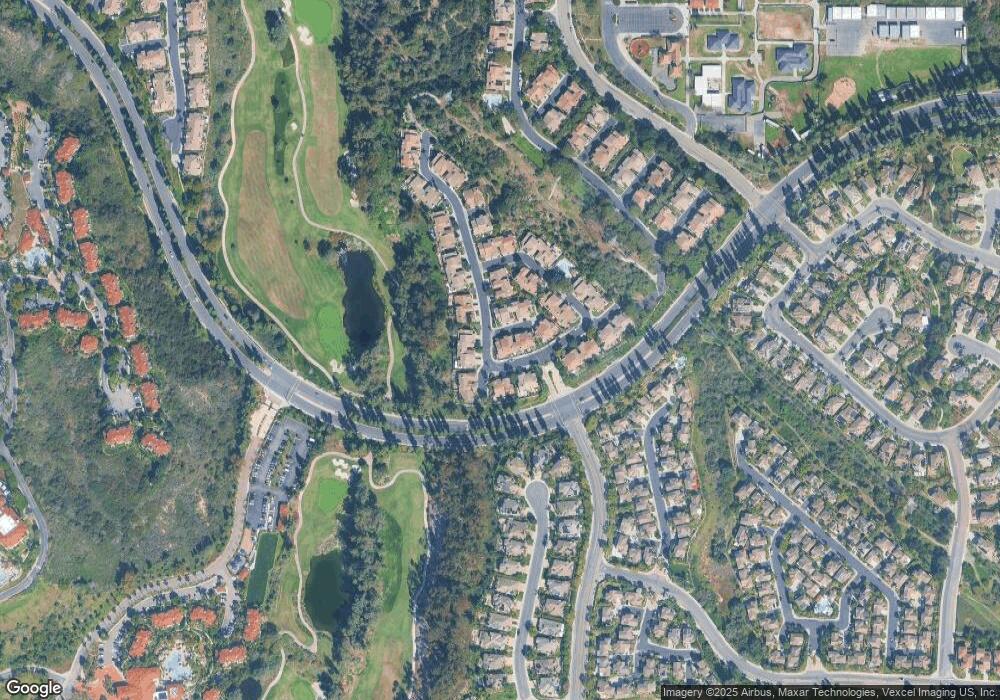

1615 Warbler Ct Unit 88 Carlsbad, CA 92011

Aviara NeighborhoodEstimated Value: $1,217,000 - $1,302,000

3

Beds

3

Baths

1,728

Sq Ft

$726/Sq Ft

Est. Value

About This Home

This home is located at 1615 Warbler Ct Unit 88, Carlsbad, CA 92011 and is currently estimated at $1,254,364, approximately $725 per square foot. 1615 Warbler Ct Unit 88 is a home located in San Diego County with nearby schools including Aviara Oaks Elementary, Aviara Oaks Middle, and Sage Creek High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 23, 2024

Sold by

Ardave Robert and Ardave Cynthia S

Bought by

Ardave Family Trust and Ardave

Current Estimated Value

Purchase Details

Closed on

Jul 15, 2005

Sold by

Grant Joseph and Grant Anthea

Bought by

Ardave Robert and Ardave Cynthia S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$340,000

Interest Rate

5.46%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jul 22, 2004

Sold by

Grant Anthea

Bought by

Grant Joseph and Grant Anthea

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$406,000

Interest Rate

6.25%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 8, 2003

Sold by

Hoehle Lisa Michele

Bought by

Grant Joseph and Grant Anthea

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$331,200

Interest Rate

6.62%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 27, 2002

Sold by

Martin Brian Leroy

Bought by

Hoehle Lisa Michele

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,000

Interest Rate

4.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 8, 1995

Sold by

Barratt American Inc

Bought by

Hoehle Lisa Michele

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,150

Interest Rate

8.47%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ardave Family Trust | -- | None Listed On Document | |

| Ardave Robert | $590,000 | Multiple | |

| Grant Joseph | -- | -- | |

| Grant Anthea | -- | Fidelity National Title Co | |

| Grant Joseph | $414,000 | Fidelity National Title Co | |

| Hoehle Lisa Michele | -- | Commerce Title Company | |

| Hoehle Lisa Michele | $194,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ardave Robert | $340,000 | |

| Previous Owner | Grant Anthea | $406,000 | |

| Previous Owner | Grant Joseph | $331,200 | |

| Previous Owner | Hoehle Lisa Michele | $143,000 | |

| Previous Owner | Hoehle Lisa Michele | $155,150 | |

| Closed | Grant Joseph | $82,800 | |

| Closed | Grant Anthea | $58,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,513 | $806,224 | $546,593 | $259,631 |

| 2024 | $8,513 | $790,417 | $535,876 | $254,541 |

| 2023 | $8,470 | $774,919 | $525,369 | $249,550 |

| 2022 | $8,341 | $759,725 | $515,068 | $244,657 |

| 2021 | $8,278 | $744,829 | $504,969 | $239,860 |

| 2020 | $8,223 | $737,193 | $499,792 | $237,401 |

| 2019 | $7,824 | $700,000 | $469,000 | $231,000 |

| 2018 | $7,451 | $680,000 | $456,000 | $224,000 |

| 2017 | $6,781 | $615,000 | $413,000 | $202,000 |

| 2016 | $6,210 | $575,000 | $387,000 | $188,000 |

| 2015 | $5,850 | $535,000 | $361,000 | $174,000 |

| 2014 | $7,104 | $600,000 | $405,000 | $195,000 |

Source: Public Records

Map

Nearby Homes

- 1736 Blackbird Cir

- 7022 Ibis Place

- 7012 Goldenrod Way

- 7212 Columbine Dr

- 1738 Oriole Ct

- 7115 Manzanita St

- 1845 Cliff Swallow Ln

- 25 El Camino Real

- 7234 Estrella de Mar Rd

- 1933 Alga Rd Unit C

- 1913 Alga Rd Unit A

- 6903 Quail Place

- 6907 Quail Place Unit F

- 7323 Estrella de Mar Rd Unit 36

- 7323 Estrella de Mar Rd Unit 47

- 7019 Estrella de Mar Rd

- 6325 Alexandri Cir

- 6911 Quail Place Unit C

- 6377 Alexandri Cir

- 7021 Estrella de Mar Rd

- 1617 Warbler Ct

- 1619 Warbler Ct

- 1613 Warbler Ct Unit 89

- 1612 Warbler Ct

- 1610 Warbler Ct

- 1623 Warbler Ct Unit 85

- 1614 Warbler Ct

- 1617 Baccharis Ave

- 6867 Adolphia Dr

- 6869 Adolphia Dr

- 1625 Warbler Ct

- 6855 Adolphia Dr Unit 58

- 1619 Baccharis Ave

- 1613 Baccharis Ave

- 6865 Adolphia Dr

- 1616 Warbler Ct

- 6857 Adolphia Dr

- 6853 Adolphia Dr

- 1615 Baccharis Ave

- 6846 Adolphia Dr Unit 94