1365 Highpoint Curve Shakopee, MN 55379

Estimated Value: $249,000 - $256,091

3

Beds

2

Baths

1,391

Sq Ft

$182/Sq Ft

Est. Value

About This Home

This home is located at 1365 Highpoint Curve, Shakopee, MN 55379 and is currently estimated at $253,523, approximately $182 per square foot. 1365 Highpoint Curve is a home located in Scott County with nearby schools including Jackson Elementary School, East Middle School, and Shakopee Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 20, 2012

Sold by

Krohn Stephanie A and Krohn David H

Bought by

Logan Scott R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Outstanding Balance

$41,350

Interest Rate

3.56%

Mortgage Type

New Conventional

Estimated Equity

$212,173

Purchase Details

Closed on

Feb 27, 2006

Sold by

Dill Christopher and Dill Terri

Bought by

Krohn Stephanie A and Krohn David H

Purchase Details

Closed on

Jul 31, 2002

Sold by

Sattler Arlene R

Bought by

Dill Christopher

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Logan Scott R | $85,000 | Burnet Title | |

| Krohn Stephanie A | $174,500 | -- | |

| Dill Christopher | $156,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Logan Scott R | $60,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,192 | $239,100 | $76,100 | $163,000 |

| 2024 | $2,274 | $228,100 | $72,400 | $155,700 |

| 2023 | $2,340 | $224,800 | $71,000 | $153,800 |

| 2022 | $2,342 | $227,400 | $72,700 | $154,700 |

| 2021 | $1,988 | $198,500 | $57,000 | $141,500 |

| 2020 | $2,214 | $187,900 | $47,300 | $140,600 |

| 2019 | $2,024 | $184,400 | $50,000 | $134,400 |

| 2018 | $1,822 | $0 | $0 | $0 |

| 2016 | $1,688 | $0 | $0 | $0 |

| 2014 | -- | $0 | $0 | $0 |

Source: Public Records

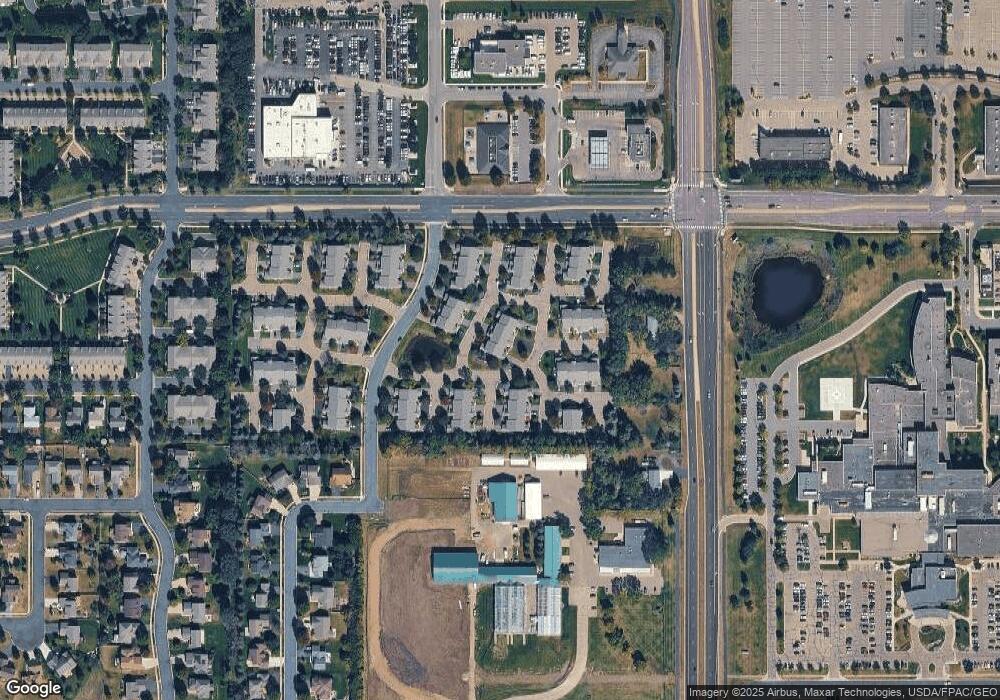

Map

Nearby Homes

- 1022 Providence Dr

- 1590 Countryside Dr Unit 5108

- 849 Providence Dr

- 826 Princeton Ave

- 1820 Mockingbird Ave

- 1844 Mockingbird Ave Unit 1102

- 668 Cobblestone Way

- 1562 Liberty Cir Unit 2403

- 2148 Mcgregor Ln

- 793 Lupine Ct

- 291 Appleblossom Ln

- 1552 Dublin Ct

- 2052 Wilhelm Ct

- 335 Bluestem Ave

- 2312 Vierling Dr E

- 2471 Tyrone Dr

- 2447 Tyrone Dr

- 2399 Tyrone Dr

- 1164 Merrifield Ct

- 1573 Creekside Ln

- 1369 Highpoint Curve

- 1739 Crestview St Unit 6

- 1373 Highpoint Curve

- 1745 Crestview St

- 1733 Crestview St Unit 7

- 1377 Highpoint Curve Unit 1

- 1727 Crestview St

- 1348 Highpoint Curve

- 1734 Crestview St

- 1358 Idlewood Way Unit 57

- 1728 Crestview St

- 1721 Crestview St Unit 27

- 1727 Weston Ln Unit 13

- 1352 Highpoint Curve Unit 63

- 1723 Weston Ln Unit 14

- 1332 Highpoint Curve

- 1731 Weston Ln

- 1385 Highpoint Curve Unit 26

- 1362 Idlewood Way

- 1364 Highpoint Curve