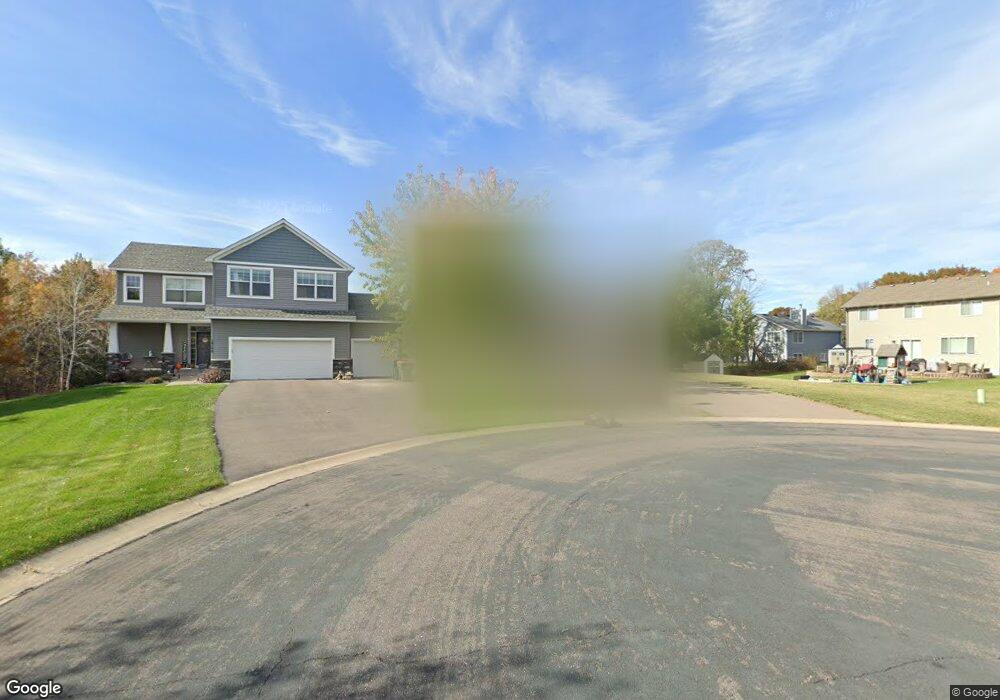

14150 Osage St NW Andover, MN 55304

Estimated Value: $503,000 - $562,000

4

Beds

3

Baths

2,538

Sq Ft

$207/Sq Ft

Est. Value

About This Home

This home is located at 14150 Osage St NW, Andover, MN 55304 and is currently estimated at $524,803, approximately $206 per square foot. 14150 Osage St NW is a home located in Anoka County with nearby schools including Crooked Lake Elementary School, Oak View Middle School, and Andover Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2016

Sold by

Eternity Homes Llc

Bought by

Lopez Jonathan and Lopez Carolyn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$332,315

Outstanding Balance

$273,525

Interest Rate

4.5%

Mortgage Type

FHA

Estimated Equity

$273,680

Purchase Details

Closed on

Jan 27, 2016

Sold by

Lopez Jonathan Andre and Lopez Carolyn

Bought by

Eternity Homes Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,000

Interest Rate

3.97%

Mortgage Type

Construction

Purchase Details

Closed on

Nov 18, 2015

Sold by

Harmon Connie L and Harmon Glenn A

Bought by

Lopez Jonathan Andre

Purchase Details

Closed on

Jul 19, 2012

Sold by

Kensington Inc

Bought by

Harmon Connie L and Lopez Jonathan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$44,400

Interest Rate

3.65%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lopez Jonathan | $343,300 | Premier Title Ins Agency Inc | |

| Eternity Homes Llc | -- | Premier Title | |

| Lopez Jonathan Andre | -- | None Available | |

| Harmon Connie L | $55,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lopez Jonathan | $332,315 | |

| Previous Owner | Eternity Homes Llc | $256,000 | |

| Previous Owner | Harmon Connie L | $44,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,844 | $499,300 | $122,000 | $377,300 |

| 2024 | $4,844 | $468,100 | $102,900 | $365,200 |

| 2023 | $4,503 | $486,400 | $102,900 | $383,500 |

| 2022 | $4,275 | $483,800 | $93,500 | $390,300 |

| 2021 | $4,150 | $395,700 | $78,600 | $317,100 |

| 2020 | $4,125 | $374,800 | $74,900 | $299,900 |

| 2019 | $3,911 | $360,600 | $71,400 | $289,200 |

| 2018 | $3,866 | $334,500 | $0 | $0 |

| 2017 | $824 | $323,600 | $0 | $0 |

| 2016 | $908 | $59,900 | $0 | $0 |

| 2015 | -- | $59,900 | $59,900 | $0 |

| 2014 | -- | $39,000 | $39,000 | $0 |

Source: Public Records

Map

Nearby Homes

- 14395 Partridge St NW

- 14404 Osage St NW

- 13919 Nightingale St NW

- 13993 Crosstown Blvd NW

- 14553 Ibis St NW

- 14780 Jay St NW

- 2115 134th Ave NW

- 1184 143rd Ave NW

- 14023 Yellow Pine St NW

- 13871 Eidelweiss St NW

- 14485 Xeon St NW

- 2066 151st Ave NW

- 2080 151st Ave NW

- 14994 Crane St NW

- 1096 142nd Ave NW

- 2481 132nd Ln NW

- TBD Gladiola St NW

- 2743 134th Ln NW

- Lot 5 Gladiola St NW

- 15285 Quinn St NW

- 14146 Osage St NW

- 2056 142nd Ave NW

- 2056 NW 142nd Ave NW

- 2068 142nd Ave NW

- 2040 142nd Ave NW

- 2089 141st Ln NW

- 2082 141st Ln NW

- 2092 142nd Ave NW

- 2101 141st Ln NW

- 2053 142nd Ave NW

- 2067 142nd Ave NW

- 2041 142nd Ave NW

- 2094 141st Ln NW

- 2079 142nd Ave NW

- 2104 142nd Ave NW

- 2113 141st Ln NW

- 2031 142nd Ave NW

- 2091 142nd Ave NW

- 2106 141st Ln NW

- 2054 142nd Ln NW