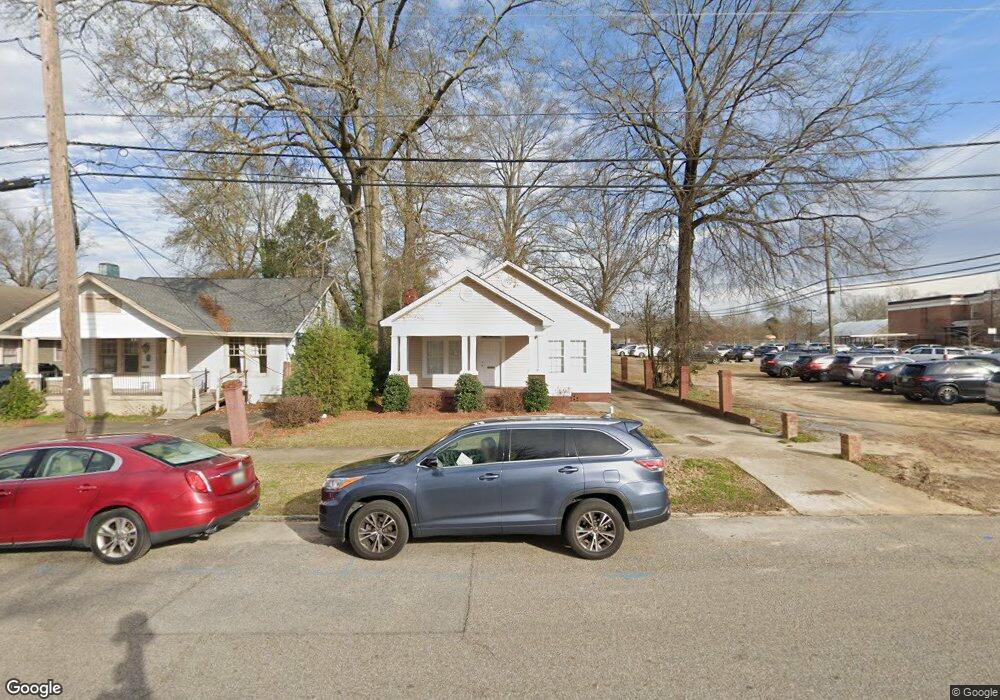

1729 Forest Ave Montgomery, AL 36106

Estimated Value: $152,844

Studio

1

Bath

1,540

Sq Ft

$99/Sq Ft

Est. Value

About This Home

This home is located at 1729 Forest Ave, Montgomery, AL 36106 and is currently estimated at $152,844, approximately $99 per square foot. 1729 Forest Ave is a home located in Montgomery County with nearby schools including E. D. Nixon Elementary School, Bellingrath Junior High School, and Lanier Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 13, 2023

Sold by

Wideman Pamela L

Bought by

Board Of Trustees Of Alabama State University

Current Estimated Value

Purchase Details

Closed on

Apr 11, 2013

Sold by

Landmark Tour Travel Llc

Bought by

Wideman Pamela L

Purchase Details

Closed on

Apr 24, 2007

Sold by

Lawson Construction Co Llc

Bought by

Landmark Tour Travel Llc

Purchase Details

Closed on

Sep 10, 2004

Sold by

Marshall Mary Alice

Bought by

Lawson Construction Co Llc

Purchase Details

Closed on

Apr 12, 2004

Sold by

Kennedy Tiffany

Bought by

Marshall Mary Alice

Purchase Details

Closed on

Mar 31, 2004

Sold by

Washington Renell and Marshall Everett

Bought by

Marshall Mary Alice

Purchase Details

Closed on

Mar 6, 2004

Sold by

Martin Julia and Martin Valarie

Bought by

Marshall Mary Alice

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Board Of Trustees Of Alabama State University | $96,000 | None Listed On Document | |

| Board Of Trustees Of Alabama State University | $96,000 | None Listed On Document | |

| Wideman Pamela L | $92,700 | None Available | |

| Landmark Tour Travel Llc | -- | None Available | |

| Lawson Construction Co Llc | -- | -- | |

| Marshall Mary Alice | -- | -- | |

| Marshall Mary Alice | -- | -- | |

| Marshall Mary Alice | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $15,960 | $4,200 | $11,760 |

| 2024 | $704 | $14,360 | $4,200 | $10,160 |

| 2023 | $704 | $14,360 | $4,200 | $10,160 |

| 2022 | $526 | $14,400 | $4,200 | $10,200 |

| 2021 | $464 | $12,700 | $4,200 | $8,500 |

| 2020 | $464 | $12,700 | $4,200 | $8,500 |

| 2019 | $464 | $12,700 | $4,200 | $8,500 |

| 2018 | $464 | $12,700 | $0 | $0 |

| 2017 | $712 | $19,500 | $4,200 | $15,300 |

| 2014 | $713 | $19,540 | $4,200 | $15,340 |

| 2013 | -- | $18,540 | $4,200 | $14,340 |

Source: Public Records

Map

Nearby Homes

- 2033 Hazel Hedge Ln

- 2053 Hazel Hedge Ln

- 2065 Hazel Hedge Ln

- 2105 College St

- 2133 Felder Terrace

- 1801 West St Unit OP

- 1324 Felder Ave

- 1327 Woodward Ave

- 1222 Felder Ave

- 1311 Woodward Ave

- 2138 E 2nd St

- 1100 Woodward Ave

- 1430 Midlane Ct

- 2405 College St

- 1201 Magnolia Curve

- 819 Felder Ave

- 1131 Magnolia Curve

- 1933 Bullard St

- 2626 Girard St

- 1713 Owens St