17845 Firtree Ct Unit 23 Carson, CA 90746

Estimated Value: $710,000 - $789,000

4

Beds

3

Baths

1,831

Sq Ft

$414/Sq Ft

Est. Value

About This Home

This home is located at 17845 Firtree Ct Unit 23, Carson, CA 90746 and is currently estimated at $757,420, approximately $413 per square foot. 17845 Firtree Ct Unit 23 is a home located in Los Angeles County with nearby schools including Ralph Bunche Elementary School, Walton Middle School, and Compton High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 25, 2020

Sold by

Sperounes Michael L

Bought by

Sperounes Michael and Sperounes Iris

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$288,500

Outstanding Balance

$256,605

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$500,815

Purchase Details

Closed on

Feb 24, 2012

Sold by

Sperounes Michael L and Sperounes Iris

Bought by

Sperounes Michael L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$269,700

Interest Rate

3.83%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 9, 2004

Sold by

K Hovnanian At Dominguez Hills Inc

Bought by

Sperounes Michael L and Sperounes Iris

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$273,050

Interest Rate

5.86%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sperounes Michael | -- | First American Title Ins Co | |

| Sperounes Michael L | -- | Orange Coast Title | |

| Sperounes Michael L | $303,500 | Landamerica Lawyers Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sperounes Michael | $288,500 | |

| Closed | Sperounes Michael L | $269,700 | |

| Closed | Sperounes Michael L | $273,050 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,862 | $431,352 | $218,091 | $213,261 |

| 2024 | $5,862 | $422,895 | $213,815 | $209,080 |

| 2023 | $5,771 | $414,604 | $209,623 | $204,981 |

| 2022 | $5,353 | $406,475 | $205,513 | $200,962 |

| 2021 | $5,441 | $398,506 | $201,484 | $197,022 |

| 2019 | $5,003 | $386,688 | $195,509 | $191,179 |

| 2018 | $4,889 | $379,107 | $191,676 | $187,431 |

| 2016 | $4,616 | $364,387 | $184,234 | $180,153 |

| 2015 | $4,353 | $358,914 | $181,467 | $177,447 |

| 2014 | $4,264 | $351,885 | $177,913 | $173,972 |

Source: Public Records

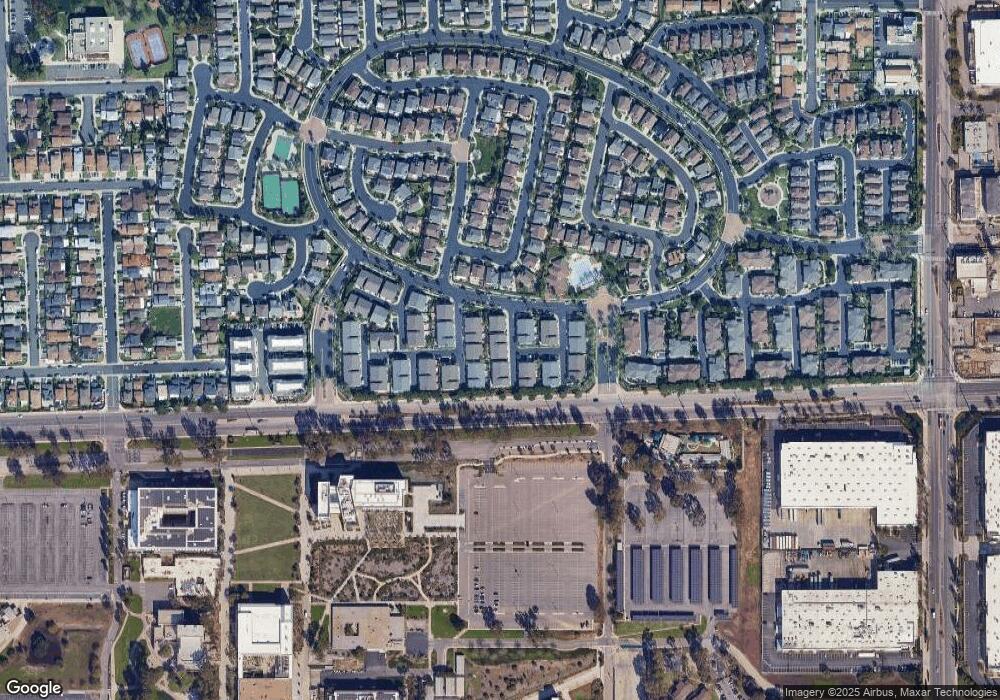

Map

Nearby Homes

- 17614 Crabapple Way

- 17809 Ash Ct

- 17533 Sagebrush Way

- 17923 Goodyear

- 17513 Keene Ave

- 17506 Wellfleet Ave

- 17506 Sandlake Ave

- 17700 Avalon Blvd Unit 422

- 17700 Avalon Blvd Unit 387

- 17700 Avalon Blvd Unit 54

- 17700 Avalon Blvd Unit 40

- 19012 Tillman Ave

- 19008 Hillford Ave

- 19202 Campaign Dr

- 143 S Tulip Ave

- 945 W Dahlia St

- 1601 1603 W 165th St

- 147 S Tulip Ave

- 19426 Belshaw Ave

- 19415 Fariman Dr

- 17851 Firtree Ct Unit 24

- 17831 Firtree Ct

- 17850 Hazelwood Ct Unit 31

- 17863 Firtree Ct

- 17823 Firtree Ct Unit 21

- 17869 Firtree Ct

- 17815 Firtree Ct Unit 20

- 17832 Hazelwood Ct Unit 33

- 17862 Hazelwood Ct

- 17836 Firtree Ct Unit 19

- 17824 Hazelwood Ct Unit 34

- 17868 Hazelwood Ct

- 17828 Firtree Ct Unit 18

- 17875 Firtree Ct

- 17864 Firtree Ct Unit 11

- 17818 Hazelwood Ct Unit 35

- 17820 Firtree Ct

- 17874 Hazelwood Ct Unit 28

- 17876 Firtree Ct

- 17870 Firtree Ct Unit 12