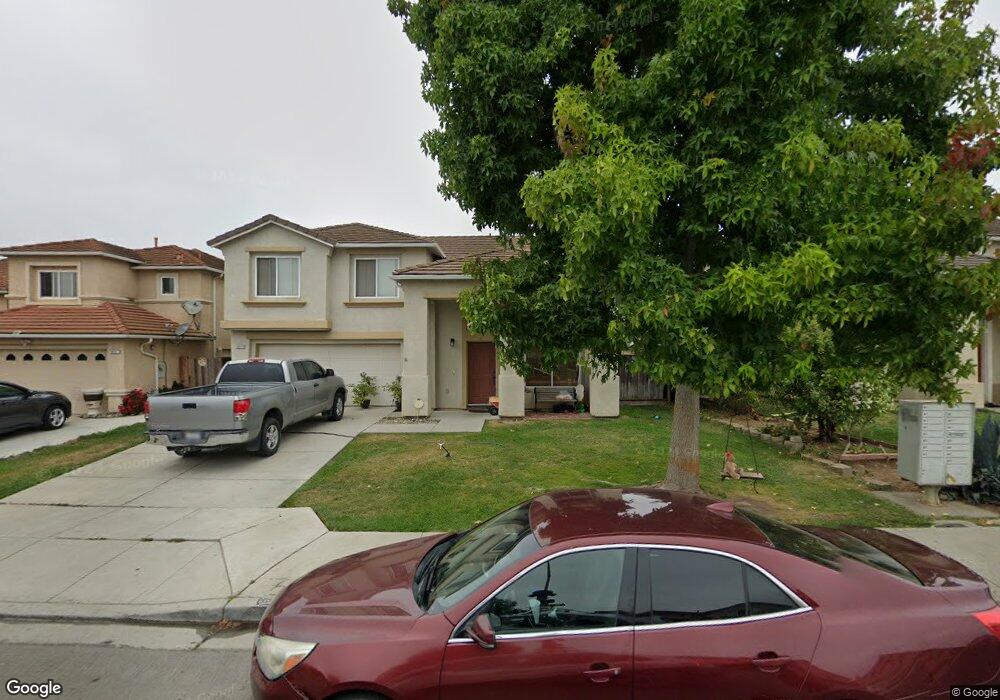

1417 Sumac Way Unit 2 Salinas, CA 93905

East Salinas NeighborhoodEstimated Value: $694,775 - $771,000

4

Beds

3

Baths

1,686

Sq Ft

$432/Sq Ft

Est. Value

About This Home

This home is located at 1417 Sumac Way Unit 2, Salinas, CA 93905 and is currently estimated at $728,944, approximately $432 per square foot. 1417 Sumac Way Unit 2 is a home located in Monterey County with nearby schools including Oscar F. Loya Elementary School, La Paz Middle School, and Alisal High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 14, 2020

Sold by

Bravo Ana B and Luquin Hector

Bought by

Luquin Hector and Bravo Ana B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$389,700

Outstanding Balance

$334,996

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$393,948

Purchase Details

Closed on

Sep 15, 2016

Sold by

Kowalski Matthew S and Kowalski Debra J

Bought by

Bravo Ana B and Luquin Hector

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$391,875

Interest Rate

3.45%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 15, 1999

Sold by

Standard Pacific Corp

Bought by

Kowalski Matthew S and Kowalski Debra J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,990

Interest Rate

7.01%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Luquin Hector | -- | Old Republic Title Company | |

| Bravo Ana B | $412,500 | Old Republic Title Company | |

| Kowalski Matthew S | $199,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Luquin Hector | $389,700 | |

| Closed | Bravo Ana B | $391,875 | |

| Previous Owner | Kowalski Matthew S | $128,990 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,469 | $478,734 | $232,114 | $246,620 |

| 2024 | $6,469 | $469,348 | $227,563 | $241,785 |

| 2023 | $6,396 | $460,146 | $223,101 | $237,045 |

| 2022 | $5,773 | $451,125 | $218,727 | $232,398 |

| 2021 | $5,770 | $442,281 | $214,439 | $227,842 |

| 2020 | $5,702 | $437,747 | $212,241 | $225,506 |

| 2019 | $5,876 | $429,165 | $208,080 | $221,085 |

| 2018 | $5,547 | $420,750 | $204,000 | $216,750 |

| 2017 | $5,746 | $412,500 | $200,000 | $212,500 |

| 2016 | $3,547 | $263,523 | $112,565 | $150,958 |

| 2015 | $3,512 | $259,566 | $110,875 | $148,691 |

| 2014 | $3,386 | $254,483 | $108,704 | $145,779 |

Source: Public Records

Map

Nearby Homes

- 1454 Madrone Dr

- 831 Cactus Ct

- 1243 De Cunha Ct

- 1258 De Cunha Ct

- 1139 Cape Cod Way

- 1204 Pickford Way

- 1413 Wiren St

- 1049 Twin Creeks Dr

- 1109 Elmsford Way

- 18 Suffield Cir

- 1101 Kimmel St

- 709 Gee St

- 912 Acosta Plaza Unit 11

- 933 Acosta Plaza Unit 35

- 914 Acosta Plaza Unit 32

- 1935 Bradbury St

- 1958 Bradbury St

- 1949 Bradbury St

- 166 Afton Rd

- 1226 Palermo Ct

- 1413 Sumac Way

- 1421 Sumac Way

- 16 Chamise Cir

- 12 Chamise Cir

- 1409 Sumac Way

- 1425 Sumac Way

- 20 Chamise Cir

- 1416 Sumac Way Unit 2

- 1420 Sumac Way Unit 2

- 1412 Sumac Way

- 8 Chamise Cir

- 1424 Sumac Way

- 1405 Sumac Way Unit 2

- 1408 Sumac Way

- 934 Sage Ct

- 24 Chamise Cir

- 932 Sage Ct

- 1428 Sumac Way

- 4 Chamise Cir

- 930 Sage Ct