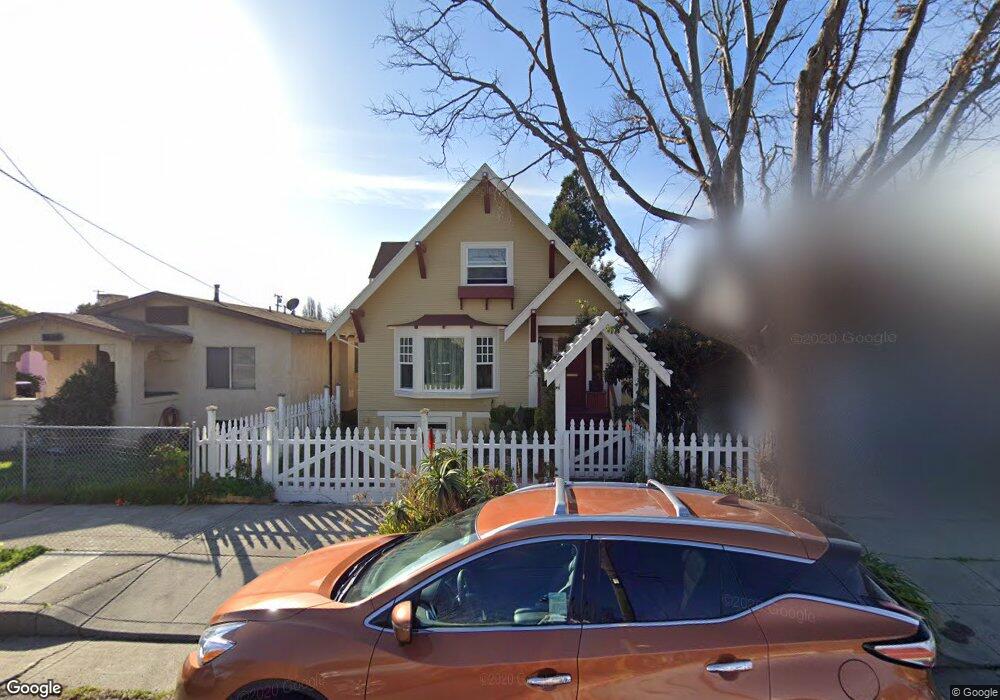

1610 10th St Berkeley, CA 94710

West Berkeley NeighborhoodEstimated Value: $757,399 - $839,000

2

Beds

2

Baths

1,702

Sq Ft

$463/Sq Ft

Est. Value

About This Home

This home is located at 1610 10th St, Berkeley, CA 94710 and is currently estimated at $788,350, approximately $463 per square foot. 1610 10th St is a home located in Alameda County with nearby schools including Rosa Parks Elementary School, Ruth Acty Elementary, and Berkeley Arts Magnet at Whittier School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 28, 2025

Sold by

Joseph Romero 2024 Trust and Truitt Katherine M

Bought by

Ashor Mohamad Saleh and Natour Zenab Mohamad

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Outstanding Balance

$99,570

Interest Rate

6.81%

Mortgage Type

New Conventional

Estimated Equity

$688,780

Purchase Details

Closed on

Apr 25, 2024

Sold by

Romero Joseph P

Bought by

Joseph Romero 2024 Trust and Romero

Purchase Details

Closed on

Mar 12, 2021

Sold by

Romero Joseph P and Romero Jose P

Bought by

Romero Joseph P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$289,000

Interest Rate

3%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ashor Mohamad Saleh | $770,000 | Old Republic Title Company | |

| Joseph Romero 2024 Trust | -- | None Listed On Document | |

| Romero Joseph P | -- | Timios Title A Ca Corp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ashor Mohamad Saleh | $100,000 | |

| Previous Owner | Romero Joseph P | $289,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,992 | $34,103 | $28,604 | $12,499 |

| 2024 | $4,992 | $33,297 | $28,043 | $12,254 |

| 2023 | $4,805 | $39,506 | $27,493 | $12,013 |

| 2022 | $5,097 | $31,732 | $26,954 | $11,778 |

| 2021 | $5,050 | $30,972 | $26,425 | $11,547 |

| 2020 | $4,679 | $37,584 | $26,155 | $11,429 |

| 2019 | $4,353 | $36,847 | $25,642 | $11,205 |

| 2018 | $4,199 | $36,124 | $25,139 | $10,985 |

| 2017 | $4,017 | $35,415 | $24,646 | $10,769 |

| 2016 | $3,742 | $34,721 | $24,163 | $10,558 |

| 2015 | $3,649 | $34,200 | $23,800 | $10,400 |

| 2014 | $3,628 | $33,530 | $23,334 | $10,196 |

Source: Public Records

Map

Nearby Homes

- 1623 10th St

- 998 Virginia St

- 935 Virginia St

- 1504 10th St

- 1609 Kains Ave

- 921 Jones St

- 1128 Delaware St

- 1728 Curtis St

- 1406 San Pablo Ave Unit A

- 817 Jones St

- 817 Delaware St

- 1919 Curtis St

- 1322 Virginia St

- 1450 Fourth St Unit 5

- 0 Camelia St Unit 41104882

- 1213 San Pablo Ave

- 1050 Allston Way

- 1411 Hearst Ave Unit 2

- 1139 Cornell Ave

- 1482 Lincoln St