14705 Forest Edge Dr Sylmar, CA 91342

Estimated Value: $736,000 - $913,523

4

Beds

3

Baths

1,932

Sq Ft

$409/Sq Ft

Est. Value

About This Home

This home is located at 14705 Forest Edge Dr, Sylmar, CA 91342 and is currently estimated at $790,881, approximately $409 per square foot. 14705 Forest Edge Dr is a home located in Los Angeles County with nearby schools including Dyer Street Elementary School, Olive Vista Middle School, and San Fernando Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2016

Sold by

Chipe Jenny Alexandra

Bought by

Chipe Jenny Alexandra and The Jenny Alexandra Chipe Revocable Trus

Current Estimated Value

Purchase Details

Closed on

Mar 17, 2016

Sold by

Santiago Felix Cruz

Bought by

Chipe Jenny Alexandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$336,600

Outstanding Balance

$266,683

Interest Rate

3.68%

Mortgage Type

New Conventional

Estimated Equity

$524,198

Purchase Details

Closed on

Nov 10, 2008

Sold by

Bravo Development Llc

Bought by

Santiago Felix Cruz

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$357,422

Interest Rate

6.04%

Mortgage Type

VA

Purchase Details

Closed on

Oct 30, 2008

Sold by

Alarcon Sandra

Bought by

Cruz Santiago Felix

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$357,422

Interest Rate

6.04%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chipe Jenny Alexandra | -- | None Available | |

| Chipe Jenny Alexandra | $396,000 | North American Title | |

| Santiago Felix Cruz | $350,000 | Chicago Title Company | |

| Cruz Santiago Felix | -- | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Chipe Jenny Alexandra | $336,600 | |

| Previous Owner | Santiago Felix Cruz | $357,422 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,155 | $495,515 | $278,068 | $217,447 |

| 2024 | $6,155 | $485,800 | $272,616 | $213,184 |

| 2023 | $6,037 | $476,275 | $267,271 | $209,004 |

| 2022 | $5,756 | $466,937 | $262,031 | $204,906 |

| 2021 | $5,676 | $457,783 | $256,894 | $200,889 |

| 2019 | $5,506 | $444,207 | $249,275 | $194,932 |

| 2018 | $5,437 | $435,498 | $244,388 | $191,110 |

| 2016 | $4,729 | $380,623 | $98,554 | $282,069 |

| 2015 | $4,661 | $374,907 | $97,074 | $277,833 |

| 2014 | $4,296 | $336,000 | $87,000 | $249,000 |

Source: Public Records

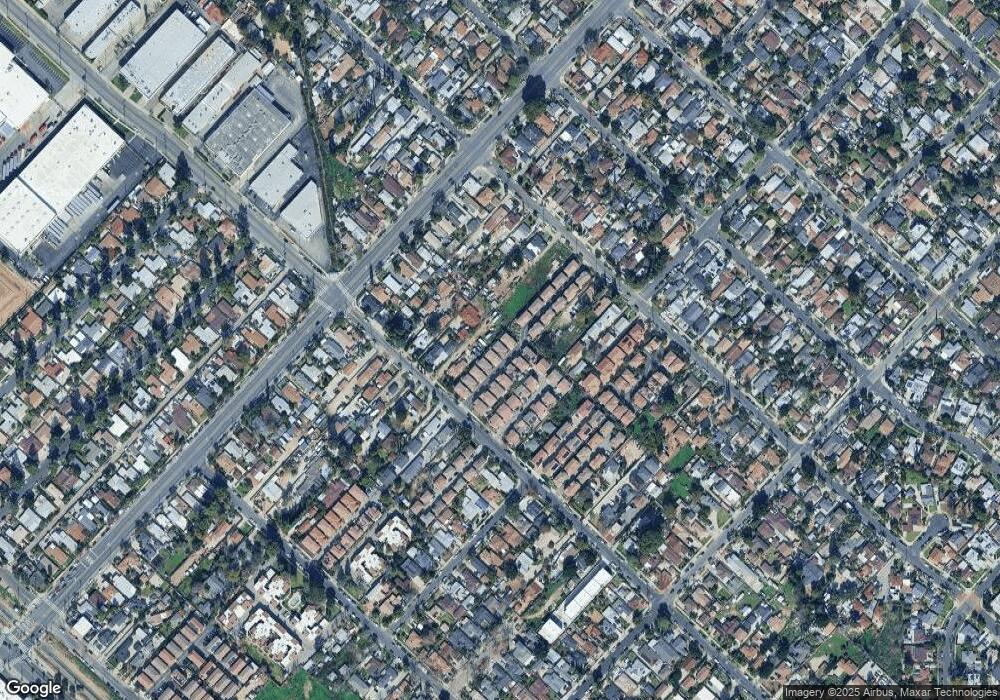

Map

Nearby Homes

- 12796 Norris Ave

- 14785 Polk St

- 14840 Polk St

- 14807 Oro Grande St

- 12642 Ralston Ave Unit 1

- 12659 Ralston Ave

- 12603 Ralston Ave

- 14594 Lyle St

- 14761 Astoria St

- 14758 Lakeside St

- 13009 Herrick Ave

- 14529 Paddock St

- 14365 Berg St

- 14909 W Navarre Way

- 15080 Polk St

- 15043 Oro Grande St

- 13016 Jamie Ave

- 13121 Norris Ave

- 13108 Fellows Ave

- 14388 Beaver St

- 14709 Forest Edge Dr

- 14701 Forest Edge Dr

- 14708 Forest Edge Dr

- 14716 Forest Edge Dr

- 14717 Forest Edge Dr Unit 3

- 14712 Forest Edge Dr

- 14713 Forest Edge Dr

- 14704 Forest Edge Dr

- 14700 Forest Edge Dr

- 14721 Forest Edge Dr

- 12738 Bradley Ave

- 12724 Palm Ct

- 12726 Bradley Ave

- 14720 Forest Edge Dr

- 14681 Forest Edge Dr

- 14725 Forest Edge Dr

- 14724 Forest Edge Dr

- 14701 Sunny Dr

- 14703 Sunny Dr

- 12728 Bradley Ave