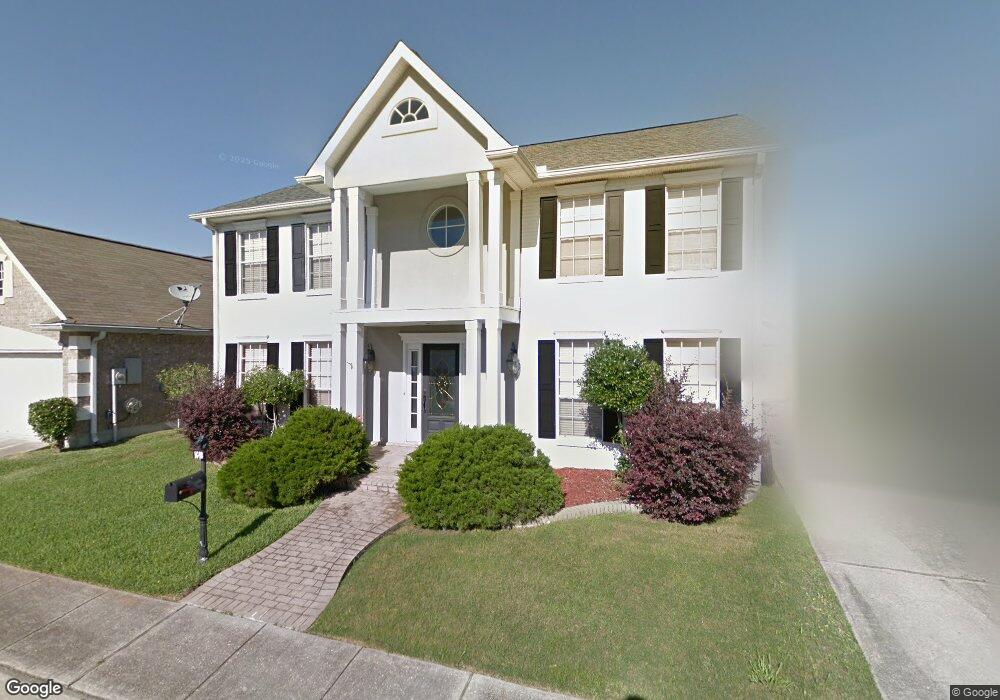

1648 Steeple Chase Ln New Orleans, LA 70131

Old Aurora NeighborhoodEstimated Value: $289,495 - $327,000

4

Beds

3

Baths

2,776

Sq Ft

$111/Sq Ft

Est. Value

About This Home

This home is located at 1648 Steeple Chase Ln, New Orleans, LA 70131 and is currently estimated at $308,874, approximately $111 per square foot. 1648 Steeple Chase Ln is a home located in Orleans Parish with nearby schools including Harriet Tubman Charter School, Alice M Harte Elementary Charter School, and Edna Karr High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 13, 2021

Sold by

Falls Deann Nixon

Bought by

Falls Anthony Julius

Current Estimated Value

Purchase Details

Closed on

Feb 14, 2020

Sold by

Falls Deann N and Falls Anthony Julius

Bought by

Falls Deann N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$223,000

Outstanding Balance

$197,451

Interest Rate

3.6%

Mortgage Type

New Conventional

Estimated Equity

$111,423

Purchase Details

Closed on

Sep 24, 2004

Sold by

Bender Thomas

Bought by

Garba Deann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$239,900

Interest Rate

5.86%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Falls Anthony Julius | -- | None Available | |

| Falls Deann N | -- | None Available | |

| Garba Deann | $239,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Falls Deann N | $223,000 | |

| Closed | Garba Deann | $239,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,600 | $26,540 | $3,780 | $22,760 |

| 2024 | $2,638 | $26,540 | $3,780 | $22,760 |

| 2023 | $1,902 | $21,120 | $3,240 | $17,880 |

| 2022 | $1,902 | $20,230 | $3,240 | $16,990 |

| 2021 | $2,073 | $21,120 | $3,240 | $17,880 |

| 2020 | $2,092 | $21,120 | $3,240 | $17,880 |

| 2019 | $2,159 | $21,120 | $3,240 | $17,880 |

| 2018 | $2,200 | $21,120 | $3,240 | $17,880 |

| 2017 | $2,086 | $21,120 | $3,240 | $17,880 |

| 2016 | $2,318 | $22,870 | $2,160 | $20,710 |

| 2015 | $2,377 | $22,870 | $2,160 | $20,710 |

| 2014 | -- | $22,870 | $2,160 | $20,710 |

| 2013 | -- | $22,870 | $2,160 | $20,710 |

Source: Public Records

Map

Nearby Homes

- 1926 Valentine Ct

- 2018 Saint Nick Dr

- 1751 Holiday Dr

- 2113 Valentine Ct

- 1726 General Collins Ave

- 1534 General Collins Ave

- 1721 General Collins Ave

- 1408 General Collins Ave

- 1614 River Oaks Dr

- 1540 Richland Rd

- 116 Danny Dr

- 2126 General Collins Ave

- 3229-31 Magellan St

- 1843 Halsey Ave

- 4128 Fiesta St

- 2049 Halsey Ave

- 1648 Steeple Chase Other

- 1640 Steeple Chase Ln

- 1656 Steeple Chase Other

- 1632 Steeple Chase Ln

- 1655 Steeple Chase Ln

- 1645 Steeple Chase Ln

- 1635 Steeple Chase Ln

- 4322 General Meyer Ave

- 4300 General Meyer Ave

- 1624 Steeple Chase Ln

- 4322 Gen Meyer Other

- 1627 Steeple Chase Ln

- 4226 General Meyer Ave

- 1645 de Battista Place

- 1616 Steeple Chase Ln

- 1621 Steeple Chase Ln

- 1621 Steeplechase St

- 1637 de Battista Place

- 1608 Steeple Chase Ln

- 1634 de Battista Place