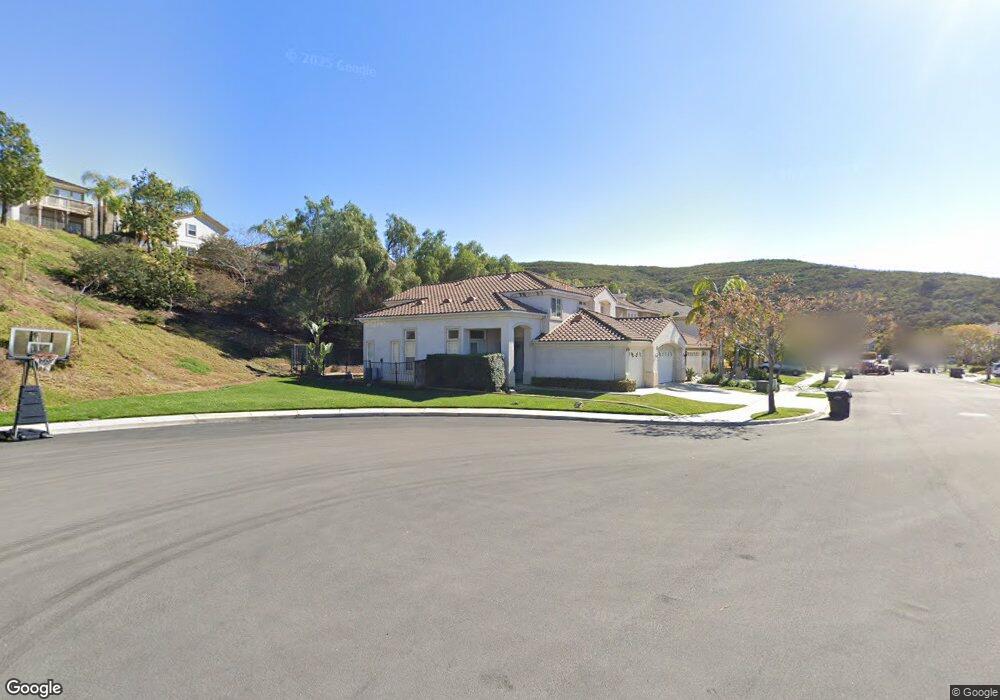

13633 Grosse Point San Diego, CA 92128

Carmel Mountain NeighborhoodEstimated Value: $1,508,154 - $1,616,000

4

Beds

3

Baths

2,648

Sq Ft

$585/Sq Ft

Est. Value

About This Home

This home is located at 13633 Grosse Point, San Diego, CA 92128 and is currently estimated at $1,547,789, approximately $584 per square foot. 13633 Grosse Point is a home located in San Diego County with nearby schools including Shoal Creek Elementary School, Meadowbrook Middle, and Rancho Bernardo High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 4, 2009

Sold by

Kato Misako

Bought by

Kato Hiroshi

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$325,000

Outstanding Balance

$211,794

Interest Rate

5.2%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Estimated Equity

$1,335,995

Purchase Details

Closed on

Mar 11, 1999

Sold by

Carmel Mountain Ranch

Bought by

Kato Hiroshi and Kato Misako

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

6.62%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kato Hiroshi | -- | Chicago Title Company | |

| Kato Hiroshi | $374,500 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kato Hiroshi | $325,000 | |

| Closed | Kato Hiroshi | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,182 | $586,925 | $172,433 | $414,492 |

| 2024 | $6,182 | $575,417 | $169,052 | $406,365 |

| 2023 | $6,050 | $564,136 | $165,738 | $398,398 |

| 2022 | $5,958 | $553,076 | $162,489 | $390,587 |

| 2021 | $5,848 | $542,232 | $159,303 | $382,929 |

| 2020 | $5,786 | $536,673 | $157,670 | $379,003 |

| 2019 | $6,531 | $526,151 | $154,579 | $371,572 |

| 2018 | $6,356 | $515,836 | $151,549 | $364,287 |

| 2017 | $81 | $505,723 | $148,578 | $357,145 |

| 2016 | $6,121 | $495,808 | $145,665 | $350,143 |

| 2015 | $6,043 | $488,361 | $143,477 | $344,884 |

| 2014 | $5,976 | $478,796 | $140,667 | $338,129 |

Source: Public Records

Map

Nearby Homes

- 14112 Stoney Gate Place

- 12224 Mulholland Ct

- 12021 Sienna Ln

- 14346 Savannah Ct

- 14354 Savannah Ct

- 14136 Capewood Ln

- 10462 Rancho Carmel Dr

- 14332 Savannah Ct

- 14323 Savannah Ct

- 10572 Rancho Carmel Dr

- 10366 Rancho Carmel Dr

- 12026 Riley Ln

- 10378 Rancho Carmel Dr

- 13737 Esprit Ave

- Residence 3 Plan at The Trails - Ashton

- Residence 2 Plan at The Trails - Ashton

- Residence 1 Plan at The Trails - Ashton

- 14215 Jonah Way

- 12047 Tivoli Park Row Unit 3

- 12061 Tivoli Park Row Unit 3

- 13625 Grosse Point

- 13617 Grosse Point

- 13609 Grosse Point

- 13634 Grosse Point

- 13626 Grosse Point

- 13620 Calvados Place

- 13612 Calvados Place

- 13642 Grosse Pointe

- 13642 Grosse Point

- 13618 Grosse Point

- 13604 Calvados Place Unit 23B1

- 13628 Calvados Place

- 13601 Grosse Point

- 13596 Calvados Place

- 13648 Grosse Point

- 13636 Calvados Place

- 13610 Grosse Point

- 13588 Calvados Place

- 13644 Calvados Place

- 13602 Grosse Point