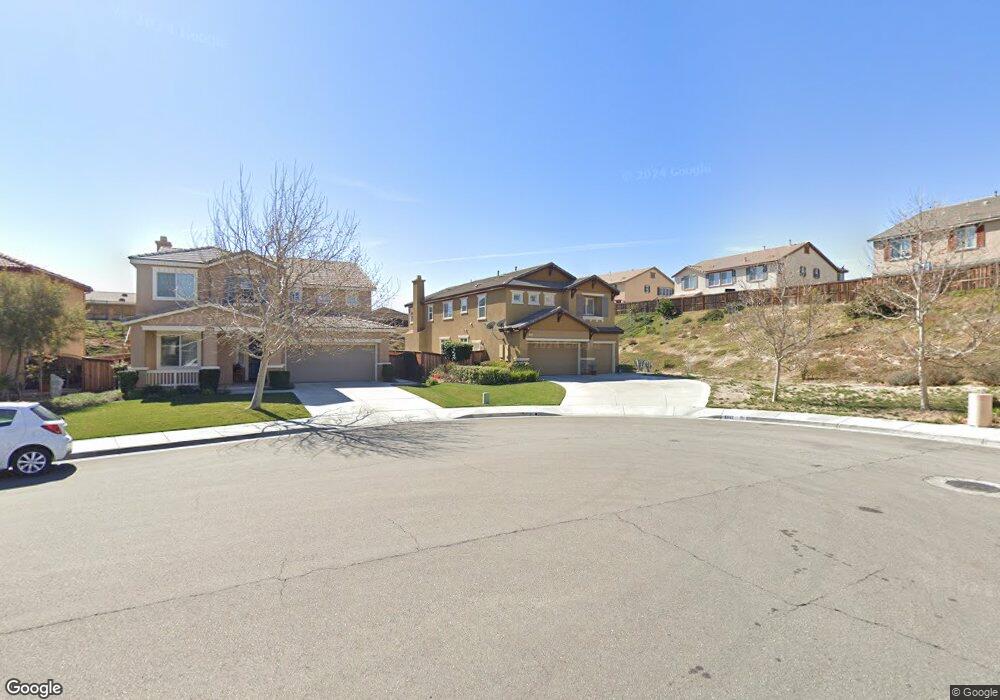

1347 Aztec Ct Beaumont, CA 92223

Estimated Value: $563,000 - $647,438

5

Beds

4

Baths

3,328

Sq Ft

$184/Sq Ft

Est. Value

About This Home

This home is located at 1347 Aztec Ct, Beaumont, CA 92223 and is currently estimated at $613,360, approximately $184 per square foot. 1347 Aztec Ct is a home located in Riverside County with nearby schools including Palm Innovation Academy, San Gorgonio Middle School, and Beaumont Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 11, 2011

Sold by

Costello Gregory Patrick and Costello Kimberly Marie

Bought by

Montalban Enoch S and Montalban Cherry Vi Relano

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$166,180

Interest Rate

4.84%

Mortgage Type

New Conventional

Estimated Equity

$447,180

Purchase Details

Closed on

Jan 23, 2008

Sold by

Capital Pacific Holdings Llc

Bought by

Costello Gregory Patrick and Costello Kimberly Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,198

Interest Rate

6.09%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Montalban Enoch S | $225,000 | Chicago Title Inland Empire | |

| Costello Gregory Patrick | $366,000 | First American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Montalban Enoch S | $200,000 | |

| Previous Owner | Costello Gregory Patrick | $73,198 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,957 | $292,467 | $83,391 | $209,076 |

| 2023 | $6,957 | $281,111 | $80,153 | $200,958 |

| 2022 | $6,835 | $275,600 | $78,582 | $197,018 |

| 2021 | $6,762 | $270,197 | $77,042 | $193,155 |

| 2020 | $6,716 | $267,428 | $76,253 | $191,175 |

| 2019 | $6,650 | $262,185 | $74,758 | $187,427 |

| 2018 | $6,667 | $257,045 | $73,294 | $183,751 |

| 2017 | $6,671 | $252,006 | $71,857 | $180,149 |

Source: Public Records

Map

Nearby Homes

- 152 Paisley Ct

- 1353 Fleet St

- 130 Boston Ave

- 1235 Jackson Ct

- 208 Dwyer Ave

- 1476 Signal Peak

- 279 White Sands St

- 283 White Sands St

- 64 Graham St

- 1457 Faircliff St

- 1428 Redwood St

- 353 Blowing Rock

- 1514 Green Creek Trail

- 1490 Flamingo St

- 1533 Big Bend

- 1534 Green Creek Trail

- 1538 Green Creek Trail

- 1549 Big Bend

- 396 Mesa Verde Park

- 125 Slippery Rock Creek

Your Personal Tour Guide

Ask me questions while you tour the home.