1721 Melrose Ave Unit 12 Chula Vista, CA 91911

Otay Mesa West NeighborhoodEstimated Value: $532,517 - $562,000

2

Beds

2

Baths

1,225

Sq Ft

$447/Sq Ft

Est. Value

About This Home

This home is located at 1721 Melrose Ave Unit 12, Chula Vista, CA 91911 and is currently estimated at $547,129, approximately $446 per square foot. 1721 Melrose Ave Unit 12 is a home located in San Diego County with nearby schools including Otay Elementary School, Castle Park Middle School, and Castle Park High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 21, 2015

Sold by

Valdez Jesus Francisco and Valdez Gilda Adriana

Bought by

Valdez Trust

Current Estimated Value

Purchase Details

Closed on

Mar 25, 2008

Sold by

Federal National Mortgage Association

Bought by

Valdez Jesus F and Valdez Gilda A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Outstanding Balance

$62,232

Interest Rate

5.72%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$484,897

Purchase Details

Closed on

Feb 1, 2008

Sold by

Washington Mutual Bank Fa

Bought by

Federal National Mortgage Association

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Outstanding Balance

$62,232

Interest Rate

5.72%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$484,897

Purchase Details

Closed on

Nov 16, 2007

Sold by

Shelby Jerry

Bought by

Washington Mutual Bank Fa

Purchase Details

Closed on

Jul 31, 2006

Sold by

Murray Darryl R and Shelby Jerry

Bought by

Shelby Jerry

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$262,000

Interest Rate

6.87%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 2, 2005

Sold by

Murray Darryl R

Bought by

Shelby Jerry W

Purchase Details

Closed on

Mar 10, 2005

Sold by

Murray Debra L

Bought by

Murray Darryl R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Interest Rate

1.37%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Mar 4, 2005

Sold by

Blakely James K

Bought by

Murray Darryl R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Interest Rate

1.37%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Apr 8, 2003

Sold by

Jimenez Adrian and Jimenez Lorena E

Bought by

Blakely James K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$207,955

Interest Rate

5.71%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 29, 2000

Sold by

Mackinnon M Y & Associates

Bought by

Jimenez Adrian and Jimenez Lorena E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,160

Interest Rate

7.13%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Valdez Trust | -- | None Available | |

| Valdez Jesus F | $180,000 | Commonwealth Land Title Co | |

| Federal National Mortgage Association | -- | Fidelity National Title | |

| Washington Mutual Bank Fa | $276,773 | Accommodation | |

| Shelby Jerry | -- | Ticor Title Co Of California | |

| Shelby Jerry | -- | Ticor Title Co Of California | |

| Shelby Jerry W | -- | -- | |

| Murray Darryl R | -- | Commonwealth Title | |

| Murray Darryl R | $325,000 | Commonwealth Title | |

| Blakely James K | $219,000 | Commonwealth Land Title Co | |

| Jimenez Adrian | $128,000 | Equity Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Valdez Jesus F | $100,000 | |

| Previous Owner | Shelby Jerry | $262,000 | |

| Previous Owner | Murray Darryl R | $260,000 | |

| Previous Owner | Blakely James K | $207,955 | |

| Previous Owner | Jimenez Adrian | $124,160 | |

| Closed | Jimenez Adrian | $7,680 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,668 | $236,418 | $94,565 | $141,853 |

