17192 Citron Irvine, CA 92612

University Park and Town Center NeighborhoodEstimated Value: $1,029,001 - $1,191,000

2

Beds

2

Baths

1,224

Sq Ft

$917/Sq Ft

Est. Value

About This Home

This home is located at 17192 Citron, Irvine, CA 92612 and is currently estimated at $1,122,000, approximately $916 per square foot. 17192 Citron is a home located in Orange County with nearby schools including University Park Elementary, Rancho San Joaquin Middle School, and University High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 3, 2005

Sold by

Stephan Robert O and Stephan Susan D

Bought by

Stephan Robert and Stephan Susan

Current Estimated Value

Purchase Details

Closed on

May 4, 1999

Sold by

Stephan Robert O and Stephan Susan D

Bought by

Stephan Robert O and Stephan Susan D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,000

Outstanding Balance

$36,907

Interest Rate

6.86%

Estimated Equity

$1,085,093

Purchase Details

Closed on

Mar 6, 1995

Sold by

Terry Michael and Terry Robin

Bought by

Stephan Robert O and Konrath Susan D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,100

Interest Rate

7%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stephan Robert | -- | -- | |

| Stephan Robert O | -- | Southland Title Corporation | |

| Stephan Robert O | $158,000 | Commonwealth Land Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stephan Robert O | $145,000 | |

| Closed | Stephan Robert O | $150,100 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,742 | $265,376 | $151,327 | $114,049 |

| 2024 | $2,742 | $260,173 | $148,360 | $111,813 |

| 2023 | $2,670 | $255,072 | $145,451 | $109,621 |

| 2022 | $2,621 | $250,071 | $142,599 | $107,472 |

| 2021 | $2,560 | $245,168 | $139,803 | $105,365 |

| 2020 | $2,545 | $242,655 | $138,370 | $104,285 |

| 2019 | $2,487 | $237,898 | $135,657 | $102,241 |

| 2018 | $2,439 | $233,234 | $132,997 | $100,237 |

| 2017 | $2,387 | $228,661 | $130,389 | $98,272 |

| 2016 | $2,281 | $224,178 | $127,832 | $96,346 |

| 2015 | $2,246 | $220,811 | $125,912 | $94,899 |

| 2014 | $2,201 | $216,486 | $123,445 | $93,041 |

Source: Public Records

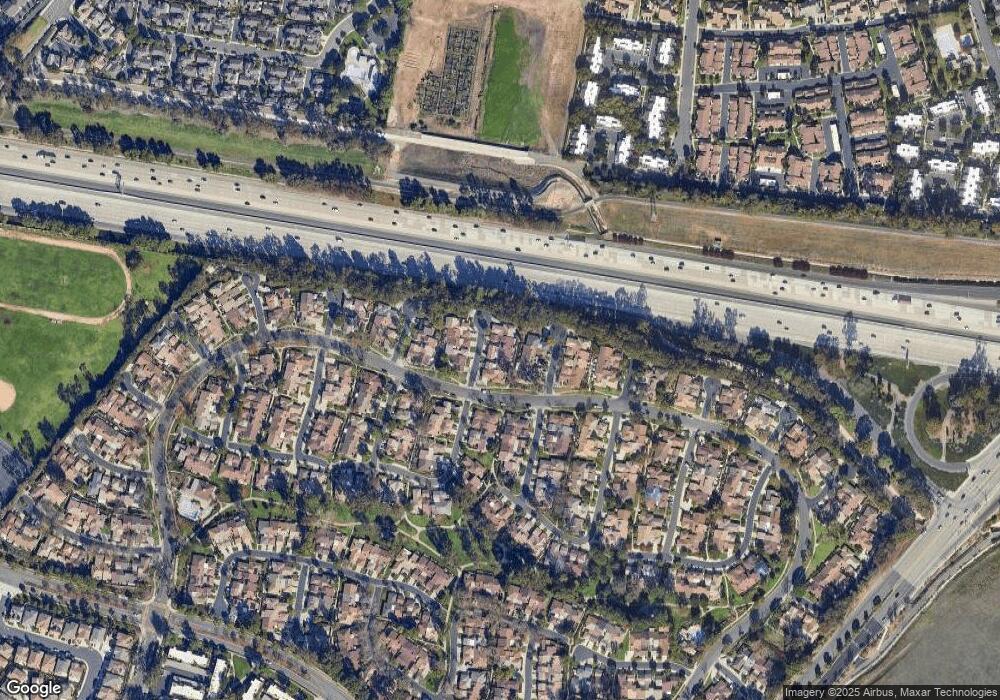

Map

Nearby Homes

- 39 Dogwood S

- 4 Dogwood N

- 17322 Rosewood

- 226 Greenmoor Unit 95

- 1 Summerfield Unit 59

- 45 Wintermist Unit 36

- 20 Wintermist

- 11 Fallingstar

- 123 Fallingstar Unit 1

- 123 Willowbend

- 39 Foxboro

- 9 Teakwood

- 17682 Cassia Tree Ln

- 527 Springbrook N

- 19 Briarglen Unit 2

- 6 Banyan Tree

- 32 Spinnaker Unit 71

- 52 Weepingwood

- 18 Broadleaf

- 12 Thicket