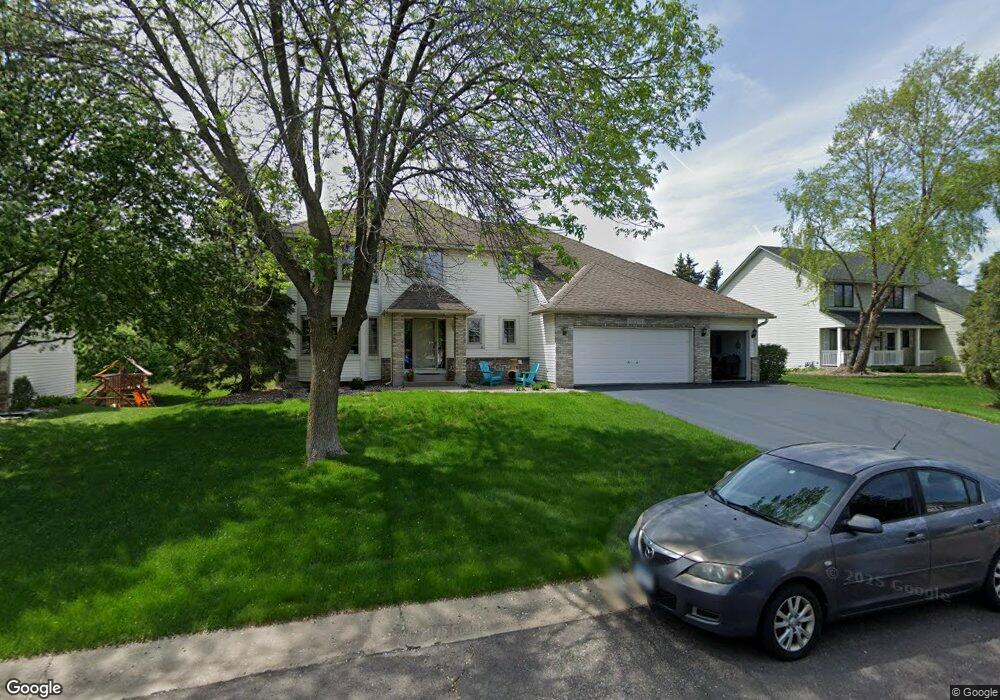

14063 Freeport Ct Saint Paul, MN 55124

Cedar Isle NeighborhoodEstimated Value: $566,927 - $619,000

5

Beds

4

Baths

2,148

Sq Ft

$278/Sq Ft

Est. Value

About This Home

This home is located at 14063 Freeport Ct, Saint Paul, MN 55124 and is currently estimated at $596,982, approximately $277 per square foot. 14063 Freeport Ct is a home located in Dakota County with nearby schools including Greenleaf Elementary School, Falcon Ridge Middle School, and Eastview Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 22, 2019

Sold by

Teiken Todd G and Teiken Pamela A

Bought by

Messner Joshua Michael and Quamme Tara May

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$373,500

Outstanding Balance

$327,701

Interest Rate

4.3%

Mortgage Type

New Conventional

Estimated Equity

$269,281

Purchase Details

Closed on

May 29, 2002

Sold by

Mazurek John J and Mazurek Cheryl A

Bought by

Teiken Todd G and Teiken Pamela A

Purchase Details

Closed on

Mar 7, 1998

Sold by

Donald L Johnson Homes Inc

Bought by

Mazurek John J

Purchase Details

Closed on

Sep 16, 1997

Sold by

Arcon Development Inc

Bought by

Donald L Johnson Homes Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Messner Joshua Michael | $415,000 | Burnet Title | |

| Teiken Todd G | $319,500 | -- | |

| Mazurek John J | $225,000 | -- | |

| Donald L Johnson Homes Inc | $42,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Messner Joshua Michael | $373,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,950 | $520,600 | $157,600 | $363,000 |

| 2023 | $5,950 | $520,600 | $157,900 | $362,700 |

| 2022 | $4,942 | $497,700 | $157,400 | $340,300 |

| 2021 | $5,296 | $424,500 | $136,700 | $287,800 |

| 2020 | $4,942 | $413,700 | $130,200 | $283,500 |

| 2019 | $4,537 | $403,100 | $124,000 | $279,100 |

| 2018 | $4,619 | $387,300 | $118,100 | $269,200 |

| 2017 | $4,606 | $377,400 | $112,400 | $265,000 |

| 2016 | $4,708 | $358,000 | $107,100 | $250,900 |

| 2015 | $4,466 | $356,468 | $103,624 | $252,844 |

| 2014 | -- | $340,336 | $99,428 | $240,908 |

| 2013 | -- | $308,181 | $90,927 | $217,254 |

Source: Public Records

Map

Nearby Homes

- 14217 Footbridge Way

- 14461 Freesia Way

- 13954 Flagstaff Ct

- 13947 Fleetwood Ave

- 7342 Upper 139th St W

- 14057 Flintwood Ct

- 7291 Upper 136th St W

- 13720 Georgia Dr

- 13868 Glendale Ct

- 14620 Garrett Ave Unit 310

- 13358 Foliage Ave

- 13715 Grafton Ct

- 7577 138th St W

- 7662 142nd St W

- 14242 Glencove Trail

- 6790 132nd St W

- 13973 Falcon Ave

- 6567 133rd St W

- 13912 Farmington Way

- 13135 Gamma Way

- 14047 Freeport Ct

- 14079 Freeport Ct

- 14095 Freeport Ct

- 14072 Freeport Ct

- 14015 Freeport Ct

- 14054 Freeport Ct

- 14038 Freeport Ct

- 14086 Freeport Ct

- 14022 Freeport Ct

- 14111 Freeport Ct

- 14006 Freeport Ct

- 14175 Foxtail Ln

- 14159 Foxtail Ct

- 14165 Foxtail Ln

- 14155 Foxtail Ln

- 14190 Foxtail Ln

- 14169 Freeport Trail

- 7025 142nd St W

- 14180 Foxtail Ln

- 14145 Foxtail Ln