1639 E El Norte Pkwy Escondido, CA 92027

Midway NeighborhoodEstimated Value: $750,122 - $842,000

3

Beds

3

Baths

1,650

Sq Ft

$483/Sq Ft

Est. Value

About This Home

This home is located at 1639 E El Norte Pkwy, Escondido, CA 92027 and is currently estimated at $797,031, approximately $483 per square foot. 1639 E El Norte Pkwy is a home located in San Diego County with nearby schools including Conway Elementary School, Rincon Middle School, and Orange Glen High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 1, 2015

Sold by

Vanderlinden Kim C and Vanderlinden Melinda

Bought by

Vander Linden Family Living Trust

Current Estimated Value

Purchase Details

Closed on

Nov 21, 2011

Sold by

Perez Fernando and Perez Zulema

Bought by

Linden Kim C Vander and Linden Melinda V Vander

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$156,000

Interest Rate

4.06%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 21, 2005

Sold by

Damianos Anthony and Damianos Sarah Josephine

Bought by

Perez Fernando and Perez Zulema

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$420,000

Interest Rate

5.56%

Mortgage Type

Unknown

Purchase Details

Closed on

Sep 28, 2001

Sold by

Damianos Tony and Damianos Sarah

Bought by

Damianos Anthony and Damianos Sarah Josephine

Purchase Details

Closed on

Feb 26, 1987

Purchase Details

Closed on

Dec 16, 1985

Purchase Details

Closed on

Jun 20, 1985

Purchase Details

Closed on

Apr 17, 1984

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vander Linden Family Living Trust | -- | Corinthian Title Company Inc | |

| Linden Kim C Vander | $236,000 | Corinthian Title Company | |

| Perez Fernando | $525,000 | Chicago Title Co | |

| Damianos Anthony | -- | -- | |

| -- | $92,300 | -- | |

| -- | $35,000 | -- | |

| -- | $35,000 | -- | |

| -- | $28,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Linden Kim C Vander | $156,000 | |

| Previous Owner | Perez Fernando | $420,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,346 | $296,417 | $125,599 | $170,818 |

| 2024 | $3,346 | $290,606 | $123,137 | $167,469 |

| 2023 | $3,270 | $284,909 | $120,723 | $164,186 |

| 2022 | $3,235 | $279,323 | $118,356 | $160,967 |

| 2021 | $3,183 | $273,847 | $116,036 | $157,811 |

| 2020 | $3,164 | $271,040 | $114,847 | $156,193 |

| 2019 | $3,088 | $265,727 | $112,596 | $153,131 |

| 2018 | $3,003 | $260,518 | $110,389 | $150,129 |

| 2017 | $2,955 | $255,411 | $108,225 | $147,186 |

| 2016 | $2,898 | $250,403 | $106,103 | $144,300 |

| 2015 | $2,874 | $246,643 | $104,510 | $142,133 |

| 2014 | $2,755 | $241,812 | $102,463 | $139,349 |

Source: Public Records

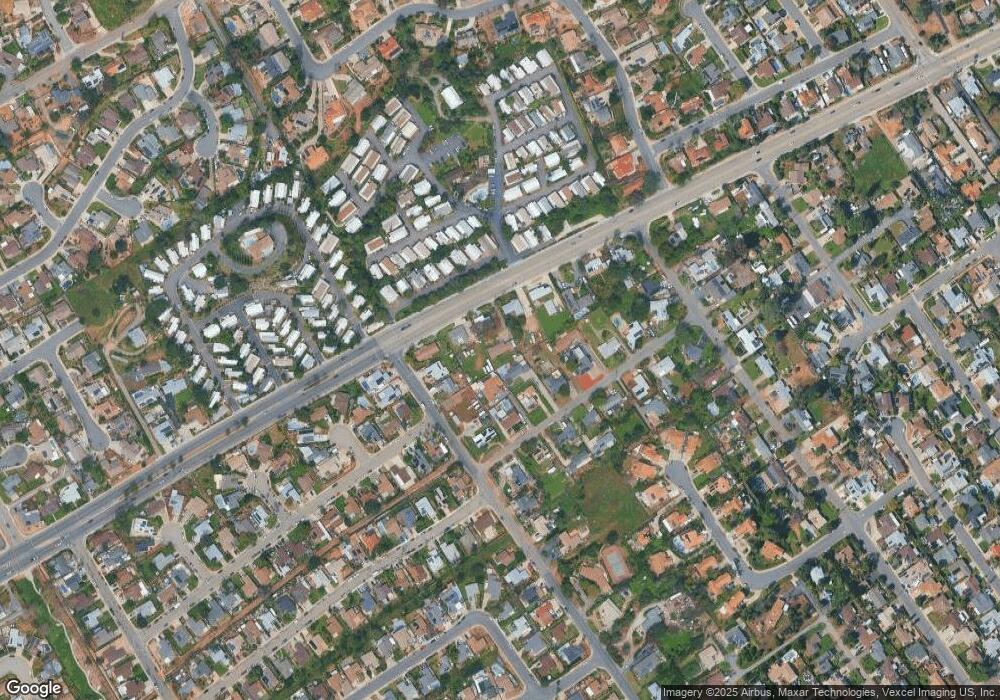

Map

Nearby Homes

- 1615 Stanley Way

- 1402 Rimrock Dr

- 1326 Daisy St

- 1160 Erica St

- 1466 Conway Dr Unit 227-520-65-00

- 1935 E El Norte Pkwy

- 1271 Marjorie Place

- 1572 Tibidabo Dr

- 1323 Greenway Rise

- 1247 Armstrong Cir

- 0 Hubbard Place Unit PTP2405367

- 1814 Centennial Way

- 809 Buchanan St

- 2106 Zachary Glen

- 1884 Loreto Glen

- 1228 Sheridan Ave

- 1637 Madrone Glen

- 1907 Centennial Way

- 2033 Lee Dr

- 1659 Madrone Glen

- 1635 E El Norte Pkwy

- 1641 E El Norte Pkwy

- 1630 Stanley Way

- 1617 E El Norte Pkwy

- 1618 Stanley Way

- 1636 Stanley Way

- 1655 E El Norte Pkwy

- 1628 Stanley Way

- 1250 N Rose St

- 1260 N Rose St

- 1650 Stanley Way

- 1616 Stanley Way

- 1605 E El Norte Pkwy

- 1604 Stanley Way

- 1663 E El Norte Pkwy

- 1656 Stanley Way

- 1627 Stanley Way

- 1635 Stanley Way

- 1572 Marjorie Ave

- 1669 E El Norte Pkwy