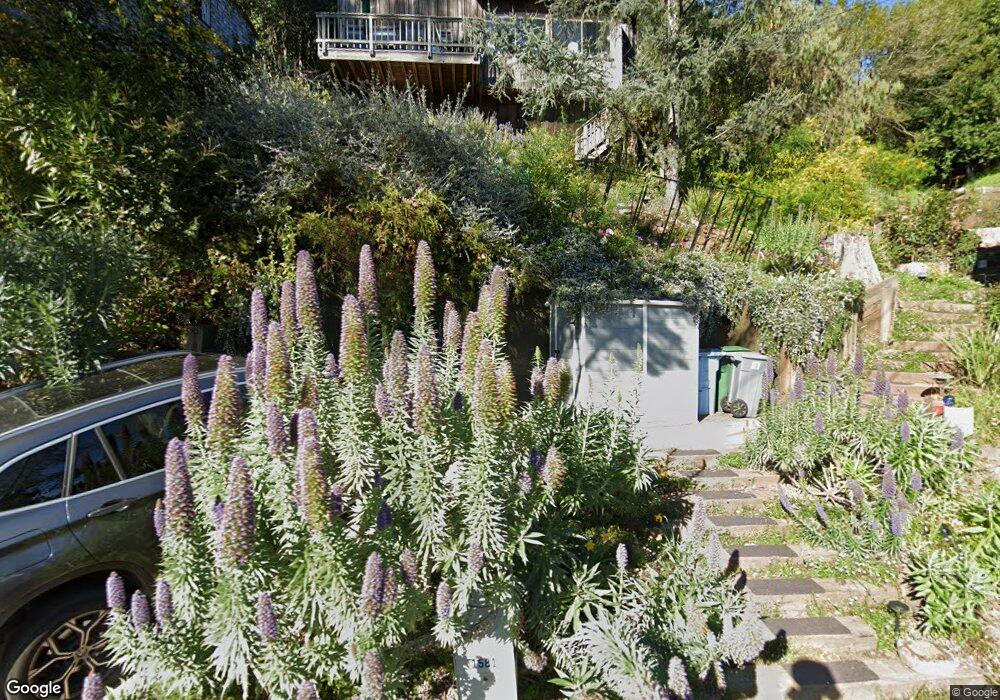

1581 Campus Dr Berkeley, CA 94708

Berkeley Hills NeighborhoodEstimated Value: $1,436,000 - $1,604,553

3

Beds

2

Baths

2,054

Sq Ft

$737/Sq Ft

Est. Value

About This Home

This home is located at 1581 Campus Dr, Berkeley, CA 94708 and is currently estimated at $1,512,888, approximately $736 per square foot. 1581 Campus Dr is a home located in Alameda County with nearby schools including Berkeley Arts Magnet at Whittier School, Cragmont Elementary School, and Washington Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 27, 2010

Sold by

Oconnell Katrina and Eisenstadt Katrina A

Bought by

Yeh James C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$540,000

Outstanding Balance

$357,372

Interest Rate

4.33%

Mortgage Type

New Conventional

Estimated Equity

$1,155,516

Purchase Details

Closed on

Jun 2, 2000

Sold by

Sedman Johanna and Packard Andrew

Bought by

Eisenstadt Katrina A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$420,000

Interest Rate

8.5%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yeh James C | $675,000 | Chicago Title Company | |

| Eisenstadt Katrina A | $525,000 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Yeh James C | $540,000 | |

| Previous Owner | Eisenstadt Katrina A | $420,000 | |

| Closed | Eisenstadt Katrina A | $25,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $16,515 | $857,741 | $259,422 | $605,319 |

| 2024 | $16,515 | $840,792 | $254,337 | $593,455 |

| 2023 | $16,135 | $831,174 | $249,352 | $581,822 |

| 2022 | $15,759 | $807,880 | $244,464 | $570,416 |

| 2021 | $15,747 | $791,902 | $239,670 | $559,232 |

| 2020 | $14,661 | $790,714 | $237,214 | $553,500 |

| 2019 | $13,829 | $775,217 | $232,565 | $542,652 |

| 2018 | $13,546 | $760,022 | $228,006 | $532,016 |

| 2017 | $13,078 | $745,125 | $223,537 | $521,588 |

| 2016 | $12,496 | $730,518 | $219,155 | $511,363 |

| 2015 | $12,303 | $719,550 | $215,865 | $503,685 |

| 2014 | $12,103 | $705,455 | $211,636 | $493,819 |

Source: Public Records

Map

Nearby Homes

- 1468 Summit Rd

- 209 Fairlawn Dr

- 1375 Queens Rd

- 0 Queens Rd Unit ML82024219

- 120 Hill Rd

- 2700 Le Conte Ave Unit 301

- 2700 Le Conte Ave Unit 402

- 2634 Virginia St Unit 13

- 2600 Hilgard Ave

- 1165 Cragmont Ave

- 2451 Le Conte Ave

- 1110 Sterling Ave

- 1123 Park Hills Rd

- 1136 Keith Ave

- 2340 Virginia St

- 0 Panoramic Way Unit 41118724

- 1106 Cragmont Ave

- 2 Panoramic Way Unit 105

- 2 Panoramic Way Unit 304

- 161 Panoramic Way

- 1577 Campus Dr

- 1585 Campus Dr

- 1544 Olympus Ave

- 1566 Olympus Ave

- 1536 Olympus Ave

- 1589 Campus Dr

- 1575 Campus Dr

- 1570 Olympus Ave

- 1588 Campus Dr

- 1530 Olympus Ave

- 1520 Olympus Ave

- 1569 Campus Dr

- 1516 Olympus Ave

- 1590 Campus Dr

- 1572 Olympus Ave

- 1510 Olympus Ave

- 1580 Olympus Ave

- 1568 Campus Dr

- 1566 Campus Dr

- 1504 Olympus Ave

Your Personal Tour Guide

Ask me questions while you tour the home.