14149 Fairgate Blvd Newbury, OH 44065

Estimated Value: $321,000 - $370,000

4

Beds

3

Baths

2,544

Sq Ft

$136/Sq Ft

Est. Value

About This Home

This home is located at 14149 Fairgate Blvd, Newbury, OH 44065 and is currently estimated at $346,892, approximately $136 per square foot. 14149 Fairgate Blvd is a home located in Geauga County with nearby schools including Notre Dame Elementary School and St Helen Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 28, 2015

Sold by

Oliver Dale and Oliver Paula

Bought by

Puletti Mark and Puletti Laura

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$166,500

Outstanding Balance

$128,683

Interest Rate

3.77%

Mortgage Type

New Conventional

Estimated Equity

$218,209

Purchase Details

Closed on

Dec 31, 2001

Sold by

Jeanne Cseplo and Cseplo Jeanne

Bought by

Oliver Dale and Oliver Paula

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$163,706

Interest Rate

6.53%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 27, 1999

Sold by

David Adrian and David J

Bought by

Cseplo Jeanne

Purchase Details

Closed on

Nov 22, 1989

Bought by

Cseplo Jeanne

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Puletti Mark | $185,000 | Lawyers Title | |

| Oliver Dale | $165,000 | Lawyers Title Ins Corp | |

| Cseplo Jeanne | -- | -- | |

| Cseplo Jeanne | $108,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Puletti Mark | $166,500 | |

| Previous Owner | Oliver Dale | $163,706 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,615 | $87,650 | $17,470 | $70,180 |

| 2023 | $3,615 | $87,650 | $17,470 | $70,180 |

| 2022 | $3,300 | $68,110 | $14,560 | $53,550 |

| 2021 | $3,290 | $68,110 | $14,560 | $53,550 |

| 2020 | $3,058 | $68,810 | $15,260 | $53,550 |

| 2019 | $3,783 | $61,530 | $15,260 | $46,270 |

| 2018 | $3,776 | $61,530 | $15,260 | $46,270 |

| 2017 | $3,783 | $61,530 | $15,260 | $46,270 |

| 2016 | $3,844 | $62,030 | $16,490 | $45,540 |

| 2015 | $3,745 | $62,030 | $16,490 | $45,540 |

| 2014 | $3,745 | $62,030 | $16,490 | $45,540 |

| 2013 | $3,288 | $62,030 | $16,490 | $45,540 |

Source: Public Records

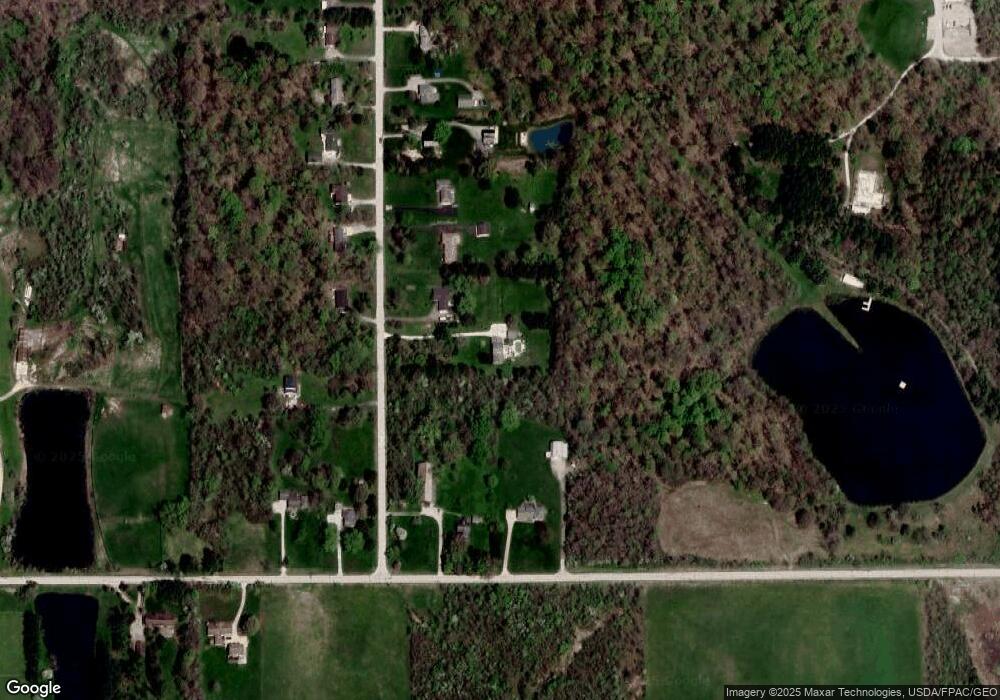

Map

Nearby Homes

- 10978 Fairmount Rd

- 11235 Pekin Rd

- 14205 Country River Ln

- 10885 Scranton Woods Trail

- 14646 Dora Dr

- 13559 Auburn Rd

- 13410 Auburn Rd

- 11700 Pekin Rd

- 11450 Eastridge Cir

- 14721 Zenith Dr

- 10685 Butternut Rd

- 11710 Butternut Rd

- 13190 N Bridle Trail

- S/L 19 Sutton Place

- 11075 Cory Ln

- 14525 Sperry Rd

- 8 Sperry Rd

- 10640 Butternut Rd

- S/L 26 Overture Dr

- 12079 Pekin Rd

- 14137 Fairgate Blvd

- 14119 Fairgate Blvd

- 14136 Fairgate Blvd

- 14089 Fairgate Blvd

- 10914 Pekin Rd

- 10930 Pekin Rd

- 14118 Fairgate Blvd

- 14160 Fairgate Blvd

- 14083 Fairgate Blvd

- 10884 Pekin Rd

- 10868 Pekin Rd

- VL Pekin Rd

- 14088 Fairgate Blvd

- 14075 Fairgate Blvd

- 14074 Fairgate Blvd

- 14057 Fairgate Blvd

- 14058 Fairgate Blvd

- 10844 Pekin Rd

- 14045 Fairgate Blvd

- 14044 Fairgate Blvd