1518 E 800th Rd Lawrence, KS 66049

Estimated Value: $555,000 - $623,864

5

Beds

3

Baths

2,223

Sq Ft

$266/Sq Ft

Est. Value

About This Home

This home is located at 1518 E 800th Rd, Lawrence, KS 66049 and is currently estimated at $592,288, approximately $266 per square foot. 1518 E 800th Rd is a home located in Douglas County with nearby schools including Langston Hughes Elementary School, Southwest Middle School, and Lawrence Free State High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 10, 2018

Sold by

Gibson Janet S

Bought by

Wahla Imran and Boumaza Fadila

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,700

Outstanding Balance

$103,738

Interest Rate

4.5%

Mortgage Type

Commercial

Estimated Equity

$488,550

Purchase Details

Closed on

Apr 30, 2004

Sold by

Farwell Mary Lyn and Sommerville James B

Bought by

Boumaza Fadila

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,400

Interest Rate

5.38%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wahla Imran | -- | Commerce Title | |

| Boumaza Fadila | -- | Kansas Secured Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wahla Imran | $119,700 | |

| Previous Owner | Boumaza Fadila | $50,400 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,246 | $63,572 | $8,708 | $54,864 |

| 2024 | $7,127 | $62,498 | $8,432 | $54,066 |

| 2023 | $6,721 | $56,937 | $7,880 | $49,057 |

| 2022 | $6,530 | $54,833 | $6,776 | $48,057 |

| 2021 | $5,390 | $44,103 | $6,665 | $37,438 |

| 2020 | $5,218 | $42,945 | $6,665 | $36,280 |

| 2019 | $4,965 | $40,922 | $6,445 | $34,477 |

| 2018 | $4,875 | $39,875 | $6,364 | $33,511 |

| 2017 | $4,826 | $38,881 | $6,364 | $32,517 |

| 2016 | $4,218 | $35,195 | $4,175 | $31,020 |

| 2015 | $4,120 | $34,167 | $4,175 | $29,992 |

| 2014 | $4,083 | $34,167 | $4,175 | $29,992 |

Source: Public Records

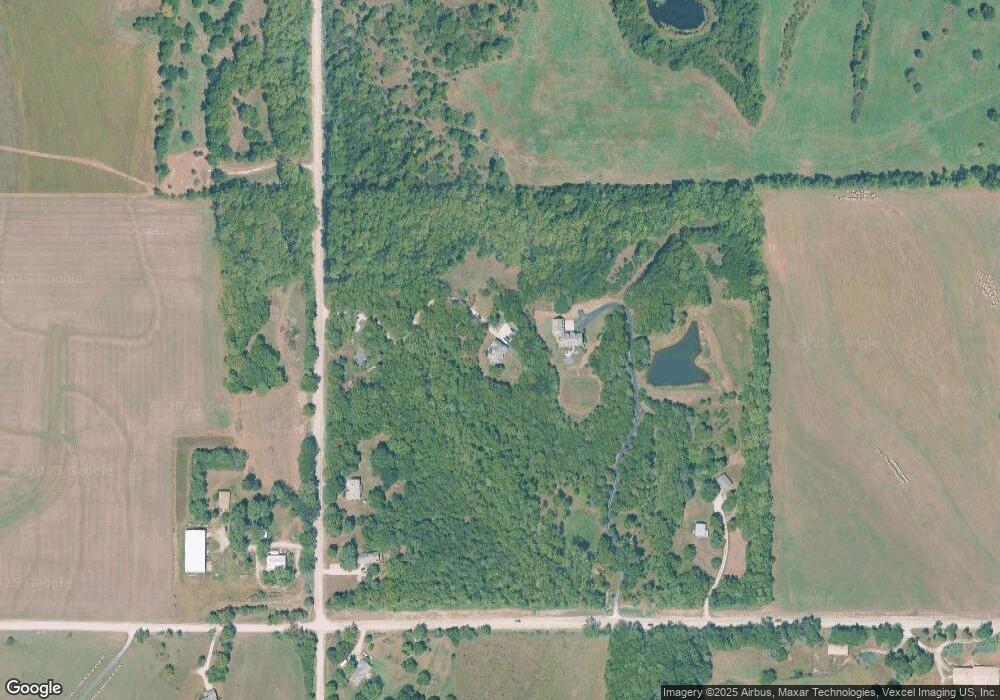

Map

Nearby Homes

- 843 N 1500 Rd

- 908 & 910 Alma Dr

- 5616 Maggie Way

- Lot 2 N Running Ridge Rd

- 1120 Klein Ct

- 6309 Serenade Ct

- 1549 Legend Trail Dr Unit A

- 1528 Legend Trail Dr Unit A

- 927 N 1464 Rd

- 1522 Legend Trail Dr Unit B

- 2250 Lake Pointe Dr Unit 1900

- 2250 Lake Pointe Dr Unit 300

- 2250 Lake Pointe Dr Unit 304

- 1709 Lake Alvamar Dr

- 1604 Bob White Dr

- 5710 Goff Ct

- 5800 Johnson Dr

- 5806 Johnson Dr

- 5802 Johnson Dr

- 1347 Kanza Dr

- 818 N 1500 Rd

- 1508 E 800 Rd

- 1508 E 800th Rd

- 1504 E 800th Rd

- 822 N 1500 Rd

- 1505 E 800th Rd

- Lot 3 E 800 Rd

- 803 N 1500 Rd

- 0000 N 1500 Rd

- 50 m/l Acres N 1500 Rd

- 795 N 1500 Rd

- 1548 E 800th Rd

- 1486 E 800 Rd

- 1486 E 800th Rd

- 833 N 1500 Rd

- 840 N 1500 Rd

- 1552 E 800th Rd

- 1552 E 800 Rd

- 785 N 1550 Rd

- 1480 E 800th Rd