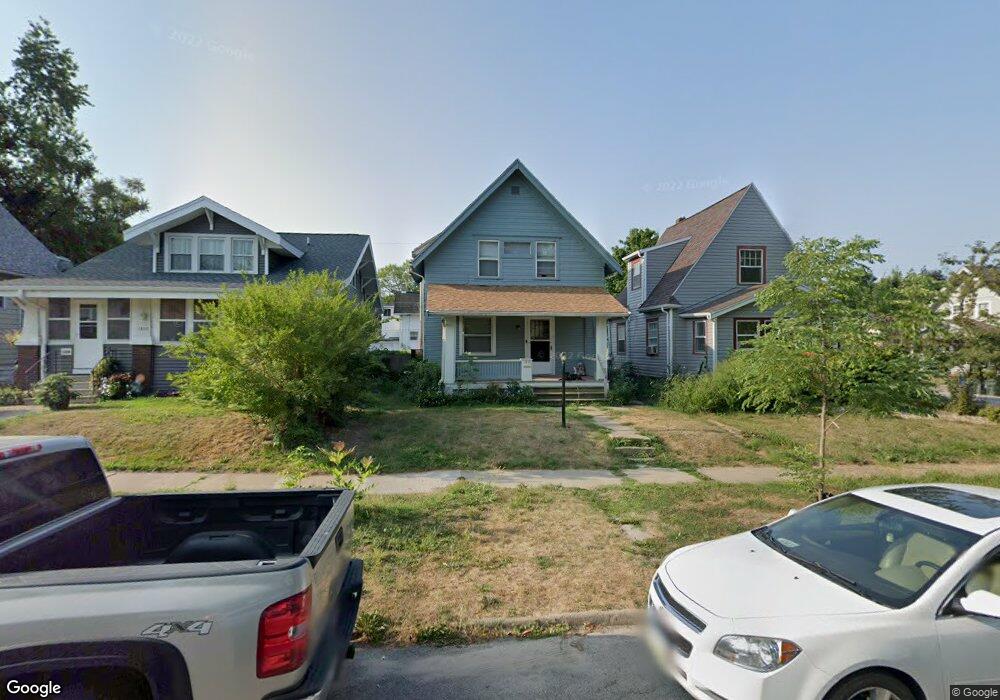

1805 7th Ave SE Cedar Rapids, IA 52403

Wellington Heights NeighborhoodEstimated Value: $119,000 - $130,000

2

Beds

1

Bath

1,067

Sq Ft

$118/Sq Ft

Est. Value

About This Home

This home is located at 1805 7th Ave SE, Cedar Rapids, IA 52403 and is currently estimated at $125,683, approximately $117 per square foot. 1805 7th Ave SE is a home located in Linn County with nearby schools including Grant Wood Elementary School, Summit Elementary School, and McKinley STEAM Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 16, 2025

Sold by

Aker Richard A

Bought by

Aker Richard A and Aker Sherry L

Current Estimated Value

Purchase Details

Closed on

Jan 27, 2006

Sold by

Tichy Scott Wayne and Tichy Scott W

Bought by

Aker Richard A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$74,432

Interest Rate

6.46%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Apr 9, 2001

Sold by

Tichy Linda Ann

Bought by

Tichy Scott Wayne

Purchase Details

Closed on

Jan 14, 1999

Sold by

Parsons Robert R

Bought by

Peiffer Development Company Lc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Aker Richard A | -- | None Listed On Document | |

| Aker Richard A | -- | None Listed On Document | |

| Aker Richard A | $78,000 | None Available | |

| Tichy Scott Wayne | -- | -- | |

| Peiffer Development Company Lc | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Aker Richard A | $74,432 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,872 | $118,300 | $20,400 | $97,900 |

| 2024 | $1,744 | $109,600 | $18,000 | $91,600 |

| 2023 | $1,744 | $105,800 | $18,000 | $87,800 |

| 2022 | $1,538 | $82,700 | $16,500 | $66,200 |

| 2021 | $1,568 | $74,200 | $14,100 | $60,100 |

| 2020 | $1,568 | $71,100 | $12,500 | $58,600 |

| 2019 | $1,358 | $63,000 | $11,000 | $52,000 |

| 2018 | $1,320 | $63,000 | $11,000 | $52,000 |

| 2017 | $1,342 | $64,600 | $11,000 | $53,600 |

| 2016 | $1,342 | $63,100 | $11,000 | $52,100 |

| 2015 | $1,420 | $66,754 | $10,976 | $55,778 |

| 2014 | $1,420 | $66,754 | $10,976 | $55,778 |

| 2013 | $1,390 | $66,754 | $10,976 | $55,778 |

Source: Public Records

Map

Nearby Homes

- 826 Wellington St SE

- 1713 7th Ave SE

- 1911 Ridgeway Dr SE

- 1828 Mount Vernon Rd SE

- 1815 5th Ave SE

- 1946 Higley Ave SE

- 809 17th St SE

- 513 17th St SE

- 414 18th St SE

- 1741 4th Ave SE

- 421 17th St SE

- 1929 Ridgeway Dr SE

- 1506 8th Ave SE

- 1522 6th Ave SE

- 510 Knollwood Dr SE

- 1041 19th St SE

- 1512 6th Ave SE

- 1815 Washington Ave SE

- 549 Vernon Dr SE

- 371 20th St SE

- 1801 7th Ave SE

- 1809 7th Ave SE

- 1813 7th Ave SE

- 716 18th St SE

- 1817 7th Ave SE

- 1804 8th Ave SE

- 1819 7th Ave SE

- 1806 8th Ave SE

- 711 18th St SE

- 705 18th St SE

- 1802 7th Ave SE

- 701 18th St SE

- 1810 8th Ave SE

- 1800 7th Ave SE

- 1821 7th Ave SE

- 713 18th St SE

- 715 18th St SE

- 1816 8th Ave SE

- 1806 7th Ave SE

- 719 18th St SE