1627 E Maryland Ave Unit 20 Phoenix, AZ 85016

Camelback East Village NeighborhoodEstimated Value: $639,000 - $866,000

3

Beds

3

Baths

2,141

Sq Ft

$348/Sq Ft

Est. Value

About This Home

This home is located at 1627 E Maryland Ave Unit 20, Phoenix, AZ 85016 and is currently estimated at $744,071, approximately $347 per square foot. 1627 E Maryland Ave Unit 20 is a home located in Maricopa County with nearby schools including Madison Heights Elementary School, Madison No. 1 Middle School, and Phoenix Coding Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 27, 2025

Sold by

Davidson Stephen M

Bought by

Terrace Horizon Llc

Current Estimated Value

Purchase Details

Closed on

Feb 3, 2015

Sold by

Out Of Touch Limited Partnership

Bought by

Davidson Stephen M

Purchase Details

Closed on

Aug 18, 2009

Sold by

Bass Robert E and Bass Tong S

Bought by

Out Of Touch Limited Partnership

Purchase Details

Closed on

Dec 6, 2006

Sold by

Hisle Heidemarie R and Hisle Wendell E

Bought by

Bass Robert and Bass Tong Suk Y

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$296,000

Interest Rate

6.12%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Terrace Horizon Llc | -- | None Listed On Document | |

| Davidson Stephen M | -- | None Available | |

| Out Of Touch Limited Partnership | $250,000 | Stewart Title & Trust Of Pho | |

| Bass Robert | $370,000 | Camelback Title Agency Llc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bass Robert | $296,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,899 | $14,581 | -- | -- |

| 2024 | $1,762 | $13,886 | -- | -- |

| 2023 | $1,762 | $27,930 | $5,585 | $22,345 |

| 2022 | $1,710 | $22,900 | $4,580 | $18,320 |

| 2021 | $1,725 | $22,830 | $4,565 | $18,265 |

| 2020 | $1,698 | $20,730 | $4,145 | $16,585 |

| 2019 | $3,321 | $36,530 | $7,300 | $29,230 |

| 2018 | $3,239 | $31,660 | $6,330 | $25,330 |

| 2017 | $3,087 | $25,350 | $5,070 | $20,280 |

| 2016 | $2,980 | $26,250 | $5,250 | $21,000 |

| 2015 | $2,768 | $28,100 | $5,620 | $22,480 |

Source: Public Records

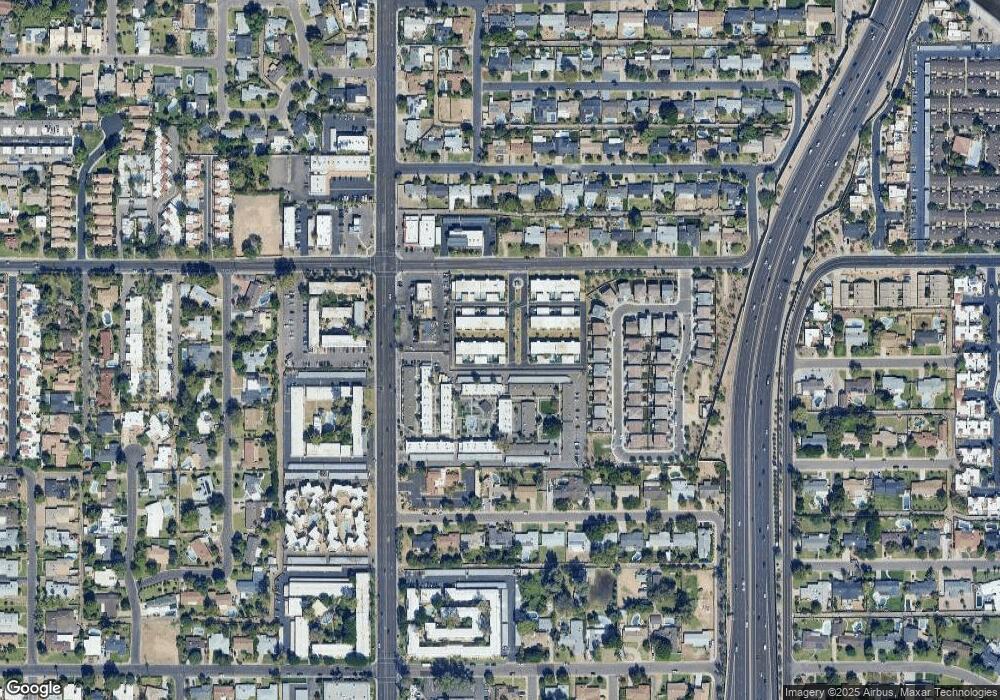

Map

Nearby Homes

- 1677 E Maryland Ave Unit 21

- 6425 N 17th St

- 6455 N 17th Place

- 1701 E Tuckey Ln

- 1441 E Maryland Ave Unit 10

- 6322 N 19th St

- 1850 E Maryland Ave Unit 61

- 6353 N 19th St

- 1555 E Ocotillo Rd Unit 20

- 1555 E Ocotillo Rd Unit 21

- 1516 E Keim Dr

- 1838 E Rose Ln

- 1920 E Maryland Ave Unit 31

- 6239 N 14th St

- 6731 N 16th St Unit 26

- 1915 E Rose Ln

- 6739 N 16th St Unit 14

- 1750 E Ocotillo Rd Unit 18

- 1345 E Rose Ln

- 6628 N 19th St

- 1625 E Maryland Ave Unit 19

- 1613 E Maryland Ave Unit 13

- 1623 E Maryland Ave Unit 18

- 1615 E Maryland Ave Unit 14

- 1621 E Maryland Ave Unit 17

- 1619 E Maryland Ave

- 1691 E Maryland Ave Unit 12

- 1679 E Maryland Ave Unit 22

- 1689 E Maryland Ave Unit 11

- 1611 E Maryland Ave Unit 4

- 1609 E Maryland Ave Unit 3

- 1681 E Maryland Ave

- 1607 E Maryland Ave

- 1687 E Maryland Ave Unit 10

- 6315 N 16th St Unit 101

- 6315 N 16th St Unit 236

- 6315 N 16th St Unit 235

- 6315 N 16th St Unit 234

- 6315 N 16th St Unit 233

- 6315 N 16th St Unit 232

Your Personal Tour Guide

Ask me questions while you tour the home.