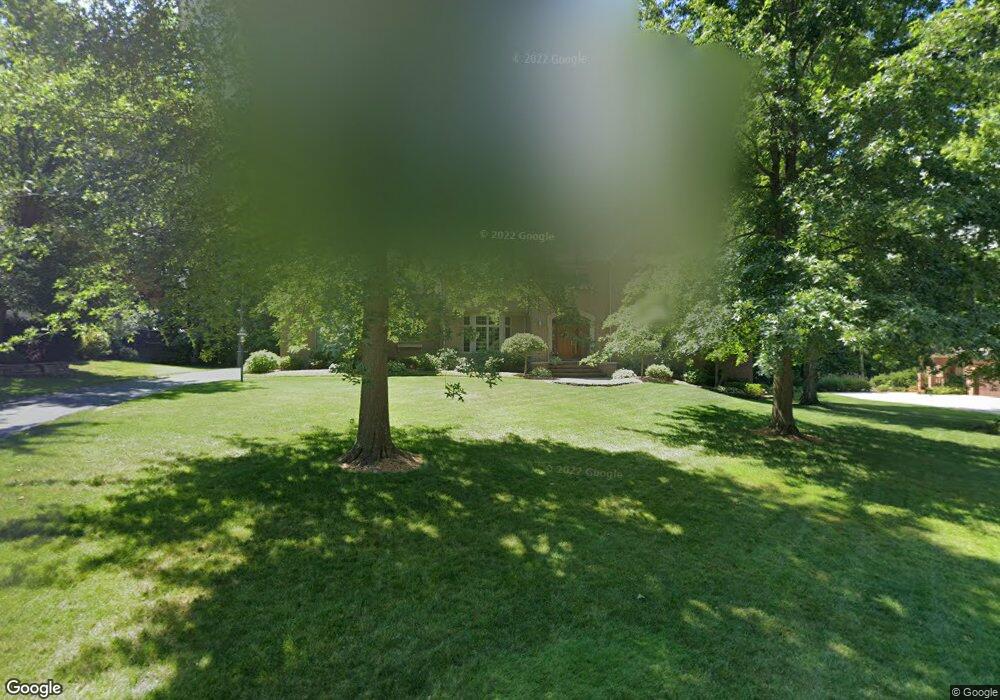

17370 Tall Tree Trail Chagrin Falls, OH 44023

Estimated Value: $987,277 - $1,161,000

4

Beds

6

Baths

4,731

Sq Ft

$228/Sq Ft

Est. Value

About This Home

This home is located at 17370 Tall Tree Trail, Chagrin Falls, OH 44023 and is currently estimated at $1,078,319, approximately $227 per square foot. 17370 Tall Tree Trail is a home located in Geauga County with nearby schools including Timmons Elementary School, Kenston Intermediate School, and Kenston Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 18, 2018

Sold by

Driscoll Anderson Oliver Bruce and Driscoll Anderson Donna

Bought by

Driscoll Anderson Oliver Bruce and Driscoll Anderson Donna

Current Estimated Value

Purchase Details

Closed on

Sep 2, 1999

Sold by

Mcdonald Donald and Mcdonald Mary

Bought by

Driscoll Anderson Oliver Bruce and Driscoll Anderson Donna

Purchase Details

Closed on

Jun 30, 1999

Sold by

Snider William J

Bought by

Mcdonald Donald and Mcdonald Mary

Purchase Details

Closed on

Dec 7, 1998

Sold by

Canyon Lakes Colony Co

Bought by

Snider William J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Driscoll Anderson Oliver Bruce | -- | None Available | |

| Driscoll Anderson Oliver Bruce | $135,000 | -- | |

| Mcdonald Donald | -- | -- | |

| Snider William J | $103,000 | Lawyers Title Ins Corp |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $15,015 | $290,820 | $56,180 | $234,640 |

| 2023 | $15,015 | $290,820 | $56,180 | $234,640 |

| 2022 | $13,112 | $223,240 | $39,660 | $183,580 |

| 2021 | $13,156 | $223,240 | $39,660 | $183,580 |

| 2020 | $13,514 | $223,240 | $39,660 | $183,580 |

| 2019 | $14,281 | $212,840 | $39,660 | $173,180 |

| 2018 | $14,282 | $212,840 | $39,660 | $173,180 |

| 2017 | $14,281 | $212,840 | $39,660 | $173,180 |

| 2016 | $15,848 | $231,250 | $39,660 | $191,590 |

| 2015 | $14,113 | $231,250 | $39,660 | $191,590 |

| 2014 | $14,113 | $231,250 | $39,660 | $191,590 |

| 2013 | $14,218 | $231,250 | $39,660 | $191,590 |

Source: Public Records

Map

Nearby Homes

- 17411 Beech Grove Trail Unit 7

- 7432 Villa Ridge

- 17581 Gates Landing Dr

- 7754 Bainbridge Rd

- 8086 Canyon Ridge

- VL Canyon Ridge

- VL 373 Canyon Ridge

- 8145 Chagrin Rd

- 39780 Alsace Ct

- V/L Northview Dr

- 16788 Geneva St

- 17844 Kenston Lake Dr

- 7436 Chagrin Rd

- 65 Quail Ridge Dr

- 39565 Patterson Ln

- 16690 Dayton St

- 18100 Hawksmoor Way

- 8405 Lucerne Dr

- S/L Rocker Ave

- 5940 Glasgow Ln

- 17380 Tall Tree Trail

- 17360 Tall Tree Trail

- 17390 Tall Tree Trail

- 7560 Trails End

- 17385 Tall Tree Trail

- 17365 Tall Tree Trail

- 17350 Tall Tree Trail

- 7570 Trails End

- 7550 Trails End

- 7580 Trails End

- 17400 Tall Tree Trail

- 17395 Tall Tree Trail

- 17345 Tall Tree Trail

- 7500 Faraway Trail

- 7490 Faraway Trail

- 7590 Trails End

- 7545 Trails End

- 7480 Faraway Trail

- 7510 Faraway Trail

- 17405 Tall Tree Trail