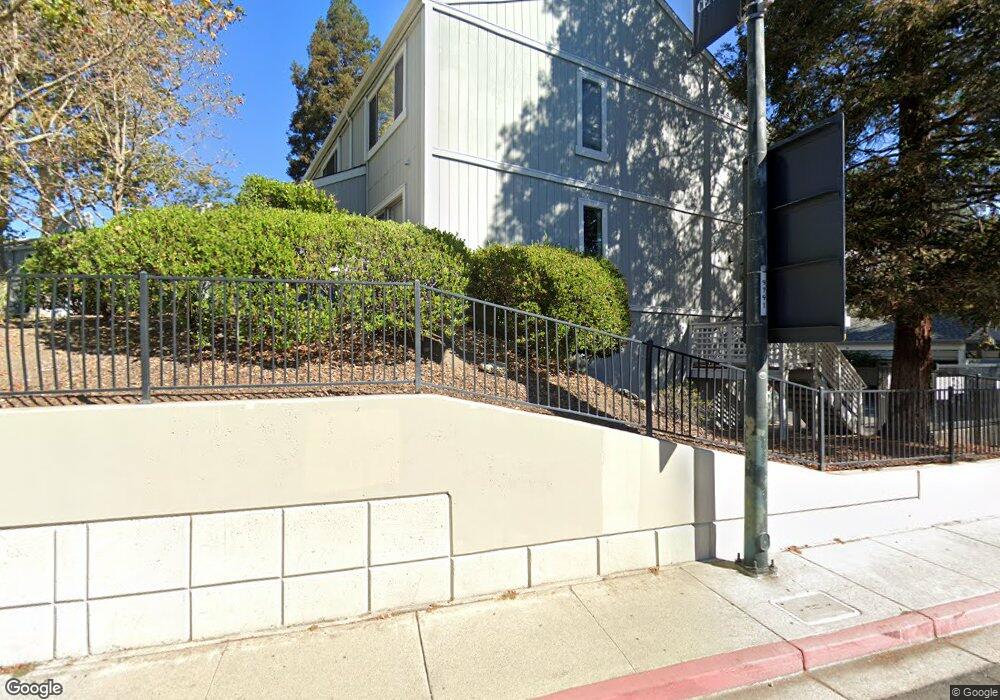

1352 Las Juntas Way Unit F Walnut Creek, CA 94597

Contra Costa Centre NeighborhoodEstimated Value: $515,903 - $635,000

2

Beds

2

Baths

1,211

Sq Ft

$464/Sq Ft

Est. Value

About This Home

This home is located at 1352 Las Juntas Way Unit F, Walnut Creek, CA 94597 and is currently estimated at $561,476, approximately $463 per square foot. 1352 Las Juntas Way Unit F is a home located in Contra Costa County with nearby schools including Fair Oaks Elementary School, Pleasant Hill Middle School, and Ygnacio Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 29, 2010

Sold by

Wells Fargo Bank Na

Bought by

Hui Yin Sum and Choi Tsz Hin

Current Estimated Value

Purchase Details

Closed on

Sep 7, 2010

Sold by

Bryght Lauryn Marie

Bought by

Wells Fargo Bank Na

Purchase Details

Closed on

Mar 1, 2001

Sold by

Williams Brandon and Williams Dixie

Bought by

Bryght Lauryn Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,000

Interest Rate

7.12%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 15, 2000

Sold by

Whitten James Arthur

Bought by

Williams Brandon and Williams Dixie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,800

Interest Rate

8.22%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jan 4, 1994

Sold by

Whitten Patricia Ann Thomas

Bought by

Whitten James Arthur

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hui Yin Sum | $200,000 | Fidelity National Title Co | |

| Wells Fargo Bank Na | $209,501 | Accommodation | |

| Bryght Lauryn Marie | $310,000 | Old Republic Title Company | |

| Williams Brandon | $181,000 | Commonwealth Land Title Co | |

| Whitten James Arthur | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bryght Lauryn Marie | $275,000 | |

| Previous Owner | Williams Brandon | $144,800 | |

| Closed | Williams Brandon | $27,150 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,542 | $256,222 | $153,735 | $102,487 |

| 2024 | $3,476 | $251,199 | $150,721 | $100,478 |

| 2023 | $3,476 | $246,274 | $147,766 | $98,508 |

| 2022 | $3,484 | $241,446 | $144,869 | $96,577 |

| 2021 | $3,401 | $236,713 | $142,029 | $94,684 |

| 2019 | $3,303 | $229,694 | $137,817 | $91,877 |

| 2018 | $3,197 | $225,191 | $135,115 | $90,076 |

| 2017 | $3,091 | $220,776 | $132,466 | $88,310 |

| 2016 | $3,004 | $216,448 | $129,869 | $86,579 |

| 2015 | $2,972 | $213,198 | $127,919 | $85,279 |

| 2014 | $2,927 | $209,023 | $125,414 | $83,609 |

Source: Public Records

Map

Nearby Homes

- 3183 Wayside Plaza Unit 308

- 3183 Wayside Plaza Unit 320

- 3183 Wayside Plaza Unit 319

- 46 Pleasant Valley Dr

- 1043 Esther Dr

- 1546 Sunnyvale Ave

- 2739 Oak Rd

- 1089 Wesley Ct Unit 8

- 1590 Sunnyvale Ave Unit 31

- 2742 Oak Rd Unit 191

- 100 Alderwood Rd

- Plan 5X at Oak Grove

- Plan 6 at Oak Grove

- Plan 3 at Oak Grove

- Plan 4X at Oak Grove

- Plan 5 at Oak Grove

- 225 Oak Cir

- 178 Oak Cir

- 1015 Pleasant Valley Dr

- 184 Oak Cir

- 1352 Las Juntas Way Unit B

- 1352 Las Juntas Way Unit A

- 1352 Las Juntas Way Unit E

- 1352 Las Juntas Way Unit D

- 1352 Las Juntas Way Unit C

- 1340 Las Juntas Way Unit L

- 1340 Las Juntas Way Unit K

- 1340 Las Juntas Way Unit J

- 1340 Las Juntas Way Unit I

- 1340 Las Juntas Way Unit H

- 1340 Las Juntas Way Unit G

- 1340 Las Juntas Way Unit F

- 1340 Las Juntas Way Unit E

- 1340 Las Juntas Way Unit D

- 1340 Las Juntas Way Unit C

- 1340 Las Juntas Way Unit B

- 1340 Las Juntas Way Unit A

- 1358 Las Juntas Way Unit Foxcreek

- 1358 Las Juntas Way

- 1358 Las Juntas Way Unit A