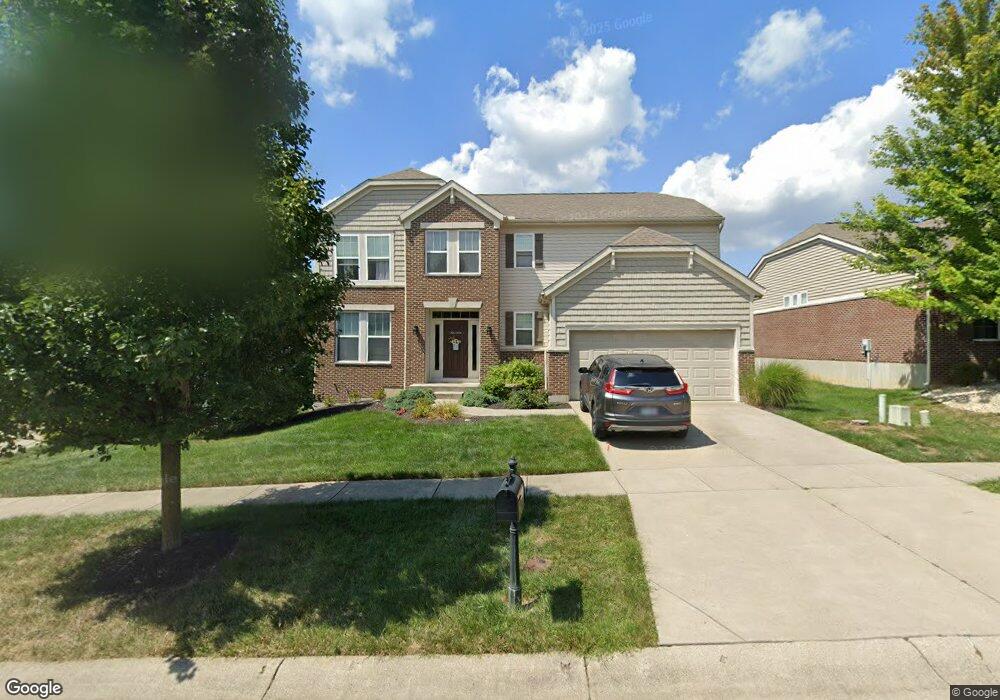

1479 Red Hawk Ct Lebanon, OH 45036

Turtlecreek Township NeighborhoodEstimated Value: $450,061 - $502,000

4

Beds

3

Baths

2,807

Sq Ft

$169/Sq Ft

Est. Value

About This Home

This home is located at 1479 Red Hawk Ct, Lebanon, OH 45036 and is currently estimated at $473,015, approximately $168 per square foot. 1479 Red Hawk Ct is a home located in Warren County with nearby schools including Bowman Primary School, Berry Intermediate School, and Donovan Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 12, 2014

Sold by

Kimble Benjamin and Kimble Wendy

Bought by

Scott David and Scott Trina Machelle

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,000

Outstanding Balance

$156,233

Interest Rate

4.15%

Mortgage Type

New Conventional

Estimated Equity

$316,782

Purchase Details

Closed on

Mar 16, 2009

Sold by

Fischer Single Family Homes Ii Llc

Bought by

Kimble Benjamin and Kimble Wendy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$217,490

Interest Rate

5.19%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 13, 2007

Sold by

Shaker Run Investment Co Llc

Bought by

Fischer Single Family Homes Ii Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Scott David | $215,000 | None Available | |

| Kimble Benjamin | $239,900 | Homestead Title | |

| Fischer Single Family Homes Ii Llc | $209,500 | Homestead Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Scott David | $204,000 | |

| Previous Owner | Kimble Benjamin | $217,490 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,510 | $113,280 | $18,200 | $95,080 |

| 2023 | $4,292 | $97,300 | $16,520 | $80,780 |

| 2022 | $4,239 | $97,300 | $16,520 | $80,780 |

| 2021 | $3,934 | $97,300 | $16,520 | $80,780 |

| 2020 | $4,004 | $82,457 | $14,000 | $68,457 |

| 2019 | $4,027 | $82,457 | $14,000 | $68,457 |

| 2018 | $3,618 | $82,457 | $14,000 | $68,457 |

| 2017 | $3,726 | $75,768 | $12,289 | $63,480 |

| 2016 | $3,858 | $75,768 | $12,289 | $63,480 |

| 2015 | $3,888 | $75,768 | $12,289 | $63,480 |

| 2014 | $3,815 | $68,880 | $11,170 | $57,710 |

| 2013 | $3,769 | $86,320 | $14,000 | $72,320 |

Source: Public Records

Map

Nearby Homes

- Miramar Plan at Greentree Meadows

- Sanibel Plan at Greentree Meadows

- Chattanooga Plan at Greentree Meadows

- Carlisle Plan at Greentree Meadows

- Harding Plan at Greentree Meadows

- Rockford Plan at Greentree Meadows

- Somerset Plan at Greentree Meadows

- Truman Plan at Greentree Meadows

- Birmingham Plan at Greentree Meadows

- 1579 Meadow View Ln

- 1357 Double Eagle Ct Unit 7103

- 1317 Double Eagle Ct

- 1750 Penelope Place

- 1770 Penelope Place

- 1779 Penelope Place

- 445 Bethpage Way Unit 7-304

- 445 Bethpage Way

- 1535 Canterbury Ct

- 1783 Penelope Place

- 4651 Swift Ct

- 1479 Red Hawk Ct Unit 55

- 1473 Red Hawk Ct Unit 54

- 1473 Red Hawk Ct

- 1485 Red Hawk Ct

- 1467 Red Hawk Ct

- 1491 Red Hawk Ct Unit 57

- 1491 Red Hawk Ct

- 1512 Shaker Run Blvd

- 1480 Red Hawk Ct

- 1506 Shaker Run Blvd

- 1518 Shaker Run Blvd

- 1474 Red Hawk Ct

- 1486 Red Hawk Ct

- 1497 Red Hawk Ct

- 1461 Red Hawk Ct

- 1492 Red Hawk Ct Unit 69

- 1492 Red Hawk Ct

- 1468 Red Hawk Ct

- 1500 Shaker Run Blvd

- 1524 Shaker Run Blvd