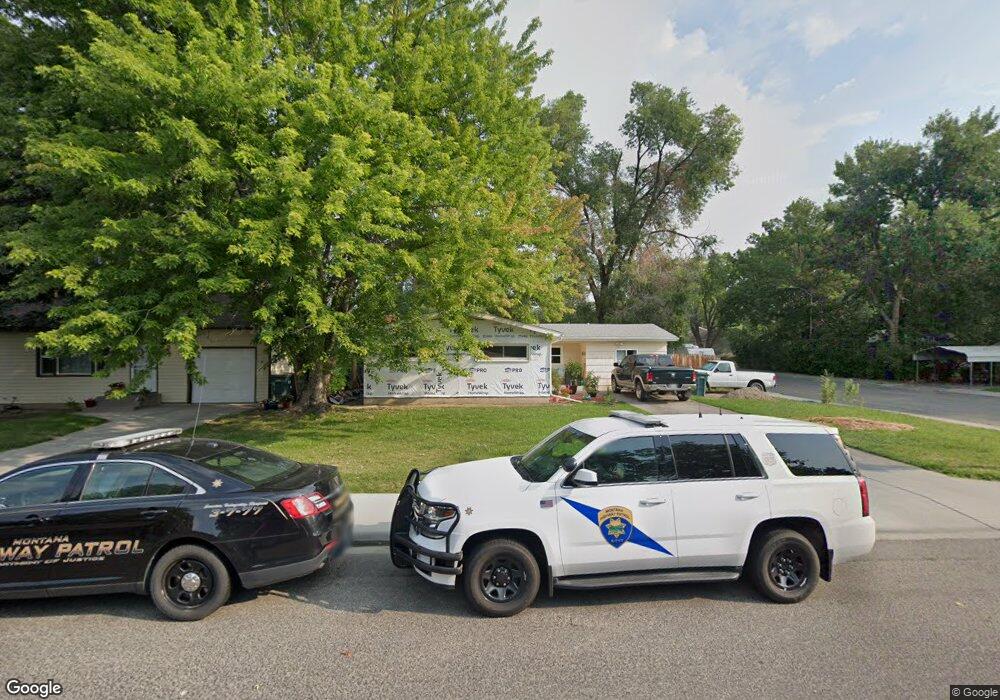

1803 Avenue F Billings, MT 59102

North Central Billings NeighborhoodEstimated Value: $335,000 - $365,008

4

Beds

2

Baths

1,736

Sq Ft

$201/Sq Ft

Est. Value

About This Home

This home is located at 1803 Avenue F, Billings, MT 59102 and is currently estimated at $349,252, approximately $201 per square foot. 1803 Avenue F is a home located in Yellowstone County with nearby schools including Rose Park School, Lewis & Clark Junior High School, and Billings Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 22, 2008

Sold by

Dare Kimberly E

Bought by

Moran Justin L and Moran Jennifer R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,306

Outstanding Balance

$100,816

Interest Rate

6.37%

Mortgage Type

FHA

Estimated Equity

$248,436

Purchase Details

Closed on

Feb 15, 2008

Sold by

Dare Kimberly E and Farrell Mary R

Bought by

Dare Kimberly E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,000

Interest Rate

5.65%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Moran Justin L | -- | None Available | |

| Dare Kimberly E | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Moran Justin L | $153,306 | |

| Previous Owner | Dare Kimberly E | $129,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,053 | $301,700 | $50,563 | $251,137 |

| 2024 | $3,053 | $296,800 | $46,309 | $250,491 |

| 2023 | $3,590 | $296,800 | $46,309 | $250,491 |

| 2022 | $2,053 | $217,400 | $0 | $0 |

| 2021 | $3,038 | $217,400 | $0 | $0 |

| 2020 | $3,022 | $204,900 | $0 | $0 |

| 2019 | $2,918 | $204,900 | $0 | $0 |

| 2018 | $2,832 | $192,800 | $0 | $0 |

| 2017 | $2,774 | $192,800 | $0 | $0 |

| 2016 | $2,604 | $178,200 | $0 | $0 |

| 2015 | $2,562 | $178,200 | $0 | $0 |

| 2014 | $2,355 | $83,581 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 1734 Mariposa Ln

- 2020 Plaza Dr

- 1944 Colton Blvd

- 2124 Dahlia Ln

- 1833 Iris Ln

- 2414 Ivy Ln

- 2035 Avenue D

- 1505 Avenue F

- 46 Shadow Place Unit 6B

- 1607 21st St W

- 2510 Terrace Dr

- 6 Heatherwood Ln

- 1834 Belvedere Dr

- 24 Heatherwood Ln Unit 12D

- 1704 Burlington Ave

- 2718 Terrace Dr

- 2230 Avenue C

- 1539 Burlington Ave

- 1329 Parkhill Dr

- 2260 Avenue C