1526 West Ln Hatfield, PA 19440

Estimated Value: $601,000 - $742,329

4

Beds

4

Baths

3,007

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 1526 West Ln, Hatfield, PA 19440 and is currently estimated at $666,832, approximately $221 per square foot. 1526 West Ln is a home located in Montgomery County with nearby schools including Walton Farm El School, Pennfield Middle School, and North Penn Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 9, 2020

Sold by

Carre Sinclair Christine

Bought by

Sinclair John and Carre Sinclair Christine

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$372,000

Outstanding Balance

$331,027

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$335,805

Purchase Details

Closed on

Oct 26, 2007

Sold by

Hahl Denise K and Hahl Charles W

Bought by

Blank Christine A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,200

Interest Rate

6.47%

Purchase Details

Closed on

Jun 29, 2004

Sold by

Doughty William S and Doughty Mary F

Bought by

Hahl Charles W and Hahl Denise K

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sinclair John | -- | None Available | |

| Blank Christine A | $388,000 | None Available | |

| Hahl Charles W | $358,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sinclair John | $372,000 | |

| Previous Owner | Blank Christine A | $58,200 | |

| Closed | Hahl Charles W | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,927 | $197,990 | -- | -- |

| 2024 | $7,927 | $197,990 | -- | -- |

| 2023 | $7,587 | $197,990 | $0 | $0 |

| 2022 | $7,340 | $197,990 | $0 | $0 |

| 2021 | $7,131 | $197,990 | $0 | $0 |

| 2020 | $6,962 | $197,990 | $0 | $0 |

| 2019 | $6,846 | $197,990 | $0 | $0 |

| 2018 | $6,847 | $197,990 | $0 | $0 |

| 2017 | $6,585 | $197,990 | $0 | $0 |

| 2016 | $6,508 | $174,190 | $48,370 | $125,820 |

| 2015 | $5,496 | $174,190 | $48,370 | $125,820 |

| 2014 | $5,496 | $174,190 | $48,370 | $125,820 |

Source: Public Records

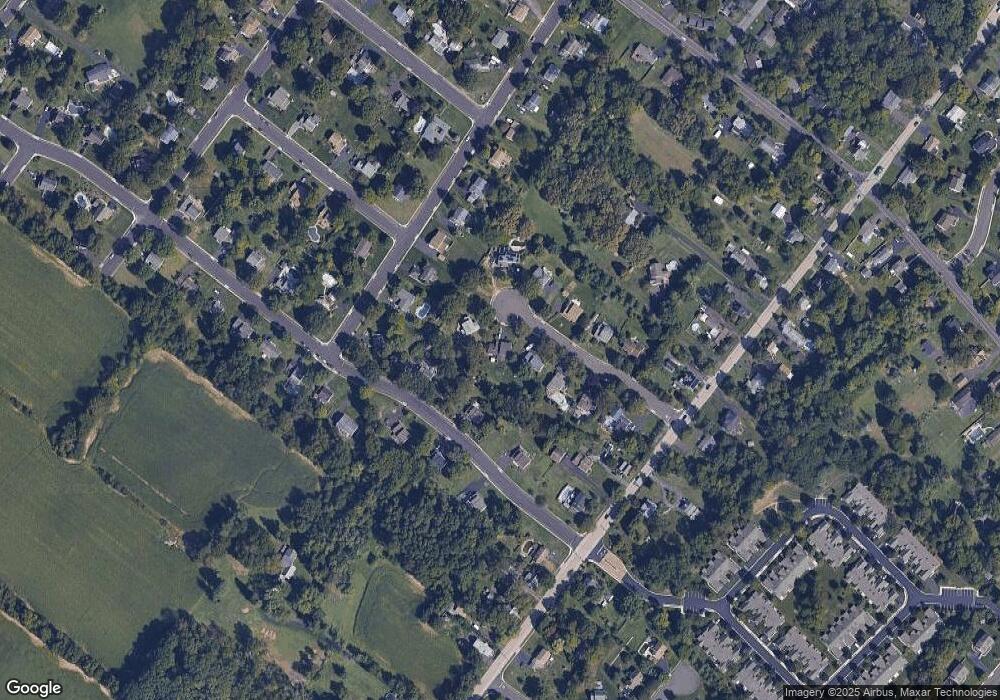

Map

Nearby Homes

- 1315 Deer Run Rd

- 109 Hickory Dr

- 1165 Mason Rd

- 113 Hickory Dr

- 1035 Forest Ave

- 480 Bentwood Dr

- 1306 W Orvilla Rd

- 1095 Owen Ln

- 1226 Cabin Rd

- 1028 Poplar St Unit 75

- 1025 Birch St

- 1744 Lydia Dr

- 512 Lamplighter Way

- 13 W End Dr

- 217 Cherry Ln

- 204 N Valley Forge Rd Unit 7B

- 833 W 4th St

- 108 Allison Ct Unit 8

- 302 W Broad St

- 413 Militia Dr