160 Governor Trumbull Way Trumbull, CT 06611

Estimated Value: $380,000 - $443,000

1

Bed

3

Baths

989

Sq Ft

$413/Sq Ft

Est. Value

About This Home

This home is located at 160 Governor Trumbull Way, Trumbull, CT 06611 and is currently estimated at $408,553, approximately $413 per square foot. 160 Governor Trumbull Way is a home located in Fairfield County with nearby schools including Tashua School, Madison Middle School, and Trumbull High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 2, 2013

Sold by

Kofes Juliana

Bought by

Therriault Thomas

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$140,000

Outstanding Balance

$102,257

Interest Rate

3.95%

Estimated Equity

$306,296

Purchase Details

Closed on

Jan 24, 2011

Sold by

Dworken Christena A

Bought by

Kofes Juliana

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

4.62%

Purchase Details

Closed on

May 23, 2005

Sold by

Patel Shash V

Bought by

Dworken Christena A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Interest Rate

5.95%

Purchase Details

Closed on

Jul 14, 2004

Sold by

Moreau Joan

Bought by

Patel Shash

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$269,000

Interest Rate

5.25%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Therriault Thomas | -- | -- | |

| Kofes Juliana | $225,000 | -- | |

| Dworken Christena A | $319,900 | -- | |

| Patel Shash | $296,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Patel Shash | $140,000 | |

| Previous Owner | Patel Shash | $180,000 | |

| Previous Owner | Patel Shash | $120,000 | |

| Previous Owner | Patel Shash | $269,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,713 | $182,700 | $0 | $182,700 |

| 2024 | $6,523 | $182,700 | $0 | $182,700 |

| 2023 | $6,420 | $182,700 | $0 | $182,700 |

| 2022 | $6,316 | $182,700 | $0 | $182,700 |

| 2021 | $5,808 | $159,740 | $0 | $159,740 |

| 2020 | $5,697 | $159,740 | $0 | $159,740 |

| 2018 | $5,569 | $159,740 | $0 | $159,740 |

| 2017 | $5,466 | $159,740 | $0 | $159,740 |

| 2016 | $5,326 | $159,740 | $0 | $159,740 |

| 2015 | $4,739 | $141,600 | $0 | $141,600 |

| 2014 | $4,639 | $141,600 | $0 | $141,600 |

Source: Public Records

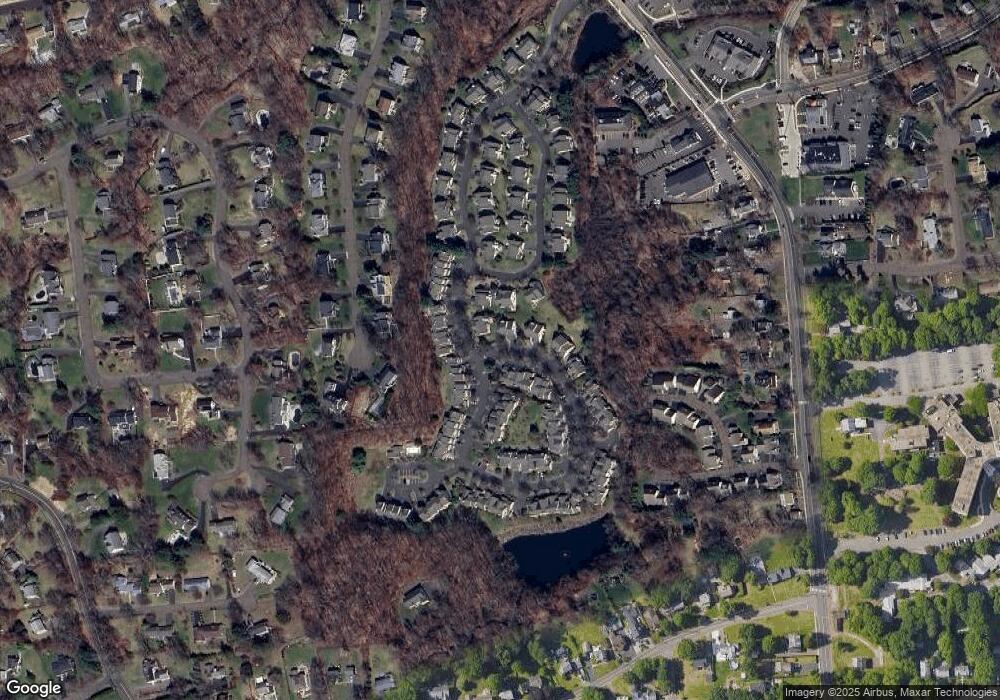

Map

Nearby Homes

- 230 Fitch Pass

- 101 Royals Ct

- 14 Gisella Rd

- 11211 Arganese Place Unit 11211

- 14 Oakland Dr

- 6680 Main St

- 211 Tanglewood Rd

- 31 Parlor Rock Rd

- 0 Main St

- 275 Dayton Rd

- 67 Limerick Rd

- 93 Putting Green Rd N

- 18 Skating Pond Rd

- 34 Merrimac Dr

- 6716 Main St

- 184 Putting Green Rd

- 17 Rainbow Dr

- 119 Lewis Rd

- 121 Lewis Rd

- 75 Roosevelt Dr

- 160 Governor Trumbull Way Unit 160

- 176 Governor Trumbull Way

- 176 Governor Trumbull Way Unit 176

- 157 Governor Trumbull Way

- 157 Governor Trumbull Way Unit 157

- 96 Stonehouse Rd

- 154 Governor Trumbull Way

- 50 Sarenee Cir

- 145 Governor Trumbull Way

- 154 Beechwood Ave

- 49 Sarenee Cir

- 150 Beechwood Ave

- 450 Pitkin Hollow

- 448 Pitkin Hollow

- 446 Pitkin Hollow

- 445 Pitkin Hollow

- 444 Pitkin Hollow

- 443 Pitkin Hollow

- 442 Pitkin Hollow

- 441 Pitkin Hollow