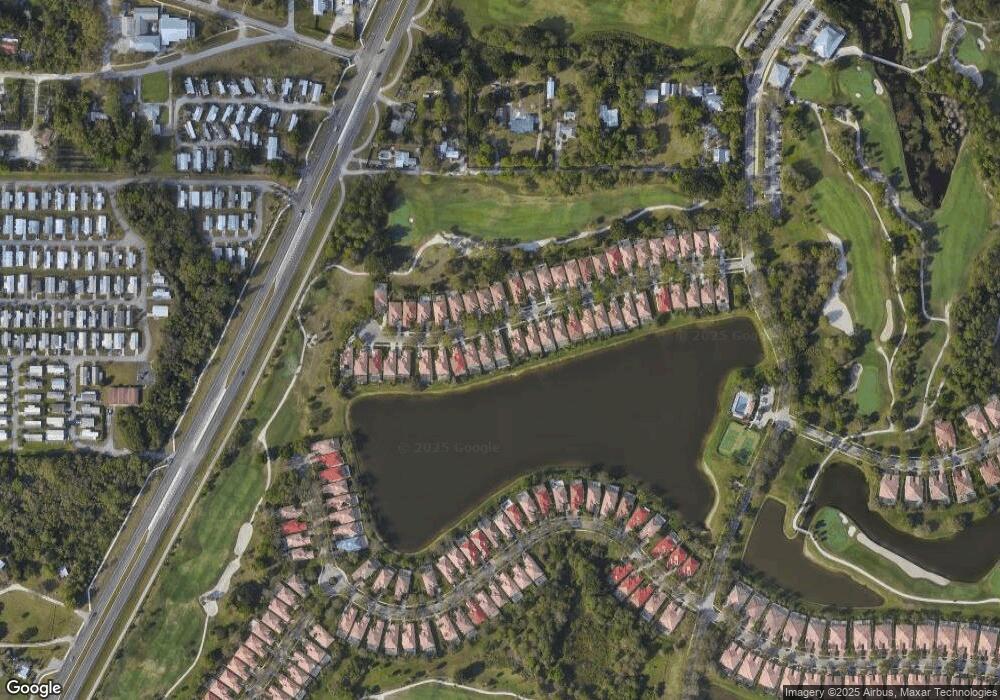

1394 SW Eagleglen Place Stuart, FL 34997

South Stuart NeighborhoodEstimated Value: $557,087 - $615,000

3

Beds

2

Baths

1,992

Sq Ft

$294/Sq Ft

Est. Value

About This Home

This home is located at 1394 SW Eagleglen Place, Stuart, FL 34997 and is currently estimated at $586,022, approximately $294 per square foot. 1394 SW Eagleglen Place is a home located in Martin County with nearby schools including Crystal Lake Elementary School, Dr. David L. Anderson Middle School, and South Fork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 26, 2019

Sold by

Alexander John D and Alexander Catherine

Bought by

Alexander Catherine

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$325,000

Outstanding Balance

$284,729

Interest Rate

3.82%

Mortgage Type

New Conventional

Estimated Equity

$301,293

Purchase Details

Closed on

Nov 10, 2016

Sold by

Gamble Patrck

Bought by

Alexander John D and Alexander Catherine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

3.42%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 24, 2010

Sold by

The Bank Of New York Mellon

Bought by

Gamble Patrick and Gamble Elsa

Purchase Details

Closed on

Nov 4, 2009

Sold by

Cornell William

Bought by

Bank Of New York

Purchase Details

Closed on

Jan 29, 1999

Sold by

Florida Club Homes Inc

Bought by

Gamble Patrick and Gamble Elsa

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alexander Catherine | $125,000 | Fidelity Natl Ttl Of Fl Inc | |

| Alexander John D | $365,000 | None Available | |

| Gamble Patrick | $262,000 | Landsafe Title | |

| Bank Of New York | -- | None Available | |

| Gamble Patrick | $205,800 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Alexander Catherine | $325,000 | |

| Previous Owner | Alexander John D | $200,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,553 | $362,701 | -- | -- |

| 2024 | $5,442 | $352,480 | -- | -- |

| 2023 | $5,442 | $342,214 | $0 | $0 |

| 2022 | $5,251 | $332,247 | $0 | $0 |

| 2021 | $5,264 | $322,570 | $0 | $0 |

| 2020 | $5,155 | $318,117 | $0 | $0 |

| 2019 | $5,073 | $310,965 | $0 | $0 |

| 2018 | $4,948 | $305,167 | $0 | $0 |

| 2017 | $4,350 | $298,890 | $145,000 | $153,890 |

| 2016 | $5,164 | $285,890 | $130,000 | $155,890 |

| 2015 | -- | $274,640 | $122,000 | $152,640 |

| 2014 | -- | $271,570 | $115,000 | $156,570 |

Source: Public Records

Map

Nearby Homes

- 1590 SW Balmoral Trace

- 1293 SW Heather Terrace

- 1724 SW Diana Terrace Unit 37

- 1745 SW Diana Terrace Unit 49

- 1722 SW Vickie Terrace Unit 12

- 9520 SW Wedgewood Ln

- 1117 SW Balmoral Trace

- 1035 SW Tamarrow Place

- 8905 SW Cherry Ln

- 1056 SW Balmoral Trace

- Delray Plan at Twin Oaks

- 8851 SW Kanner Oaks Dr

- Hayden Plan at Twin Oaks

- Cali Plan at Twin Oaks

- 8841 SW Kanner Oaks Dr

- 940 SW Tamarrow Place

- 8831 SW Kanner Oaks Dr

- 8821 SW Kanner Oaks Dr

- 715 SW Balmoral Trace

- 819 SW Bromelia Terrace

- 1406 SW Eagleglen Place

- 1382 SW Eagleglen Place

- 1418 SW Eagleglen Place

- 1370 SW Eagleglen Place

- 1430 SW Eagleglen Place

- 1358 SW Eagleglen Place

- 1393 SW Eagleglen Place

- 1405 SW Eagleglen Place

- 1381 SW Eagleglen Place

- 1442 SW Eagleglen Place

- 1417 SW Eagleglen Place

- 1346 SW Eagleglen Place

- 1369 SW Eagleglen Place

- 0 SW Eagleglen Place

- 1429 SW Eagleglen Place

- 1357 SW Eagleglen Place

- 1454 SW Eagleglen Place

- 1334 SW Eagleglen Place

- 1441 SW Eagleglen Place

- 1322 SW Eagleglen Place