1704 Bennigan Dr Hilliard, OH 43026

Sweetwater NeighborhoodEstimated Value: $203,000 - $211,000

2

Beds

2

Baths

1,024

Sq Ft

$202/Sq Ft

Est. Value

About This Home

This home is located at 1704 Bennigan Dr, Hilliard, OH 43026 and is currently estimated at $206,804, approximately $201 per square foot. 1704 Bennigan Dr is a home located in Franklin County with nearby schools including Hilliard Horizon Elementary School, Hilliard Station Sixth Grade Elementary School, and Hilliard Memorial Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 14, 2018

Sold by

Fabbro Aloysius F and Fabbro Sharon L

Bought by

Gardner Wayne and Gardner Sara

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$121,164

Outstanding Balance

$106,748

Interest Rate

4.8%

Mortgage Type

FHA

Estimated Equity

$100,056

Purchase Details

Closed on

Mar 28, 2002

Sold by

Rachel Beals and Beals Rachel Beals

Bought by

Fabbro Michael E and Fabbro Sharon L

Purchase Details

Closed on

May 22, 1996

Sold by

Qualstan Corp

Bought by

Beals Rachel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$78,400

Interest Rate

8.1%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gardner Wayne | $123,400 | Bridge Title & Escrow Box | |

| Fabbro Michael E | $73,000 | Chicago Title | |

| Beals Rachel | $81,107 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gardner Wayne | $121,164 | |

| Previous Owner | Beals Rachel | $78,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,161 | $55,970 | $10,850 | $45,120 |

| 2023 | $2,738 | $55,965 | $10,850 | $45,115 |

| 2022 | $2,605 | $42,630 | $5,460 | $37,170 |

| 2021 | $2,602 | $42,630 | $5,460 | $37,170 |

| 2020 | $2,595 | $42,630 | $5,460 | $37,170 |

| 2019 | $2,338 | $32,800 | $4,200 | $28,600 |

| 2018 | $2,083 | $32,800 | $4,200 | $28,600 |

| 2017 | $2,145 | $32,800 | $4,200 | $28,600 |

| 2016 | $1,961 | $25,590 | $4,480 | $21,110 |

| 2015 | $1,838 | $25,590 | $4,480 | $21,110 |

| 2014 | $1,842 | $25,590 | $4,480 | $21,110 |

| 2013 | $983 | $26,950 | $4,725 | $22,225 |

Source: Public Records

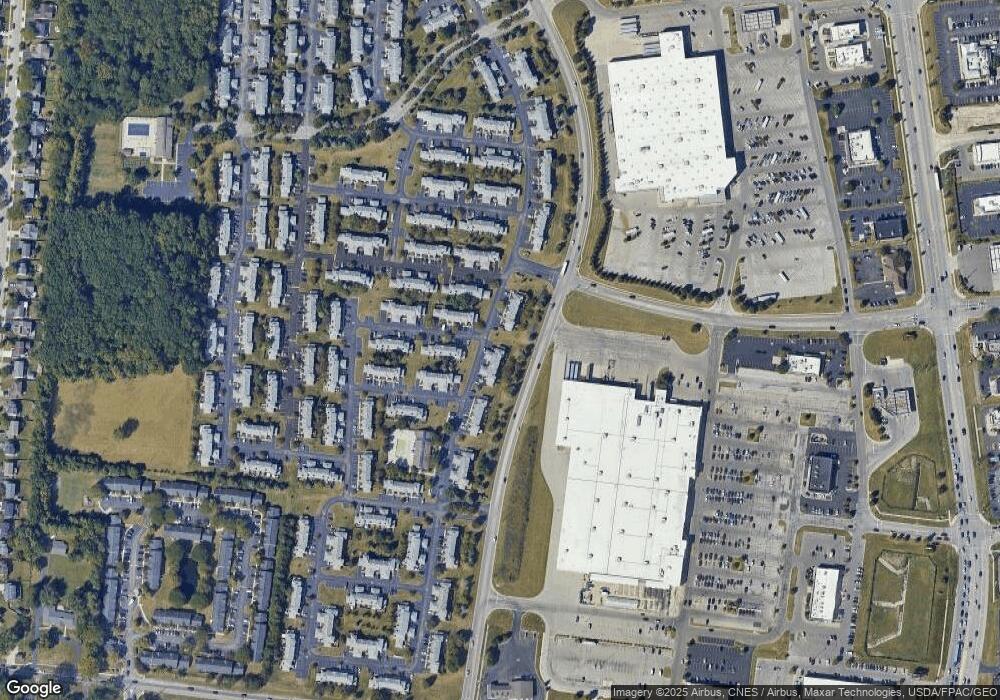

Map

Nearby Homes

- 1668 Blackhorse Ln Unit 157B

- 5725 Kilbury Ln Unit 123C

- 5710 Kilbury Ln Unit 121A

- 1652 Bennigan Dr Unit 175A

- 1768 Ridgebury Dr Unit 135A

- 1686 Jupiter Ave

- 1640 Jupiter Ave

- 5672 Galveston Dr

- 5681 Mango Ln Unit 102D

- 1422 Ithaca Dr

- 1432 Bellow Falls Place

- 5682 Mango Ln Unit 105E

- 5981 Lakefront Ave

- 5932 Waterview Dr

- 2000 Jasper Ln Unit 26E

- 2014 Burbridge Ln Unit 29C

- 1999 Jasper Ln Unit 24A

- 5983 Cape Coral Ln

- 5612 Valencia Park Blvd Unit 13E

- 5739 Stonepath Dr

- 1702 Bennigan Dr

- 1702 Bennigan Dr Unit 165B

- 1700 Bennigan Dr Unit 165C

- 1698 Bennigan Dr Unit 165D

- 1696 Bennigan Dr Unit 165E

- 1694 Bennigan Dr Unit 165F

- 1694 Bennigan Dr

- 1712 Bennigan Dr

- 1714 Bennigan Dr

- 1714 Bennigan Dr Unit 164D

- 5687 Ashcroft Ln Unit 163A

- 5686 Ashcroft Ln Unit 162F

- 5688 Ashcroft Ln Unit 162E

- 1716 Bennigan Dr Unit 164C

- 5689 Ashcroft Ln Unit 163B

- 5691 Ashcroft Ln

- 1718 Bennigan Dr Unit 164B

- 1688 Bennigan Dr Unit 169A

- 5690 Ashcroft Ln

- 5688 Palos Ln