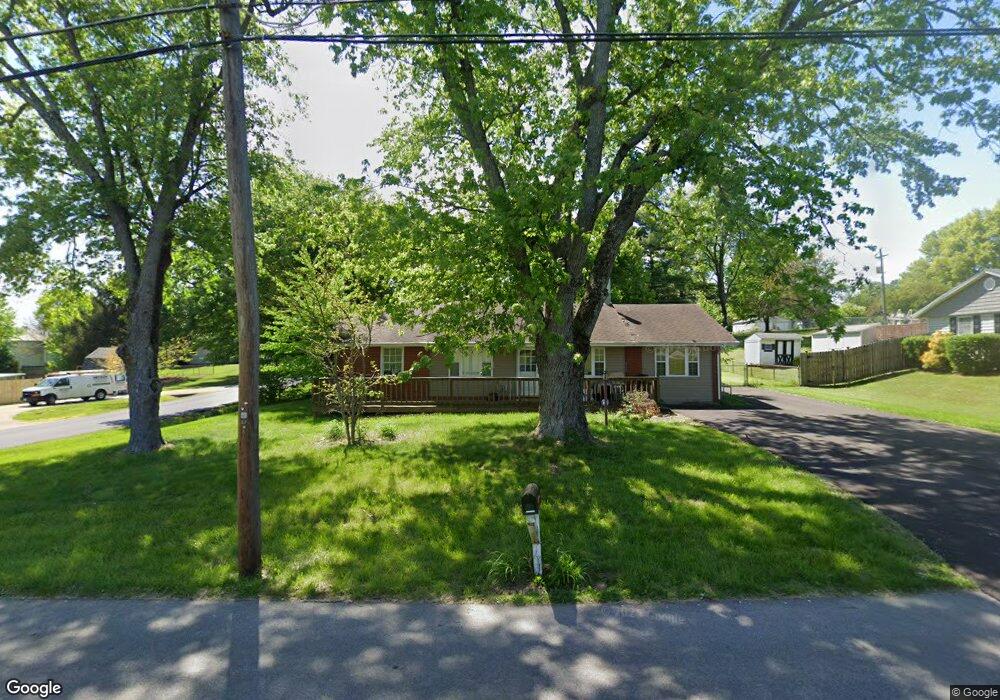

1635 Canal Ln Georgetown, IN 47122

Estimated Value: $192,973 - $235,000

3

Beds

1

Bath

1,280

Sq Ft

$165/Sq Ft

Est. Value

About This Home

This home is located at 1635 Canal Ln, Georgetown, IN 47122 and is currently estimated at $211,243, approximately $165 per square foot. 1635 Canal Ln is a home located in Floyd County with nearby schools including Georgetown Elementary School, Highland Hills Middle School, and Floyd Central High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 5, 2018

Sold by

Hinton Tonya K

Bought by

Happel Bradon J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,212

Interest Rate

4.4%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 9, 2011

Sold by

E & D Properties Llc

Bought by

Hinton Tonya K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,799

Interest Rate

4.87%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 23, 2010

Sold by

Fannie Mae

Bought by

E & D Properties Llc

Purchase Details

Closed on

Feb 11, 2010

Sold by

Wagoner Kenneth W

Bought by

Federal National Mortgage Association

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Happel Bradon J | -- | Legacy Title | |

| Hinton Tonya K | -- | None Available | |

| E & D Properties Llc | -- | Statewide Title Company Inc | |

| Federal National Mortgage Association | $73,643 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Happel Bradon J | $121,212 | |

| Previous Owner | Hinton Tonya K | $90,799 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $476 | $90,700 | $26,800 | $63,900 |

| 2023 | $546 | $97,500 | $26,800 | $70,700 |

| 2022 | $579 | $98,200 | $26,800 | $71,400 |

| 2021 | $509 | $92,300 | $26,800 | $65,500 |

| 2020 | $496 | $92,400 | $26,800 | $65,600 |

| 2019 | $484 | $92,400 | $26,800 | $65,600 |

| 2018 | $589 | $96,600 | $26,800 | $69,800 |

| 2017 | $629 | $96,800 | $26,800 | $70,000 |

| 2016 | $514 | $90,100 | $26,800 | $63,300 |

| 2014 | $538 | $90,300 | $26,800 | $63,500 |

| 2013 | -- | $90,000 | $26,800 | $63,200 |

Source: Public Records

Map

Nearby Homes

- 8031 Hudson Ln

- 8026 Hudson Ln

- 1232 Walts Rd

- 2004 Peach Tree Ln

- 1034 Brookstone Ct

- 7014 Dylan Cir

- 7001 - LOT 971 Mitsch Ln

- 6614 State Road 64 Vacant Land

- 7003- LOT 970 Mitsch Ln

- 7005- LOT 969 Mitsch Ln

- 2022 Brookstone Way

- 3006 Zachary Trail

- 4046 Oakstone Dr

- 1004 Carter Dr

- 1034 Oskin Dr Unit 204

- 1036 Oskin Dr Unit 203

- 1040 Oskin Dr Unit 201

- 1038 Oskin Dr Unit 202

- Finch Bonus Plan at Knob Hill

- Haylyn 48' Plan at Knob Hill

Your Personal Tour Guide

Ask me questions while you tour the home.