Estimated Value: $332,515 - $439,000

4

Beds

3

Baths

3,882

Sq Ft

$98/Sq Ft

Est. Value

About This Home

This home is located at 1350 Fetter Rd, Lima, OH 45801 and is currently estimated at $379,379, approximately $97 per square foot. 1350 Fetter Rd is a home located in Allen County with nearby schools including Bath Elementary School, Bath Middle School, and Bath High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 8, 2024

Sold by

Saffle Georgiana M and Saffle Paul J

Bought by

Saffle Paul J and Pg Saffle Llc

Current Estimated Value

Purchase Details

Closed on

Jan 17, 2024

Sold by

Bassett Scott T and Bassett Ruth A

Bought by

Saffle Paul J and Saffle Georgiana M

Purchase Details

Closed on

May 15, 1995

Sold by

Albright D Michael

Bought by

Saffle Paul and Saffle Georgianna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,750

Interest Rate

8.39%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 1, 1988

Bought by

Albright D Michael

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Saffle Paul J | -- | None Listed On Document | |

| Saffle Paul J | -- | None Listed On Document | |

| Saffle Paul J | -- | None Listed On Document | |

| Saffle Paul J | $2,700 | None Listed On Document | |

| Saffle Paul | $85,000 | -- | |

| Albright D Michael | $62,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Saffle Paul | $80,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,637 | $105,990 | $6,830 | $99,160 |

| 2023 | $4,443 | $89,820 | $5,780 | $84,040 |

| 2022 | $4,395 | $88,310 | $5,780 | $82,530 |

| 2021 | $4,405 | $88,310 | $5,780 | $82,530 |

| 2020 | $3,810 | $67,730 | $5,250 | $62,480 |

| 2019 | $3,810 | $67,730 | $5,250 | $62,480 |

| 2018 | $3,412 | $65,870 | $5,250 | $60,620 |

| 2017 | $3,194 | $56,910 | $5,250 | $51,660 |

| 2016 | $3,074 | $55,130 | $5,250 | $49,880 |

| 2015 | $2,876 | $56,280 | $5,250 | $51,030 |

| 2014 | $2,876 | $49,350 | $5,250 | $44,100 |

| 2013 | $2,878 | $49,350 | $5,250 | $44,100 |

Source: Public Records

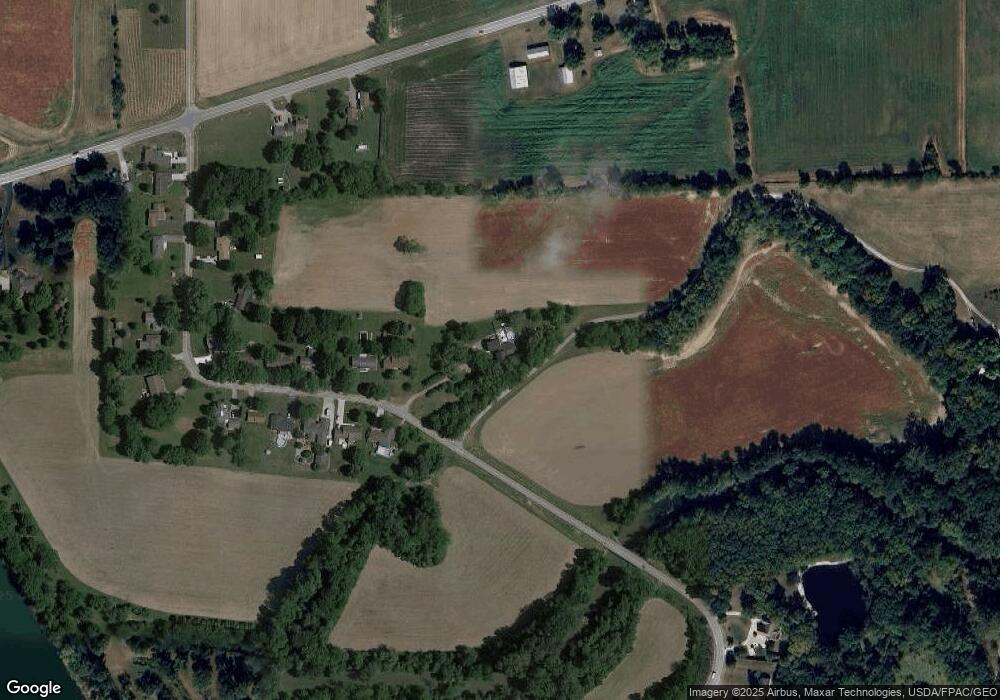

Map

Nearby Homes

- 307 Ridge Crest Cir

- 287 Barnsbury Dr

- 3805 Cambridge Place

- 485 S Mumaugh Rd

- 800 Heritage Dr

- 120 Barnsbury Dr

- 4786 Harding Hwy

- 125 Kensington Cir

- 301 Fenway Dr

- 222 Pinewood Cir

- 304 Pinewood Cir

- 211 Pinewood Cir

- 573 Waterview Cir

- 303 Pinewood Cir

- 5496 Sandusky Rd

- 1503 Findlay Rd Unit Lot 6

- 2049 Harding Hwy

- 620 Willard Ave

- 3252 Stewart Rd

- 2223 Makin Dr