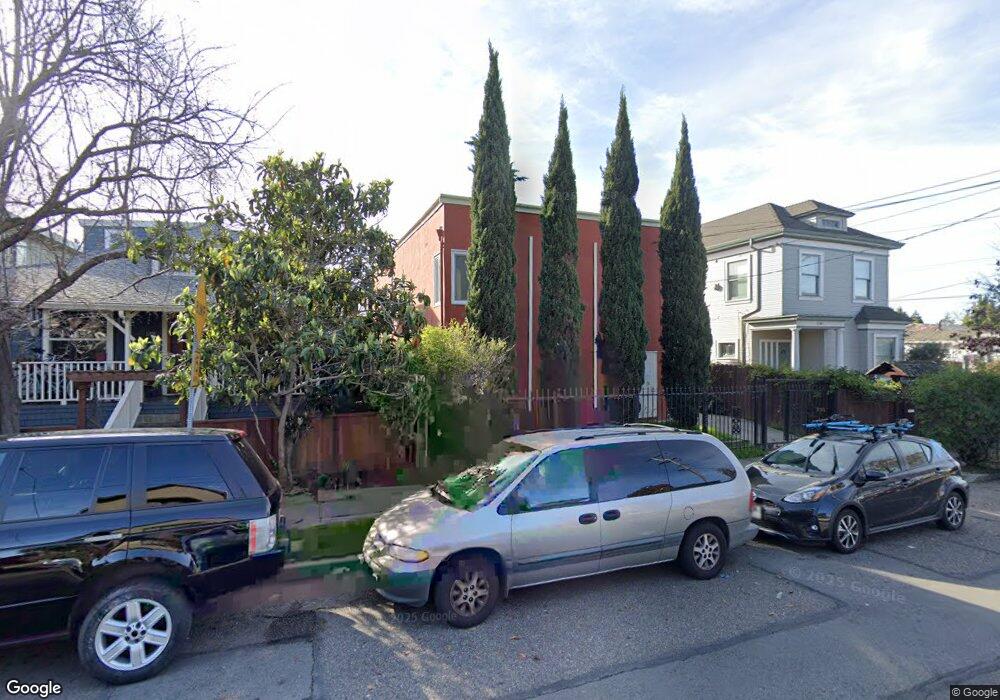

1704 Ward St Berkeley, CA 94703

South Berkeley NeighborhoodEstimated Value: $1,011,000 - $1,306,000

4

Beds

4

Baths

2,360

Sq Ft

$485/Sq Ft

Est. Value

About This Home

This home is located at 1704 Ward St, Berkeley, CA 94703 and is currently estimated at $1,143,667, approximately $484 per square foot. 1704 Ward St is a home located in Alameda County with nearby schools including Malcolm X Elementary School, Emerson Elementary School, and John Muir Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 18, 1999

Sold by

Home Svgs Of America Fsb

Bought by

Chavez Mateo S and Chavez Juana R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,000

Interest Rate

6.7%

Purchase Details

Closed on

Jan 15, 1999

Sold by

Avant Leslie A and Swartz William F

Bought by

Avant Leslie A and Swartz William F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,000

Interest Rate

6.7%

Purchase Details

Closed on

Dec 30, 1997

Sold by

Johnson Crawford L and Home Svgs Of America Fsb

Bought by

Home Svgs Of America Fsb

Purchase Details

Closed on

Aug 21, 1996

Sold by

Brown Samuel and Brown Noble

Bought by

Young Karen R

Purchase Details

Closed on

Dec 15, 1994

Sold by

Brown Samuel and Brown Noble

Bought by

Brown Samuel and Brown Noble L

Purchase Details

Closed on

Feb 1, 1994

Sold by

Bansner Horst and Bansner Eva Jo

Bought by

Dobkin David and Dobkin Donna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$450,000

Interest Rate

7.19%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chavez Mateo S | $170,000 | First American Title Guarant | |

| Avant Leslie A | -- | -- | |

| Home Svgs Of America Fsb | $166,500 | Fidelity National Title | |

| Young Karen R | -- | -- | |

| Brown Samuel | -- | -- | |

| Dobkin David | $914,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Chavez Mateo S | $136,000 | |

| Previous Owner | Dobkin David | $450,000 | |

| Closed | Dobkin David | $75,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,464 | $266,494 | $79,948 | $186,546 |

| 2024 | $7,464 | $261,270 | $78,381 | $182,889 |

| 2023 | $7,274 | $256,148 | $76,844 | $179,304 |

| 2022 | $7,064 | $251,127 | $75,338 | $175,789 |

| 2021 | $7,023 | $246,203 | $73,861 | $172,342 |

| 2020 | $6,461 | $243,678 | $73,103 | $170,575 |

| 2019 | $6,001 | $238,901 | $71,670 | $167,231 |

| 2018 | $5,856 | $234,218 | $70,265 | $163,953 |

| 2017 | $5,610 | $229,627 | $68,888 | $160,739 |

| 2016 | $5,293 | $225,125 | $67,537 | $157,588 |

| 2015 | $5,205 | $221,744 | $66,523 | $155,221 |

| 2014 | $5,383 | $217,400 | $65,220 | $152,180 |

Source: Public Records

Map

Nearby Homes

- 2701 Grant St

- 2829 California St

- 1726 Parker St Unit 2

- 1726 Parker St Unit 1

- 1612 Parker St

- 1819 Carleton St

- 1515 Derby St

- 1634 Blake St

- 2926 Ellis St

- 2533 Grant St

- 2750 Sacramento St

- 2758 Sacramento St

- 2774 Sacramento St

- 2782 Sacramento St

- 2790 Sacramento St

- 1450 Ward St

- 1901 Parker St Unit 3

- 1524 Blake St

- 1604 Dwight Way

- 1516 Blake St

Your Personal Tour Guide

Ask me questions while you tour the home.