| 2024 | $2,668 | $231,783 | $92,711 | $139,072 |

| 2023 | $2,631 | $227,240 | $90,894 | $136,346 |

| 2022 | $2,554 | $222,785 | $89,112 | $133,673 |

| 2021 | $2,494 | $218,417 | $87,365 | $131,052 |

| 2020 | $2,434 | $216,179 | $86,470 | $129,709 |

| 2019 | $2,371 | $211,941 | $84,775 | $127,166 |

| 2018 | $2,333 | $207,786 | $83,113 | $124,673 |

| 2017 | $2,283 | $203,713 | $81,484 | $122,229 |

| 2016 | $2,228 | $199,720 | $79,887 | $119,833 |

| 2015 | $2,196 | $196,721 | $78,688 | $118,033 |

| 2014 | -- | $180,000 | $72,000 | $108,000 |

Source: Public Records

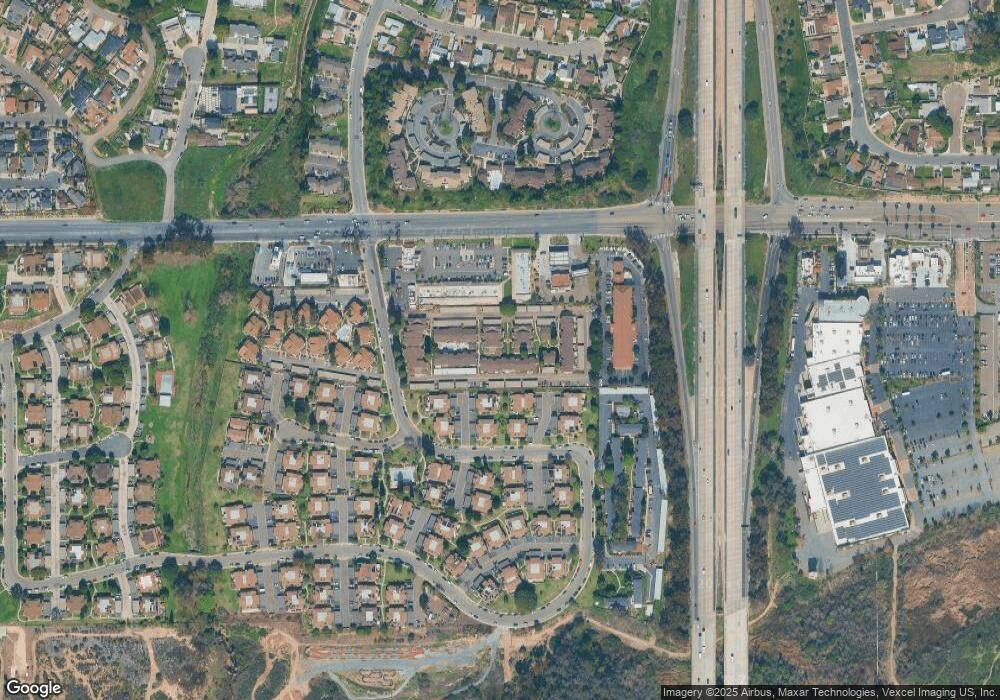

Map

Nearby Homes

- 265 Rancho Dr Unit C

- 321 Rancho Dr Unit 45

- 1677 Melrose Ave Unit H

- 1679 Melrose Ave Unit H

- 1720 Melrose Ave Unit 27

- 1665 Melrose Ave

- 237 Otay Valley Rd Unit C

- 237 Rancho Dr Unit C

- 1640 Maple Dr Unit 55

- 512 Timber St

- 362 Palm Ave

- 234 Date St

- 1568 Larkhaven Dr

- 1521 Malta Ave

- 1532 Grand Teton Ct

- 4089 Palm Ave

- 0 Brandywine Ave

- 1450 Melrose Ave Unit 78

- 1450 Melrose Ave Unit 47

- 1661 Point Conception Ct

- 1721 Melrose Ave Unit 1

- 1723 Melrose Ave Unit 22

- 1723 Melrose Ave Unit 21

- 1723 Melrose Ave Unit 20

- 1723 Melrose Ave Unit 19

- 1723 Melrose Ave Unit 18

- 1723 Melrose Ave Unit 17

- 1721 Melrose Ave Unit 16

- 1721 Melrose Ave Unit 15

- 1721 Melrose Ave Unit 14

- 1721 Melrose Ave Unit 13

- 1737 Melrose Ave Unit 64

- 1737 Melrose Ave Unit 63

- 1737 Melrose Ave Unit 62

- 1737 Melrose Ave Unit 61

- 1721 Melrose Ave Unit 11

- 1721 Melrose Ave Unit 10

- 1721 Melrose Ave Unit 9

- 1721 Melrose Ave Unit 8

- 1721 Melrose Ave Unit 7