14644 County Road 155 Kenton, OH 43326

Estimated Value: $403,000 - $688,154

4

Beds

1

Bath

3,122

Sq Ft

$175/Sq Ft

Est. Value

About This Home

This home is located at 14644 County Road 155, Kenton, OH 43326 and is currently estimated at $545,577, approximately $174 per square foot. 14644 County Road 155 is a home located in Hardin County with nearby schools including Kenton Elementary School, Kenton Middle School, and Kenton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 2025

Sold by

Turner Jerald Wayne and Baughman Lou Ellen

Bought by

Turner Jerald Wayne and Baughman Lou Ellen

Current Estimated Value

Purchase Details

Closed on

Aug 13, 2021

Sold by

Sprang Cheryll Denise and Sprang Dennis

Bought by

Turner Jerald Wayne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$405,663

Interest Rate

2.9%

Mortgage Type

Commercial

Purchase Details

Closed on

Aug 20, 2020

Sold by

Turner Norman Lee

Bought by

Sprang Cheryll Denise and Turner Jerald Wayne

Purchase Details

Closed on

Oct 4, 2016

Sold by

Turner Norman Lee

Bought by

Sprang Cheryll Denise and Turner Jarald Wayne

Purchase Details

Closed on

May 6, 2016

Bought by

Norman Lee Turner

Purchase Details

Closed on

Aug 16, 2010

Sold by

Turner Norman Lee and Turner Patricia M

Bought by

Hanna Dane M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Turner Jerald Wayne | -- | None Listed On Document | |

| Turner Jerald Wayne | -- | None Listed On Document | |

| Turner Jerald Wayne | $400,000 | Superior Title Llc | |

| Sprang Cheryll Denise | -- | None Available | |

| Sprang Cheryll Denise | -- | None Available | |

| Norman Lee Turner | -- | -- | |

| Hanna Dane M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Turner Jerald Wayne | $405,663 | |

| Previous Owner | Turner Jerald Wayne | $50,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,060 | $138,950 | $40,120 | $98,830 |

| 2023 | $6,060 | $138,950 | $40,120 | $98,830 |

| 2022 | $3,793 | $83,110 | $20,150 | $62,960 |

| 2021 | $3,841 | $83,110 | $20,150 | $62,960 |

| 2020 | $2,949 | $83,110 | $20,150 | $62,960 |

| 2019 | $3,083 | $89,540 | $33,260 | $56,280 |

| 2018 | $3,133 | $89,540 | $33,260 | $56,280 |

| 2017 | $1,461 | $89,540 | $33,260 | $56,280 |

| 2016 | $3,004 | $91,130 | $43,890 | $47,240 |

| 2015 | $3,222 | $91,130 | $43,890 | $47,240 |

| 2014 | $1,557 | $91,670 | $43,450 | $48,220 |

| 2013 | $1,118 | $66,620 | $20,040 | $46,580 |

Source: Public Records

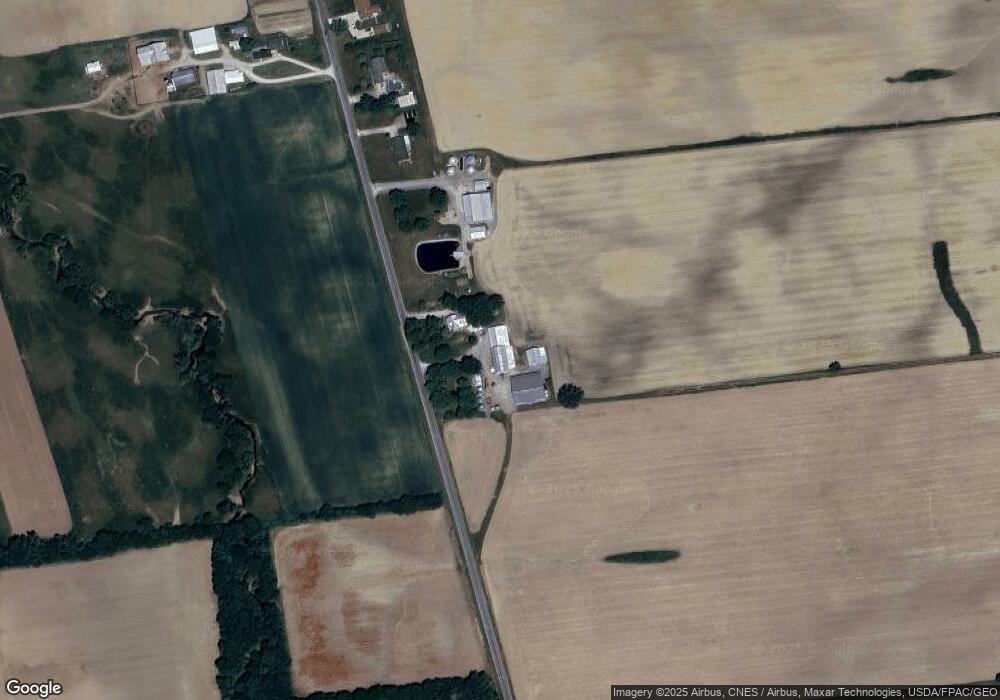

Map

Nearby Homes

- 13450 State Route 292

- 320 Letson Ave

- 727 S Detroit St

- 414 Robinson Ave

- 639 S Main St

- 508 Decatur St

- 510 Decatur St

- 920 Cooper St

- 726 Tracy St

- 121 S High St

- 702 W Franklin St Unit 702 1/2

- 115 Scioto St

- 530 E Franklin St

- 513 E Franklin St

- 723 W Lima St Unit 66

- 723 W Lima St Unit 1

- 0 Ohio 309

- 39 Grape St

- 11279 Township Road 180

- 219 W Carrol St

- 14540 County Road 155

- 14494 County Road 155

- 14458 County Road 155

- 14458 County Rd

- 14467 County Road 155

- 14890 County Road 155

- 14390 County Road 155

- 14970 County Road 155

- 14367 County Rd

- 14367 County Road 155

- 14338 County Road 155

- 14335 County Road 155

- 14302 County Road 155

- 14302 Cr

- 14301 County Road 155

- 14260 County Road 155

- 14260 Cr

- 14265 Cr