14699 Hanks Dr Red Bluff, CA 96080

Estimated Value: $295,000 - $410,595

2

Beds

1

Bath

1,173

Sq Ft

$285/Sq Ft

Est. Value

About This Home

This home is located at 14699 Hanks Dr, Red Bluff, CA 96080 and is currently estimated at $334,198, approximately $284 per square foot. 14699 Hanks Dr is a home located in Tehama County with nearby schools including Jackson Heights Elementary School, Vista Preparatory Academy, and Red Bluff High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 3, 2008

Sold by

Vilche Joseph and Vilche Carmen J

Bought by

Ingram Charles F and Simon Terra L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,000

Outstanding Balance

$63,048

Interest Rate

6.09%

Mortgage Type

Unknown

Estimated Equity

$271,150

Purchase Details

Closed on

Feb 13, 2008

Sold by

Vilche Fracis E and Vilche Carmen J

Bought by

Vilche Joseph and Vilche Carmen J

Purchase Details

Closed on

Dec 7, 2000

Sold by

Vilche Joseph and Vilche Carmen

Bought by

Hardisty Francis E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,000

Interest Rate

7.71%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ingram Charles F | $105,000 | Fidelity Natl Title Co Of Ca | |

| Vilche Joseph | -- | None Available | |

| Hardisty Francis E | $90,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ingram Charles F | $96,000 | |

| Previous Owner | Hardisty Francis E | $115,000 | |

| Closed | Hardisty Francis E | $3,900 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,204 | $317,236 | $90,137 | $227,099 |

| 2023 | $1,930 | $181,457 | $78,240 | $103,217 |

| 2022 | $2,005 | $186,477 | $78,240 | $108,237 |

| 2021 | $1,961 | $186,477 | $78,240 | $108,237 |

| 2020 | $1,686 | $154,977 | $78,240 | $76,737 |

| 2019 | $1,729 | $154,977 | $78,240 | $76,737 |

| 2018 | $1,539 | $101,908 | $71,127 | $30,781 |

| 2017 | $1,029 | $93,664 | $64,661 | $29,003 |

| 2016 | $871 | $89,738 | $61,582 | $28,156 |

| 2015 | $939 | $89,738 | $61,582 | $28,156 |

| 2014 | $831 | $79,497 | $53,550 | $25,947 |

Source: Public Records

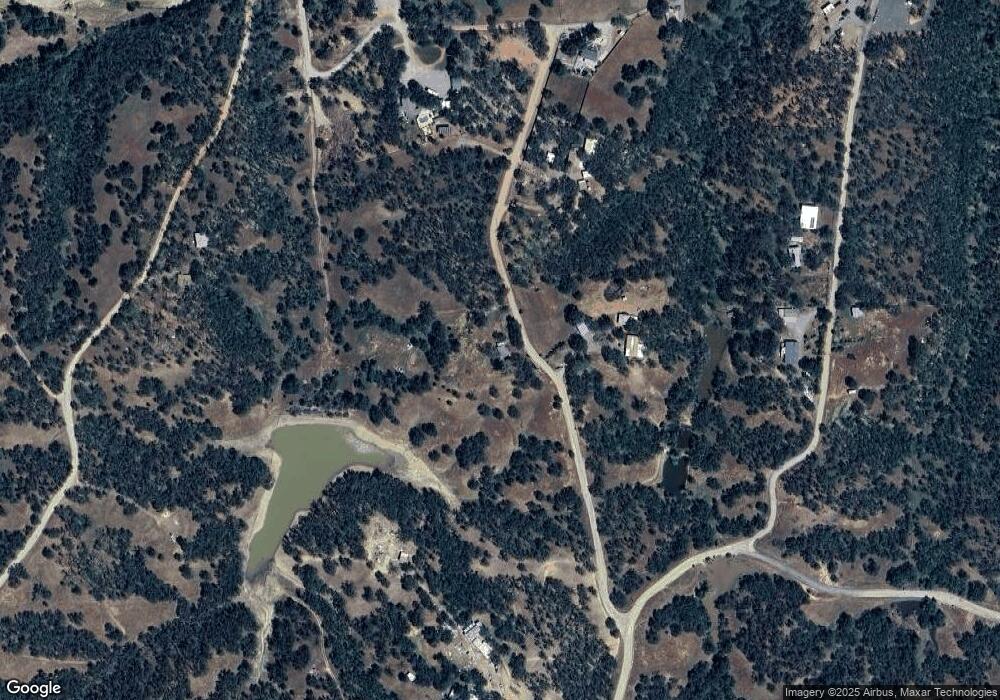

Map

Nearby Homes

- 18633 Stallion Dr

- 18574 Stallion Dr

- 14445 Green Valley Acres Dr

- 14721 Nevis Rd

- 17825 Clearwater Dr

- 19725 Quercus Lobata Byway

- 19600 Sunshine Dr

- 13279 Road Runner Loop

- 14575 Kinney Ave

- 14605 Kinney Ave

- 14807 Hilltop Dr

- 14805 Hilltop Dr Unit 14807 Hilltop Drive

- 14805 Hilltop Dr

- 14560 Warren Ave

- 13185 Montecito Rd

- 19015 Bonita Rd

- 15410 Autumn Oaks Ct

- 18670 Farris St

- 0 Vintage Dr Unit 23007603

- Lot 7 Siesta Way

- 14695 Hanks Dr

- 14670 Hanks Dr

- 0 Hanks Dr Unit CH14206693

- 0 Hanks Dr Unit CH14204792

- 0 Hanks Dr Unit 201400746

- 0 Hanks Dr Unit 201400998

- 14630 Cramer Rd

- 14615 Hanks Dr

- 14651 Cramer Rd

- Lot C9 Dar Ln

- 14710 Hanks Dr

- 14655 Betz Ln

- 18600 Dar Ln

- 14715 Betz Ln

- 14830 Oak Knoll Dr

- 14585 Betz Ln

- 18569 California 36 Unit 18569 Hwy 36W

- 18569 State Highway 36 W

- 14621 Cramer Rd

- 14519 Skyline Dr