14152 Foothill Blvd Unit 36 Sylmar, CA 91342

Estimated Value: $556,000 - $586,000

3

Beds

3

Baths

1,429

Sq Ft

$400/Sq Ft

Est. Value

About This Home

This home is located at 14152 Foothill Blvd Unit 36, Sylmar, CA 91342 and is currently estimated at $571,597, approximately $399 per square foot. 14152 Foothill Blvd Unit 36 is a home located in Los Angeles County with nearby schools including Sylmar Leadership Academy, San Fernando Senior High School, and PUC Community Charter Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 19, 2010

Sold by

Fannie Mae

Bought by

Foley Malcom W

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$39,950

Outstanding Balance

$26,309

Interest Rate

4.31%

Mortgage Type

Stand Alone Second

Estimated Equity

$556,737

Purchase Details

Closed on

Apr 6, 2010

Sold by

Serrano Silvia

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Mar 3, 2008

Sold by

Serrano Sylvia

Bought by

Olguin Sally

Purchase Details

Closed on

Oct 26, 2007

Sold by

Ohannesian Ronald

Bought by

Serrano Sylvia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,000

Interest Rate

6.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 9, 2000

Sold by

Ohannesian Gerald V

Bought by

Ohannesian Gerald and Gerald V Ohannesian Living Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Foley Malcom W | $235,000 | Old Republic Title Company | |

| Federal National Mortgage Association | $316,996 | Accommodation | |

| Olguin Sally | -- | None Available | |

| Serrano Sylvia | $365,000 | Fidelity National Title | |

| Ohannesian Gerald | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Foley Malcom W | $39,950 | |

| Open | Foley Malcom W | $188,000 | |

| Previous Owner | Serrano Sylvia | $292,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,781 | $301,063 | $86,215 | $214,848 |

| 2024 | $3,781 | $295,161 | $84,525 | $210,636 |

| 2023 | $3,711 | $289,374 | $82,868 | $206,506 |

| 2022 | $3,541 | $283,701 | $81,244 | $202,457 |

| 2021 | $3,492 | $278,139 | $79,651 | $198,488 |

| 2020 | $3,524 | $275,288 | $78,835 | $196,453 |

| 2019 | $3,389 | $269,891 | $77,290 | $192,601 |

| 2018 | $3,341 | $264,600 | $75,775 | $188,825 |

| 2016 | $3,182 | $254,328 | $72,834 | $181,494 |

| 2015 | $3,137 | $250,508 | $71,740 | $178,768 |

| 2014 | $3,154 | $245,602 | $70,335 | $175,267 |

Source: Public Records

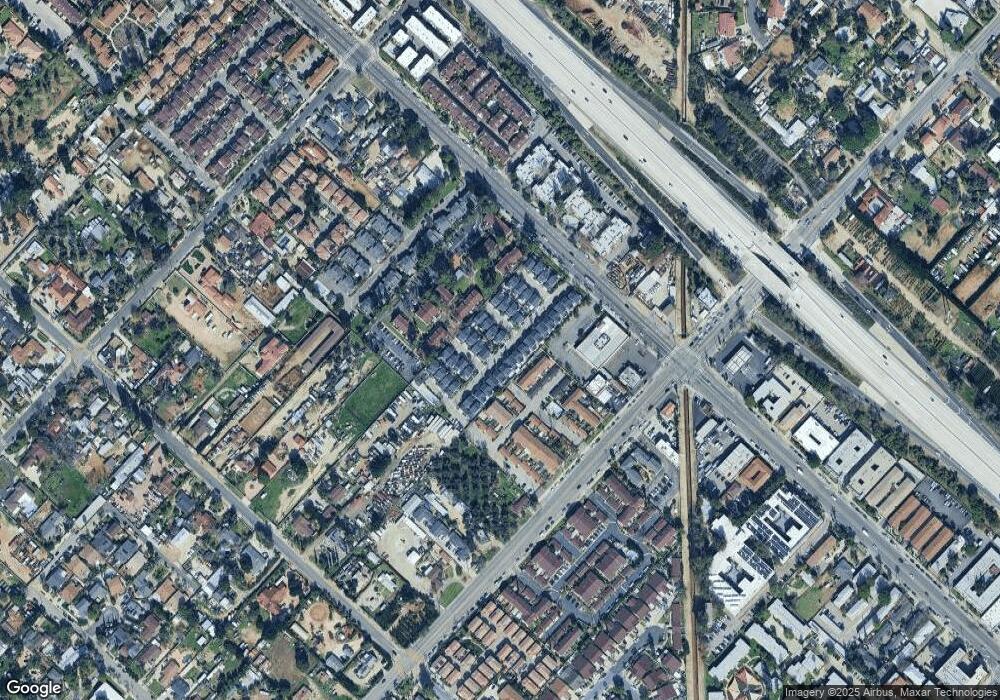

Map

Nearby Homes

- 14020 Foothill Blvd

- 14287 Foothill Blvd Unit 33

- 14291 Foothill Blvd Unit 11

- 14293 Foothill Blvd Unit 21

- 14293 Foothill Blvd Unit 19

- 14428 Rex St

- 13659 Gladstone Ave

- 14401 Lakeside St

- 14325 Foothill Blvd Unit 34

- 14039 Astoria St Unit 114

- 14523 Ryan St

- 14344 Foothill Blvd Unit 306

- 14345 Foothill Blvd Unit 102

- 14380 Foothill Blvd

- 14072 Tyler St

- 14425 Foothill Blvd Unit 17

- 14024 Tyler St

- 13144 Bromont Ave Unit 42

- 13080 Dronfield Ave

- 13080 Dronfield Ave Unit 13

- 14152 Foothill Blvd Unit 44

- 14152 Foothill Blvd Unit 38

- 14152 Foothill Blvd Unit 37

- 14152 Foothill Blvd Unit 34

- 14152 Foothill Blvd Unit 33

- 14152 Foothill Blvd Unit 32

- 14152 Foothill Blvd Unit 31

- 14152 Foothill Blvd Unit 30

- 14152 Foothill Blvd Unit 29

- 14152 Foothill Blvd Unit 28

- 14152 Foothill Blvd Unit 27

- 14152 Foothill Blvd Unit 26

- 14152 Foothill Blvd Unit 25

- 14152 Foothill Blvd Unit 24

- 14152 Foothill Blvd Unit 23

- 14152 Foothill Blvd Unit 6

- 14152 Foothill Blvd Unit 5

- 14152 Foothill Blvd Unit 4

- 14152 Foothill Blvd Unit 3

- 14152 Foothill Blvd Unit 2