1448 Cliff Ct Unit 30 Columbus, OH 43204

Marble Cliff Crossing NeighborhoodEstimated Value: $175,000 - $182,000

1

Bed

1

Bath

770

Sq Ft

$231/Sq Ft

Est. Value

About This Home

This home is located at 1448 Cliff Ct Unit 30, Columbus, OH 43204 and is currently estimated at $177,804, approximately $230 per square foot. 1448 Cliff Ct Unit 30 is a home located in Franklin County with nearby schools including Valleyview Elementary School, Westmoor Middle School, and West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 24, 2020

Sold by

Corrova Peter and Corrova Lynda

Bought by

Mershon Sheana

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,000

Outstanding Balance

$102,013

Interest Rate

3%

Mortgage Type

New Conventional

Estimated Equity

$75,791

Purchase Details

Closed on

Sep 28, 2016

Sold by

Hall Rebecca J

Bought by

Corrova Peter and Corrova Lynda

Purchase Details

Closed on

Sep 28, 2007

Sold by

Mccormick Thomas J and Mccormick Mary Jo

Bought by

Hall Rebecca J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,000

Interest Rate

6.49%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mershon Sheana | $125,000 | Crown Trident Title Agcy Inc | |

| Corrova Peter | $98,900 | None Available | |

| Hall Rebecca J | $81,000 | Talon Group |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mershon Sheana | $115,000 | |

| Previous Owner | Hall Rebecca J | $81,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,228 | $49,640 | $12,080 | $37,560 |

| 2023 | $2,199 | $49,630 | $12,075 | $37,555 |

| 2022 | $2,130 | $41,060 | $8,330 | $32,730 |

| 2021 | $2,133 | $41,060 | $8,330 | $32,730 |

| 2020 | $2,189 | $41,060 | $8,330 | $32,730 |

| 2019 | $1,824 | $29,330 | $5,950 | $23,380 |

| 2018 | $1,560 | $29,330 | $5,950 | $23,380 |

| 2017 | $1,823 | $29,330 | $5,950 | $23,380 |

| 2016 | $1,431 | $21,600 | $3,850 | $17,750 |

| 2015 | $1,299 | $21,600 | $3,850 | $17,750 |

| 2014 | $1,302 | $21,600 | $3,850 | $17,750 |

| 2013 | $676 | $22,750 | $4,060 | $18,690 |

Source: Public Records

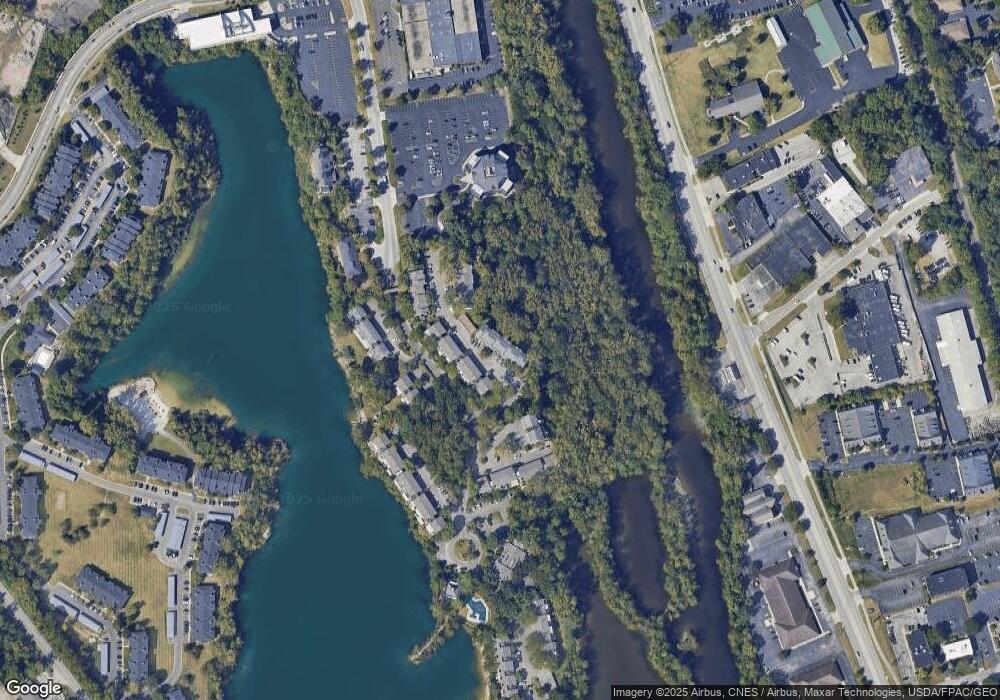

Map

Nearby Homes

- 1301 Lake Shore Dr Unit 199

- 2700 Mc Kinley Ave

- 1214 Lake Shore Dr Unit C

- 1631 Roxbury Rd Unit F3

- 1631 Roxbury Rd Unit B6

- 2015 W 5th Ave Unit 211

- 2015 W 5th Ave Unit 102

- 2015 W 5th Ave Unit 108

- 1313 Lincoln Rd

- 1561 Glenn Ave

- 2704 Scioto Station Dr Unit 2704

- 1459 Elmwood Ave Unit 1459

- 2754 Scioto Station Dr

- 1782 Wyandotte Rd

- 2875 Lowell Dr

- 1733 Elmwood Ave

- 1661 Ashland Ave Unit 663

- 3161 Bowdoin Cir

- 1000 Urlin Ave Unit 1822

- 1000 Urlin Ave Unit 2007

- 1442 Cliff Ct

- 1454 Cliff Ct Unit 19

- 1448 Cliff Ct Unit 29

- 1452 Cliff Ct

- 1444 Cliff Ct Unit 34

- 1440 Cliff Ct

- 1454 Cliff Ct Unit 21

- 1452 Cliff Ct

- 1440 Cliff Ct

- 1474 Cliff Ct

- 1442 Cliff Ct

- 1444 Cliff Ct

- 1474 Cliff Ct

- 1448 Cliff Ct

- 1454 Cliff Ct Unit 20

- 1452 Cliff Ct Unit 24

- 1440 Cliff Ct Unit 42

- 1442 Cliff Ct Unit 38

- 1444 Cliff Ct Unit 36

- 1474 Cliff Ct