1806 Stanton Rd Encinitas, CA 92024

Central Encinitas NeighborhoodEstimated Value: $732,276 - $838,000

2

Beds

2

Baths

936

Sq Ft

$857/Sq Ft

Est. Value

About This Home

This home is located at 1806 Stanton Rd, Encinitas, CA 92024 and is currently estimated at $802,319, approximately $857 per square foot. 1806 Stanton Rd is a home located in San Diego County with nearby schools including Park Dale Lane Elementary, Oak Crest Middle School, and La Costa Canyon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 14, 2025

Sold by

Gretsch Ryan

Bought by

Gretsch Family Trust and Gretsch

Current Estimated Value

Purchase Details

Closed on

Oct 12, 2020

Sold by

Elizabeth Jane Gretsch Family Trust and Gretsch Ryan

Bought by

Gretsch Ryan

Purchase Details

Closed on

Dec 15, 2014

Sold by

Gretsch Elizabeth J

Bought by

Gretsch Elizabeth Jane

Purchase Details

Closed on

Nov 17, 2010

Sold by

Gretsch Tammy

Bought by

Gretsch Ryan A

Purchase Details

Closed on

Nov 10, 2010

Sold by

Spannenberg Ralph H and Spannenberg Evelyn I

Bought by

Gretsch Elizabeth J and Gretsch Ryan A

Purchase Details

Closed on

Mar 5, 2003

Sold by

Spannenberg Ralph H

Bought by

Spannenberg Ralph H and Spannenberg Evelyn I

Purchase Details

Closed on

May 11, 1999

Sold by

Roak Alice C

Bought by

Spannenberg Ralph H

Purchase Details

Closed on

Dec 4, 1995

Sold by

Roak Alice Clara

Bought by

Spannenberg Ralph H

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gretsch Family Trust | -- | None Listed On Document | |

| Gretsch Ryan | -- | None Listed On Document | |

| Gretsch Elizabeth Jane | -- | None Available | |

| Gretsch Ryan A | -- | First American Title Insuran | |

| Gretsch Elizabeth J | $255,000 | First American Title Ins Co | |

| Spannenberg Ralph H | -- | -- | |

| Spannenberg Ralph H | -- | -- | |

| Roak Alice Clara | -- | -- | |

| Spannenberg Ralph H | -- | -- |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,012 | $326,687 | $212,574 | $114,113 |

| 2024 | $4,012 | $320,282 | $208,406 | $111,876 |

| 2023 | $3,873 | $314,003 | $204,320 | $109,683 |

| 2022 | $3,763 | $307,847 | $200,314 | $107,533 |

| 2021 | $3,683 | $301,812 | $196,387 | $105,425 |

| 2020 | $3,609 | $298,718 | $194,374 | $104,344 |

| 2019 | $3,541 | $292,862 | $190,563 | $102,299 |

| 2018 | $3,487 | $287,121 | $186,827 | $100,294 |

| 2017 | $3,431 | $281,492 | $183,164 | $98,328 |

| 2016 | $3,333 | $275,973 | $179,573 | $96,400 |

| 2015 | $3,260 | $271,828 | $176,876 | $94,952 |

| 2014 | $3,174 | $266,505 | $173,412 | $93,093 |

Source: Public Records

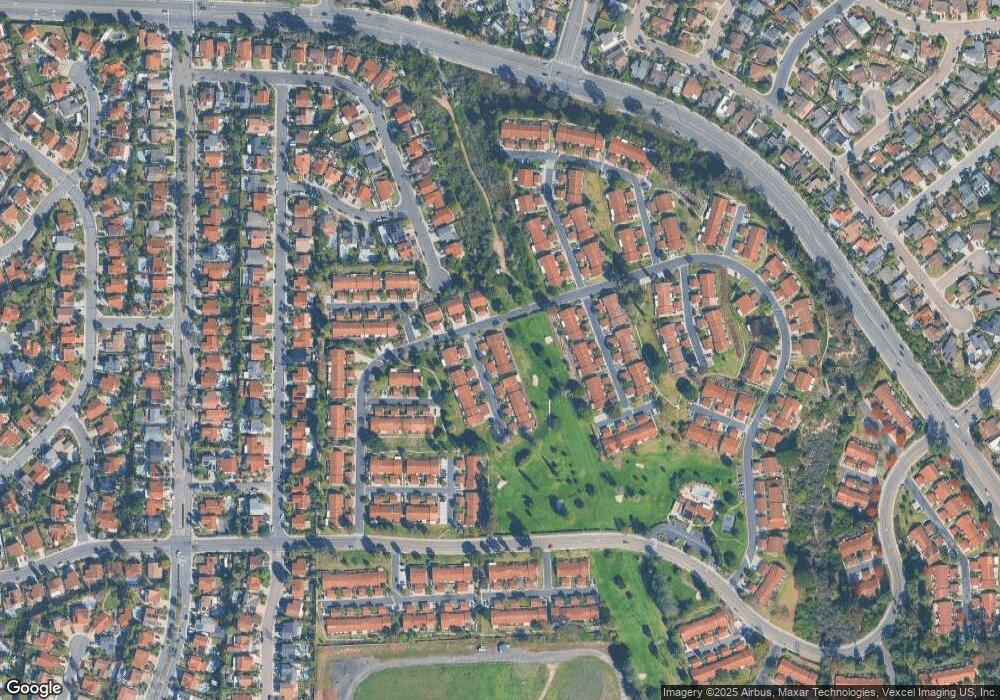

Map

Nearby Homes

- 1644 Forestdale Dr

- 1741 Charleston Ln

- 114 Cerro St

- 1926 Springdale Ln

- 349 Horizon Dr

- 1982 Fairlee Dr

- 2118 Valleydale Ln

- 608 Crest Dr

- 1549 Avenida de Las Adelsas

- 1824 Eastwood Ln

- 1517 Shields Ave

- 1510 Orangeview Dr Unit 1&2

- 1830 Gatepost Rd

- 803 Hollyridge Dr

- 277 Via Del Cerrito

- 324 Countrywood Ln

- 1617 Blossom Field Way

- 1709 Edgefield Ln

- 1642 Blossom Field Way

- 0 Crest Dr Unit 250045003

- 307 Harrisburg Dr

- 1805 Stanton Rd

- 1807 Stanton Rd

- 308 Harrisburg Dr Unit 315

- 1808 Stanton Rd

- 1817 Stanton Rd

- 1828 Stanton Rd

- 1811 Stanton Rd

- 1662 Forestdale Dr

- 1813 Stanton Rd

- 1819 Stanton Rd

- 1668 Forestdale Dr

- 1670 Forestdale Dr

- 1674 Forestdale Dr

- 319 Harrisburg Dr Unit 319

- 1812 Stanton Rd

- 1821 Stanton Rd Unit 307

- 314 Harrisburg Dr

- 309 Harrisburg Dr

- 1816 Stanton Rd

Your Personal Tour Guide

Ask me questions while you tour the home.