1745 Sandstone Curve Shakopee, MN 55379

Estimated Value: $254,000 - $274,000

2

Beds

2

Baths

1,422

Sq Ft

$184/Sq Ft

Est. Value

About This Home

This home is located at 1745 Sandstone Curve, Shakopee, MN 55379 and is currently estimated at $261,717, approximately $184 per square foot. 1745 Sandstone Curve is a home located in Scott County with nearby schools including Jackson Elementary School, East Middle School, and Shakopee Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 15, 2021

Sold by

Chalupsky Brant and Chalupsky Stacy

Bought by

Zverev Nikolay N

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Outstanding Balance

$164,592

Interest Rate

2.99%

Mortgage Type

New Conventional

Estimated Equity

$97,125

Purchase Details

Closed on

May 14, 2004

Sold by

Kimball Dale and Kimball Nicole

Bought by

Plant Stacy and Chalupsky Brant

Purchase Details

Closed on

Oct 3, 2002

Sold by

Singer Scott A and Singer Debbie A

Bought by

Kimball Dale and Kimball Nicole

Purchase Details

Closed on

Dec 23, 1998

Sold by

Brightkeys Building & Development Corp

Bought by

Singer Scott A and Singer Debbie A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Zverev Nikolay N | $225,000 | Burnet Title | |

| Plant Stacy | $169,900 | -- | |

| Kimball Dale | $158,500 | -- | |

| Singer Scott A | $109,540 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Zverev Nikolay N | $180,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,214 | $241,600 | $68,500 | $173,100 |

| 2024 | $2,294 | $230,500 | $65,200 | $165,300 |

| 2023 | $2,346 | $227,100 | $63,900 | $163,200 |

| 2022 | $2,204 | $228,700 | $65,500 | $163,200 |

| 2021 | $1,884 | $189,100 | $51,300 | $137,800 |

| 2020 | $2,020 | $180,600 | $42,000 | $138,600 |

| 2019 | $1,900 | $172,200 | $40,000 | $132,200 |

| 2018 | $1,818 | $0 | $0 | $0 |

| 2016 | $1,656 | $0 | $0 | $0 |

| 2014 | -- | $0 | $0 | $0 |

Source: Public Records

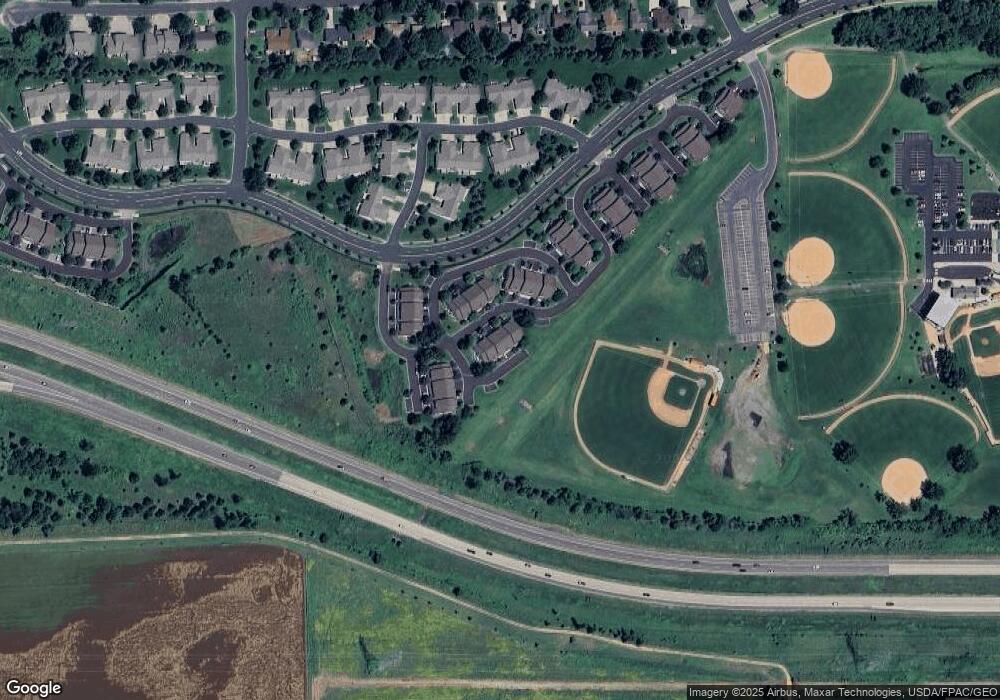

Map

Nearby Homes

- 1853 Stone Meadow Blvd

- 2224 Quarry Ln

- 1226 Polk St S

- 1259 Taylor St Unit 3

- 1279 Taylor St Unit 5

- 1187 Jackson St S

- 1690 Windigo Ln

- 1861 Attenborough St

- 2007 10th Ave W Unit 12

- 816 Regent Dr

- The Ferguson Plan at Bluff View - Cottage Series

- The Edison Plan at Bluff View - Cottage Series

- The Tatum Plan at Bluff View - Cottage Series

- The Pattison Plan at Bluff View - Cottage Series

- The Harmony Plan at Bluff View - Freedom Series

- The Dover II Plan at Bluff View - Freedom Series

- The Clifton II Plan at Bluff View - Freedom Series

- The Cali Plan at Bluff View - Freedom Series

- 1179 Cubasue Ct

- 1813 6th Ave W

- 1749 Sandstone Curve

- 1741 Sandstone Curve Unit 1043

- 1741 Sandstone Curve

- 1748 Stone Meadow Blvd

- 1744 Stone Meadow Blvd

- 1752 Stone Meadow Blvd

- 1753 Sandstone Curve

- 1740 Stone Meadow Blvd

- 1729 Stone Meadow Blvd

- 1733 Stone Meadow Blvd

- 1725 Stone Meadow Blvd

- 1772 Sandstone Curve

- 1721 Stone Meadow Blvd

- 1768 Sandstone Curve

- 1764 Sandstone Curve

- 1728 Pebble Terrace

- 1713 Stone Meadow Blvd

- 1732 Pebble Terrace

- 1709 Stone Meadow Blvd

- 1724 Pebble Terrace